Nieuw in Audit International v2022.1.0

Deze versie van Audit International Cloud bevat de wijzigingen en nieuwe vereisten in ISA 315 (herzien 2019) die bedoeld zijn om accountants te verduidelijken en te helpen bij het consistenter en robuuster identificeren en beoordelen van risico's op een afwijking van materieel belang. Als gevolg van deze veranderingen en nieuwe vereisten zijn er updates doorgevoerd in Audit International Cloud.

Dit is wat er nieuw is in Audit International v2022.1.0.

Inhoud bijwerken

Auditplannen en procedures werkprogramma's

De volgende wijzigingen zijn doorgevoerd in alle werkprogramma's op het gebied van financiën in de map Plannen en procedures, met documentreferentie X.101:

-

Documentbegeleiding:

-

De leidraad voor het document bijgewerkt om duidelijkere richtlijnen te geven voor het bepalen van auditprocedures en instructies voor het invullen van het werkprogramma.

-

-

Gedetailleerd auditantwoord:

-

Nieuwe groep toegevoegd met twee subgroepen:

-

Overwegingen voor auditrespons: Nieuwe procedures om te helpen bij het ontwerpen van de auditrespons.

-

Tabel met antwoorden op controles: Nieuwe tabel toegevoegd om te helpen bij het documenteren van de juiste aard en omvang van de controleprocedures voor elke relevante bewering.

-

-

-

Wijzigingen in groepering:

-

De groepen A. SUBSTANTE PROCEDURES - BASIS en B. SUBSTANTE PROCEDURES - UITGEBREID werden samengevoegd tot SUBSTANTE PROCEDURES.

-

Groep C. SUBSTANTE ANALYTISCHE PROCEDURES werd hernoemd naar SUBSTANTE ANALYTISCHE PROCEDURES.

-

Nieuwe groep TESTS OF CONTROLS en nieuwe procedures toegevoegd.

-

-

Procedure voor door de entiteit benoemde deskundigen:

-

De antwoordset van de procedure bijgewerkt tot Firm has SUFFICIENT expertise / Firm has INSUFFICIENT expertise / N/A om beter aan te sluiten bij de vereisten van de procedure.

-

-

Evaluatie van de werkprocedure voor aangestelde deskundigen:

-

De procedure Zichtbaarheidsvoorwaarden bijgewerkt zodat deze afhankelijk is van het antwoord op de procedure "Door entiteit benoemde deskundigen". De procedure wordt nu weergegeven als het antwoord op de procedure "Entity appointed experts" is ingesteld op Firm has INSUFFICIENT expertise.

-

-

Boekhoudkundige schattingen:

-

Zichtbaarheidsinstellingen in de groep ACCOUNTING ESTIMATES worden nu gestuurd door de selecties in B200 Inzicht in de entiteit en haar omgeving, procedure Essentiële elementen van het inzicht van de auditor in de entiteit en haar omgeving.

-

Wijzigingen in reactieset

De handmatige antwoordset is vervangen door procedure-invoernotities voor alle werkprogramma's op financieel gebied in de map Plannen en procedures, evenals voor alle andere checklists die een gecombineerde picklist en handmatige antwoordset hadden. Deze wijziging zorgt voor meer efficiëntie bij het reageren op procedures en het gebruik van de geautomatiseerde aftekenfunctionaliteit.

Daarnaast zijn alle checklists met een antwoordset Gedaan/niet gedaan/n.v.t. vervangen door een antwoordset die is afgestemd op de tekst van de procedure om de documentatie te verbeteren bij het reageren op procedures en het beoordelen van reacties op procedures.

Werkbladen voor inhoudelijke analyseprocedures

Er zijn substantiële werkbladen met analytische procedures toegevoegd aan alle financiële gebieden in de map Plannen en Procedures.

Het doel van deze oefenhulpen is het plannen en uitvoeren van een inhoudelijke analytische procedure.

Tests van controles werkbladen

In de map Controletests onder de map Risicorespons zijn werkbladen voor steekproeven toegevoegd voor de volgende Business Cycles:

-

C050 Werkblad - Steekproeven - Controletests - Inkomsten, vorderingen, ontvangsten

-

C055 Werkblad - Steekproeven - Controletests - Aankopen, schulden, betalingen

-

C060 Werkblad - Steekproef - Controletests - Salarisadministratie

-

C065 Werkblad - Steekproeven - Testen van controles - Financiële verslaglegging

-

C070 Werkblad - Steekproeven - Controletests - Investeringen

-

C075 Werkblad - Steekproeven - Controletests - Inventarisatie

-

C080 Werkblad - Steekproeven - Controletests - Schatkist

-

C090 Werkblad - Controletests - Controles op het niveau van financiële overzichten

Het doel van deze praktijkhulpen is om richtlijnen te geven voor het gebruik van controletests bij het evalueren van de operationele effectiviteit van controles.

Inhoud groepscontrole

De volgende documenten met betrekking tot groepsaudits zijn bijgewerkt om oudere inhoud van groepsaudits te verwijderen:

-

C205 Groepsaudit - Acceptatie en planning: (voorheen C170)

-

C210 Groepsaudit - Communicatie: (voorheen C180)

-

C215 Groepsaudit - Evaluatie en conclusie: (voorheen C190)

-

C205 Werkblad - Consolidatie voltooien: Ver&wijderen

-

C220 Werkblad - EQR checklist - Groepsaudits met deelauditors: (voorheen C210)

-

C215 Werkblad - Groepsaudit - Algemene strategie: Ver&wijderen

-

C220 Werkblad - Groepsaudit - Groepsauditplan: Ver&wijderen

-

C240 Werkblad - Groepscontrole - Voorbereiding van groepscontrole-instructies (verwijderd)

Lijst van bijgewerkte documenten

| Documentnummer Cloud | Documentnaam | Wijzigen |

| A100 | Controlelijst Optimizer - Eerste beslissingen over betrokkenheid | Kleine procedurewijzigingen |

| A200 | Voorbereidende activiteiten | Kleine procedurewijzigingen |

| A300 | Algemene controlestrategie | Grote procedurewijzigingen |

| A315 | Werkblad - Inzicht in en evaluatie van een serviceorganisatie | Kleine procedurewijzigingen |

| A320 | Werkblad - Inzicht in en evaluatie van de interne auditfunctie | Grote procedurewijzigingen |

| A400 | Team planningsgesprekken | Grote procedurewijzigingen |

| A405 | De risicobeoordelingsprocedures voorbereiden | Grote procedurewijzigingen |

| A410 (nieuw formulier) | Werkblad - Fraudescenario's | Nieuw documentformaat |

| A505 | Materialiteit van kwalitatieve informatie | Nieuw document |

| B200 | De entiteit en haar omgeving begrijpen | Grote procedurewijzigingen |

| B205 | Inzicht in de entiteit en haar omgeving - Industrie, regelgeving en andere externe factoren | Grote procedurewijzigingen |

| B210 | B210 Inzicht in de entiteit en haar omgeving - Aard van de entiteit | Grote procedurewijzigingen |

| B215 | Inzicht in de entiteit en haar omgeving - Keuze en toepassing van grondslagen voor financiële verslaggeving en financiële verslaggevingsaangelegenheden | Grote procedurewijzigingen |

| {&B220}V&erwijderen | Inzicht in de entiteit en haar omgeving - Doelstellingen, strategieën en gerelateerde bedrijfsrisico's | Verwijderd (procedures samengevoegd in B210) |

| B220 (voorheen B225) | Inzicht in de entiteit en haar omgeving - Meting en beoordeling van de financiële prestaties van de entiteit | Kleine procedurewijzigingen |

| B250 | Werkblad - Inzicht in boekhoudkundige schattingen | Kleine procedurewijzigingen |

| B260 | Werkblad - Resultaat van schattingen van voorgaande boekjaren | Kleine procedurewijzigingen |

| B300 | Inzicht in de controles van de entiteit | Grote procedurewijzigingen |

| B305 | De IT-omgeving begrijpen | Kleine procedurewijzigingen |

| B310 | Inzicht in de IT-omgeving - Lijst | Kleine procedurewijzigingen |

| B315 | Risico's en controles op entiteitsniveau (Kern) | Grote procedurewijzigingen |

| (Nieuw formulier) | Grote procedurewijzigingen | |

| B320 | Algemene IT-controles | Kleine procedurewijzigingen |

| B325 | B325 Werkblad - Implementatie van controles - controles van bedrijfsprocessen | Kleine procedurewijzigingen |

| B330 (nieuw formulier) | Werkblad - Informatiestroom - Bedrijfsproces | Nieuw document |

| B400 | Beoordeling van RMM (inclusief frauderisico's) | Grote procedurewijzigingen |

| B405 | Frauderisico's identificeren | Grote procedurewijzigingen |

| B410 | Werkblad - Notulen van bestuursvergaderingen | Kleine procedurewijzigingen |

| B600 | Specifieke gebieden | Grote procedurewijzigingen |

| C100 | Auditreactie op beoordeelde risico's | Grote procedurewijzigingen |

| C110 | Reageren op risico's op het niveau van financiële overzichten | Grote procedurewijzigingen |

| C115 | Werkblad - Evaluatie van de bedrijfscontinuïteit | Grote procedurewijzigingen |

| C135 | Gebeurtenissen na balansdatum (Kerncijfers) | Kleine procedurewijzigingen |

| C140 | Werkblad - Transacties met verbonden partijen (kern) | Kleine procedurewijzigingen |

| C150 | Kasstroomoverzicht - Controleprocedures | Grote procedurewijzigingen |

| 1,101 | Materiële vaste activa - Controleprocedures | Kleine procedurewijzigingen |

| 5,101 | Vastgoedbeleggingen - Controleprocedures | Kleine procedurewijzigingen |

| 20,101 | Langetermijninvesteringen - Controleprocedures | Kleine procedurewijzigingen |

| 35,101 | Leningen en voorschotten - Controleprocedures | Kleine procedurewijzigingen |

| 40,101 | Landbouwactiva - Controleprocedures | Grote procedurewijzigingen |

| 40.110 (nieuwe vorm) | Controlelijst voor het tellen van landbouwactiva | Nieuw document |

| 110,101 | Inventaris - Auditprocedures | Grote procedurewijzigingen |

| 110,110 | Checklist voorraadtelling | Grote procedurewijzigingen |

| 120,101 | Investeringen - Controleprocedures | Kleine procedurewijzigingen |

| 130,110 | Debiteurenbevestiging - Aanvullende procedures | Grote procedurewijzigingen |

| 300,101 | Schuld op lange termijn - Controleprocedures | Grote procedurewijzigingen |

| 335,101 | Overheidssubsidies - Controleprocedures | Grote procedurewijzigingen |

| 340,101 | Leases voor lessees - Controleprocedures | Grote procedurewijzigingen |

| 425,110 | Crediteurenbevestiging - Aanvullende procedures | Grote procedurewijzigingen |

| 1600,105 | Salarisadministratie en andere uitgaven - Controleprocedures | Grote procedurewijzigingen |

| 1700,101 | Overige inkomsten | Grote procedurewijzigingen |

| 1800,101 | Overige kosten | Grote procedurewijzigingen |

| D100 | Evaluatie van geïdentificeerde onjuistheden | Kleine procedurewijzigingen |

| D300 | Evaluatie van het werk van anderen die bij de audit betrokken zijn | Grote procedurewijzigingen |

| D305 | Werkblad - Controlelijst kwaliteitscontrole van de opdracht | Kleine procedurewijzigingen |

| D500 | Communicatie met management/TCWG | Kleine procedurewijzigingen |

| D505 | Werkblad - Zaken die moeten worden gecommuniceerd aan het management en de met governance belaste personen | Grote procedurewijzigingen |

| D510 | Mededelingen van de auditor aan de met governance belaste personen en het management | Grote procedurewijzigingen |

| D600 | Audit voltooid | Grote procedurewijzigingen |

| D610 | Controlelijst voor rapportage | Kleine procedurewijzigingen |

| D615 | Checklist documentatie | Grote procedurewijzigingen |

| D625 | Checklist - Audit voltooien (Kern) | Kleine procedurewijzigingen |

Risicobeoordeling

De volgende risicobeoordelingsfuncties zijn toegevoegd om de wijzigingen en nieuwe vereisten in ISA 315 (herzien 2019) aan te pakken:

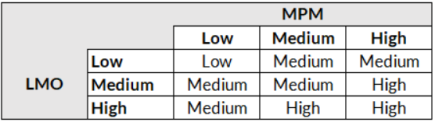

Inherent risico (IR):

-

LMO: Waarschijnlijkheid van onjuiste weergave:

-

Beoordelingsschaal: 3

-

Laag (L)

-

Gemiddeld (M)

-

Hoog (H)

-

-

-

MPM: Omvang van potentiële onjuiste weergave:

-

Beoordelingsschaal: 3

-

Laag (L)

-

Gemiddeld (M)

-

Hoog (H)

-

-

-

Inherent risico automatisering:

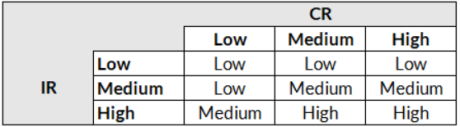

Risico op een afwijking van materieel belang (RMM):

-

Beoordelingsschaal:

-

Onbeduidend: I

-

Laag: L

-

Gemiddeld M

-

Hoog H

-

Veelzeggend: S

-

-

RMM Automatisering:

Bedrijfscycli

De volgende bedrijfscycli zijn toegevoegd:

-

Inkomsten, vorderingen, ontvangsten

-

Inkoopboek en betalingen

-

Salarisadministratie

-

Financiële rapportage

-

Investering

-

Voorraad

-

Schatkist

Nieuwe rollen en regelingen

Er is een nieuwe partnerrol gemaakt en toegewezen aan de beoordelingsworkflow.

Er is een nieuw partnerbeoordelingsschema gemaakt met de volgende details:

-

Voorbereidende rol:

-

Auteur

-

-

Rol van beoordelaar:

-

Beoordeeld door

-

Partner

-

Het partnerbeoordelingsschema werd toegewezen aan de volgende documenten:

-

C205 Groepsaudit - Acceptatie en planning

-

C215 Groepsaudit - Evaluatie en conclusie

-

D625 Checklist - Audit voltooien

Het voorlopige en definitieve schema werd toegewezen aan de volgende documenten:

-

A500 Materialiteit

-

A505 Materialiteit van kwalitatieve toelichtingen

-

B500 Risicobeoordelingsrapport

-

B700 Risicorapport