Post tax adjustments

If you need to make adjustments for tax purposes, you can post a tax adjusting entry using the Adjustments page or the Trial Balance page. You can post entries to accounts or groups and can include a description of the entry and an annotation.

To post a tax adjustment using the Trial Balance page, see Post adjustments to the trial balance.

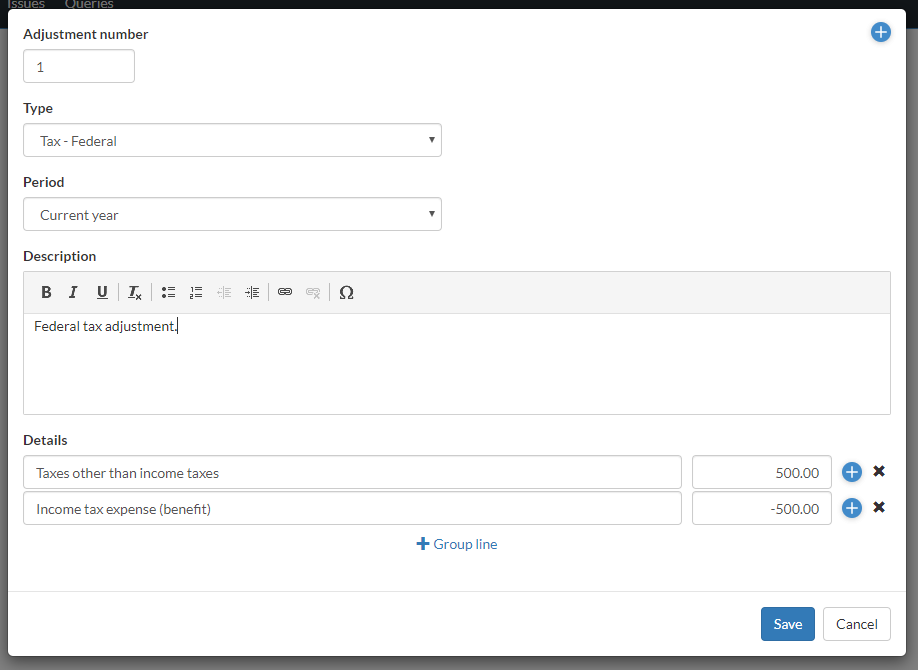

To post a tax adjustment using the Adjustments page:

-

Go to the Adjustments page.

-

Select +Adjustment.

A confirmation message displays. Select Proceed once you read and acknowledge that once you add adjustments in your engagement, you can't change the reporting period.

-

Enter the Adjustment Number.

Note: The application automatically increments the adjustment number.

-

Choose a tax adjustment Type.

Note: The available adjustment types are based on your product setup.

-

Enter a description for the adjustment.

-

Under Details, select + Account line to post the adjusting entry to an account, or select + Group line to post it to a grouping.

-

Select an account or a grouping and enter the adjustment amount.

If you are making an adjustment to a group in a consolidated file, you must select the entity to apply the adjustment to.

-

Select + Account line or + Group line to add another account or grouping to balance the adjustment.

-

Select Save.

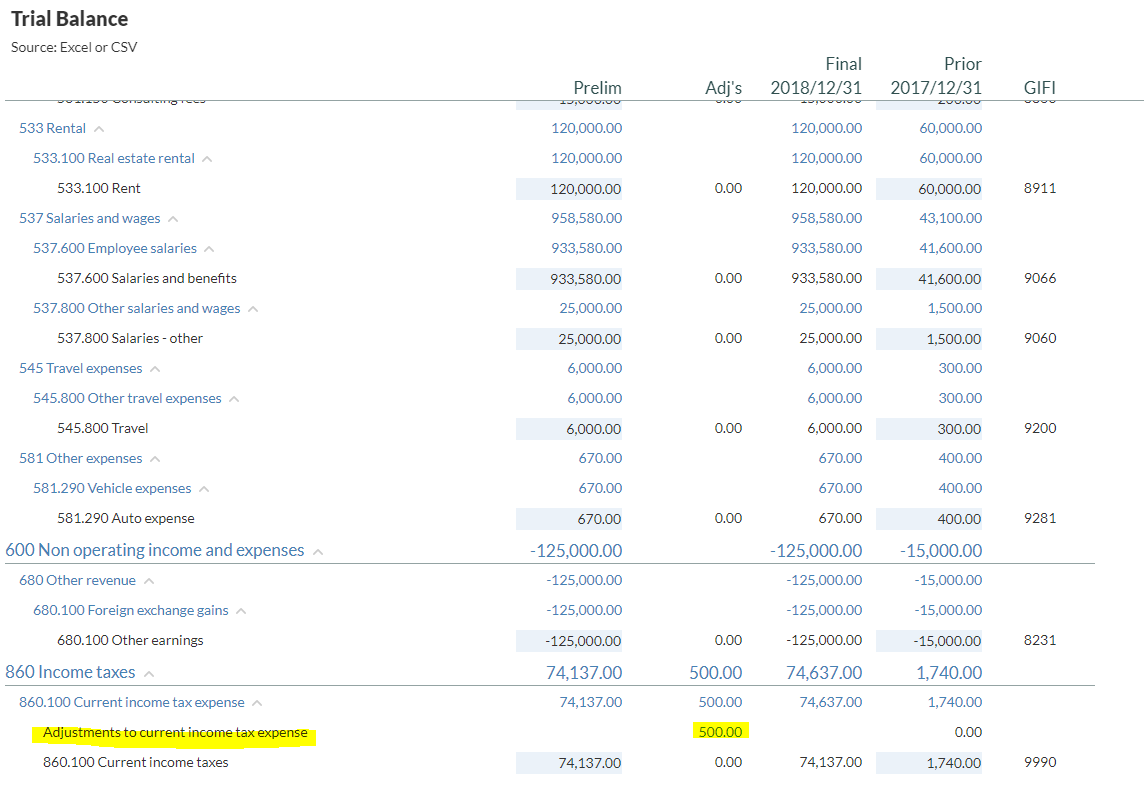

Tax adjustments are displayed in the trial balance. Go to the Trial Balance page to view the tax adjustment you added in the Adjustments column.