Steueranpassungen vornehmen

Wenn Sie Anpassungen für steuerliche Zwecke vornehmen müssen, können Sie diese über die Seite Anpassungen oder die Seite Hauptabschlussübersicht vornehmen. Sie können Buchungen für Konten oder Gruppen vornehmen und eine Beschreibung des Eintrags sowie eine Referenz hinzufügen.

Um eine Steueranpassung über die Seite Hauptabschlussübersicht vorzunehmen, siehe Abschlussbuchungen in Hauptabschlussübersicht vornehmen.

Um Steueranpassungen auf der Seite Buchungen vorzunehmen:

-

Gehen Sie auf die Seite Buchungen.

-

Wählen Sie +Buchung.

Eine Bestätigungsmeldung wird angezeigt. Wählen Sie Fortfahren sobald Sie gelesen und bestätigt haben, dass Sie den Berichtszeitraum nicht mehr ändern können, wenn Sie Anpassungen in Ihrem Engagement vornehmen.

-

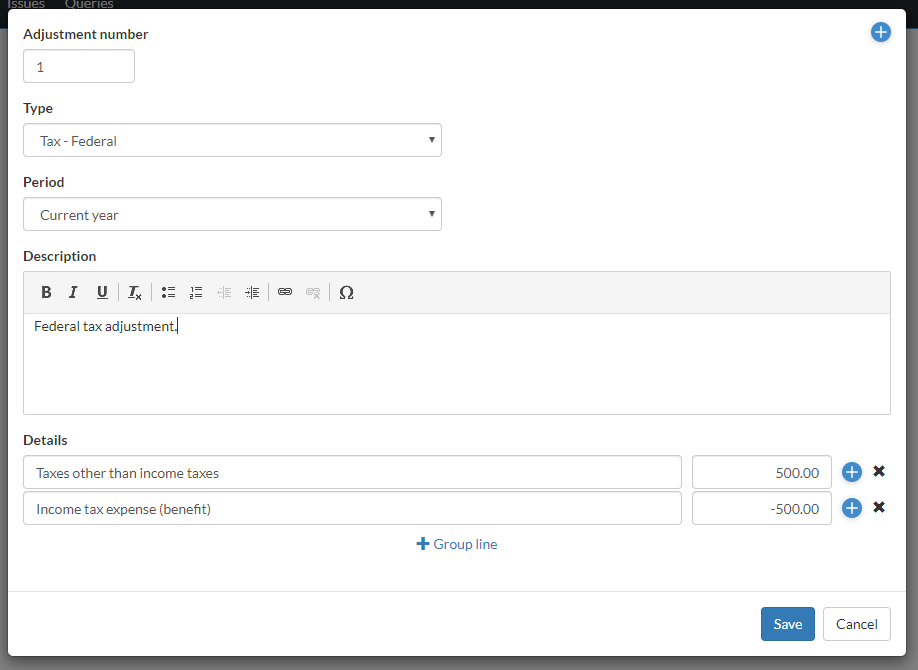

Geben Sie die Buchungsnummer ein.

Bitte beachten Sie: Die Anwendung erhöht automatisch die Buchungsnummer.

-

Wählen Sie einen Typ für die Steueranpassung aus.

Bitte beachten Sie: Die verfügbaren Buchungstypen basieren auf Ihrem Produkt-Setup.

-

Geben Sie eine Beschreibung für die Buchung ein.

-

Bei Details wählen Sie + Kontozeile, um eine Buchung für ein Konto vorzunehmen oder + Gruppenzeile, wenn die Buchung für eine Kontengruppe erstellt werden soll.

-

Wählen Sie ein Konto oder eine Kontengruppe und geben Sie den Buchungsbetrag ein.

Wenn Sie eine Buchung für eine Gruppe in einer konsolidierten Datei vornehmen, müssen Sie die Einheit wählen, der die Anpassung zugewiesen werden soll.

-

Wählen Sie + Kontozeile oder + Gruppenzeile, um ein weiteres Konto oder eine weitere Kontengruppe hinzuzufügen, um die Buchung auszugleichen.

-

Klicken Sie auf Speichern.

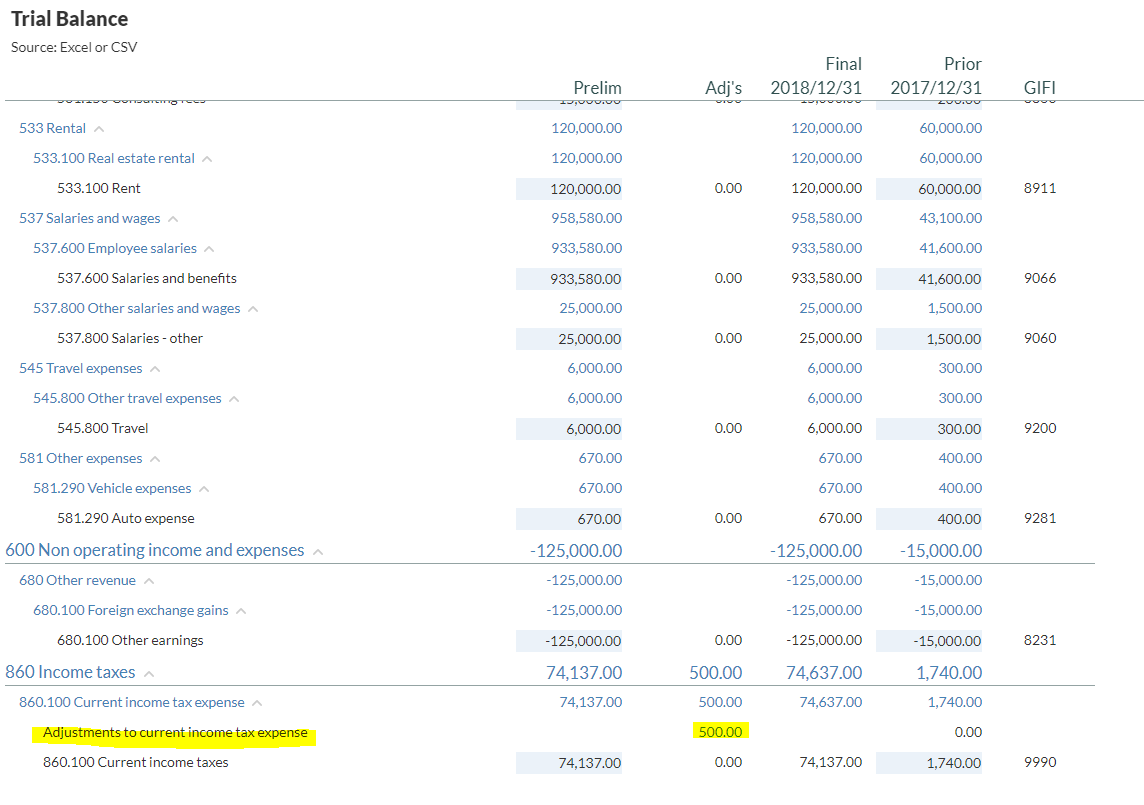

Steueranpassungen werden in der Hauptabschlussübersicht angezeigt. Gehen Sie zur Seite Hauptabschlussübersicht, um die von Ihnen hinzugefügten Steueranpassungen in der Spalte Buchungen anzuzeigen.