What's new - PEG ReviewComp Winter 2022 (v1.2292.0)

For a demonstration of what's new, watch the video below.

Here is a listing of what's new for the PEG ReviewComp Winter 2022 release.

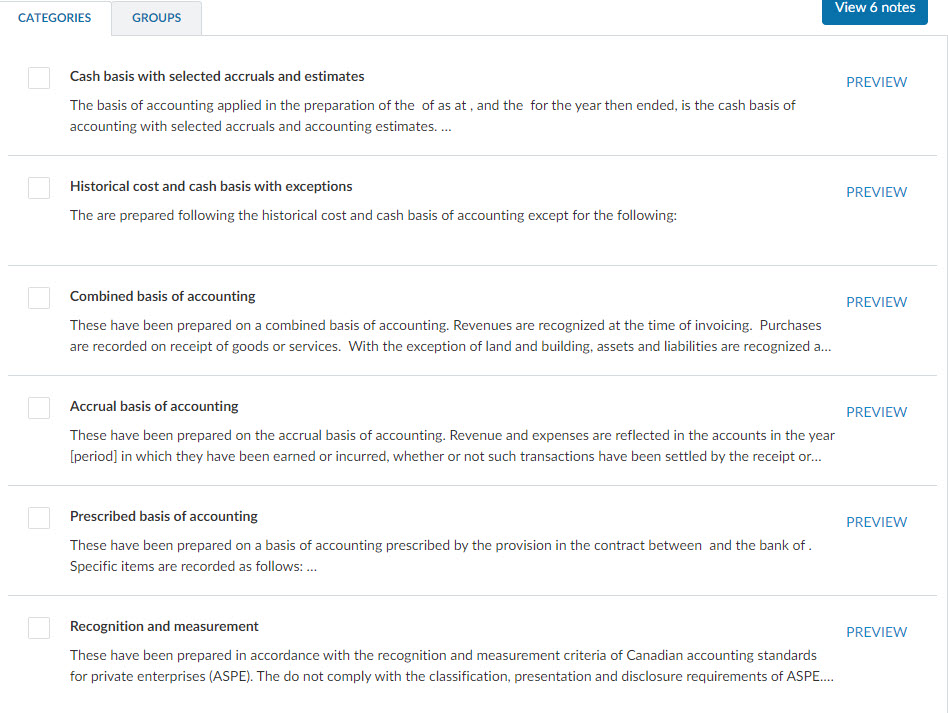

Enhancements to the Basis of accounting note

A new Recognition and measurement note has been added to the required Basis of accounting note in Compilation engagements. The Basis of accounting note has also been enhanced to help you identify the disclosures that apply to your engagement. When you select the Basis of accounting note from the Notes Library, you can now choose from a variety of categories.

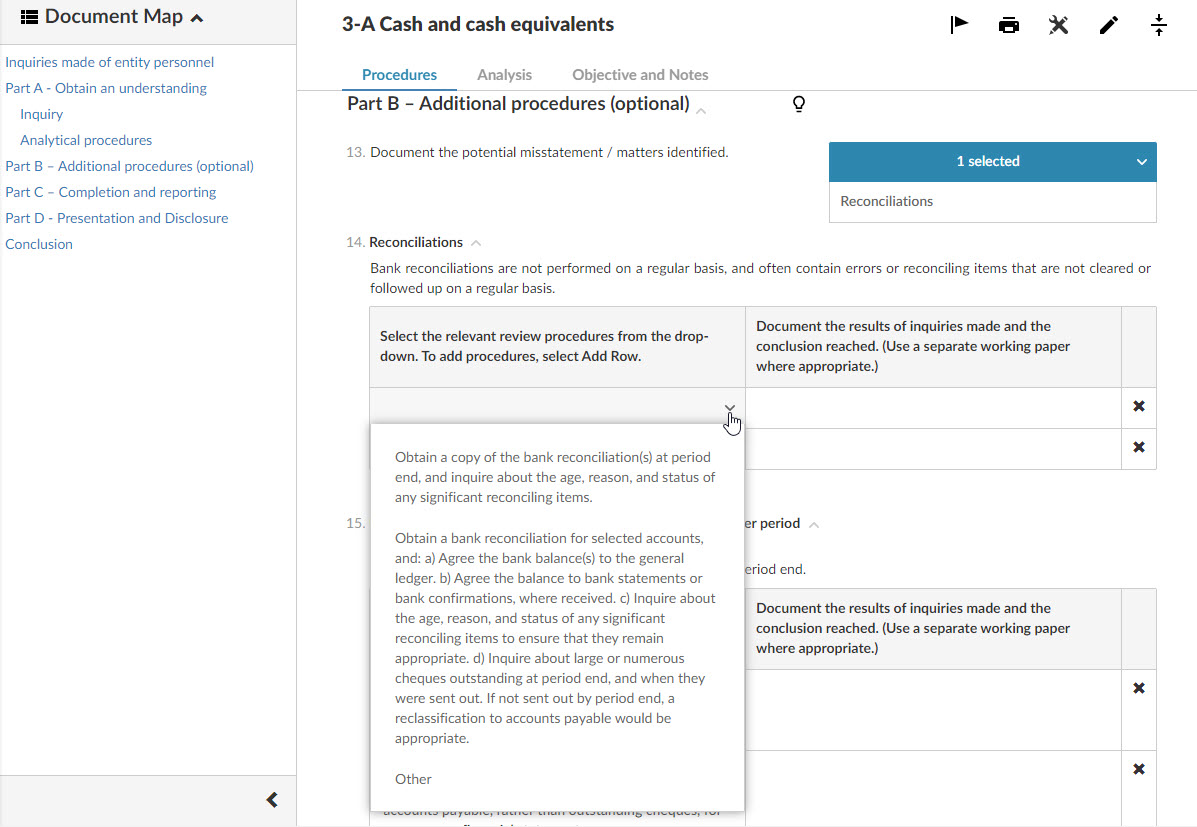

Formatting updates to Part B Review procedures

In Review engagement work programs, the Part B - Additional procedures (optional) section no longer displays additional review procedures by default. Instead, you can select the applicable procedures from the drop-down.

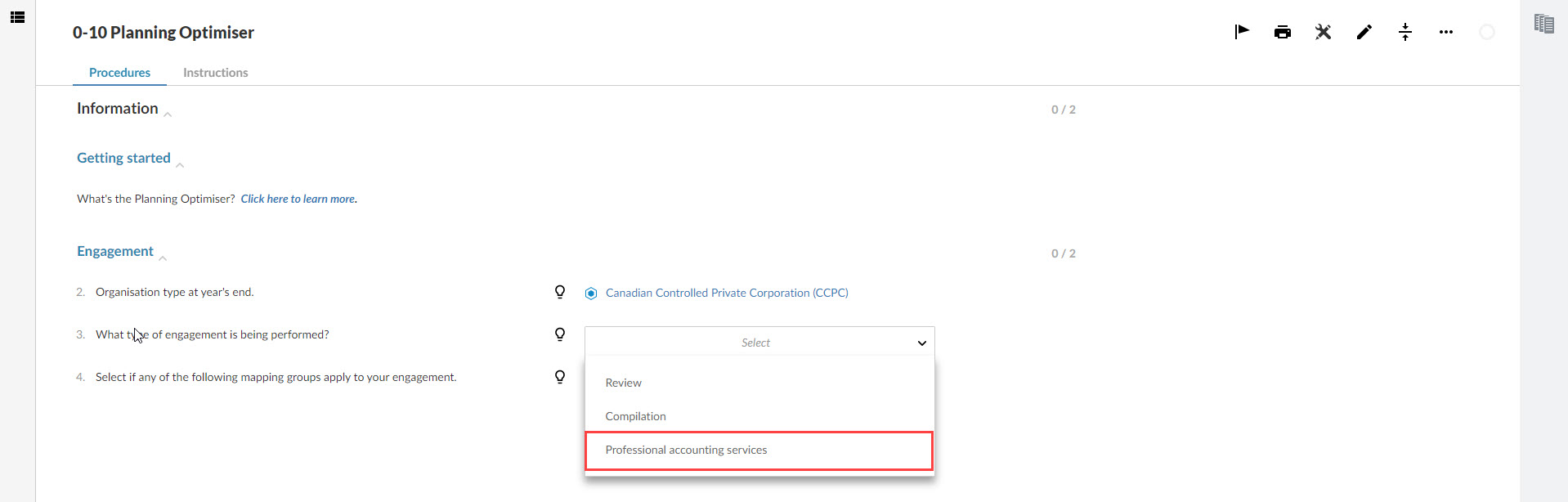

Professional accounting services

We’ve enhanced PEG ReviewComp to now include Professional accounting services. Professional accounting services is an engagement type designed for practitioners that offer ad hoc services such as financial statement preparation, bookkeeping and tax services. Now, you can complete reviews, compilations and professional accounting services engagement types all from one platform.

To learn more, see What is PEG ReviewComp?

PEG content updates

PEG ReviewComp is up to date with the 2022 CPA Canada PEG form content updates.

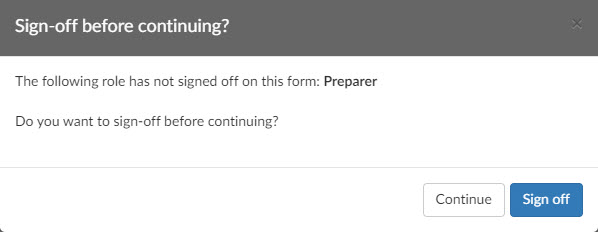

Document sign-off prompt

You can now receive a reminder to sign off on your documents before moving on to the next document. Using the sign-off prompt question in the 010 Planning optimiser document, you can also choose which roles you want to display the reminder for.

To learn more, see Modify sign-off roles.

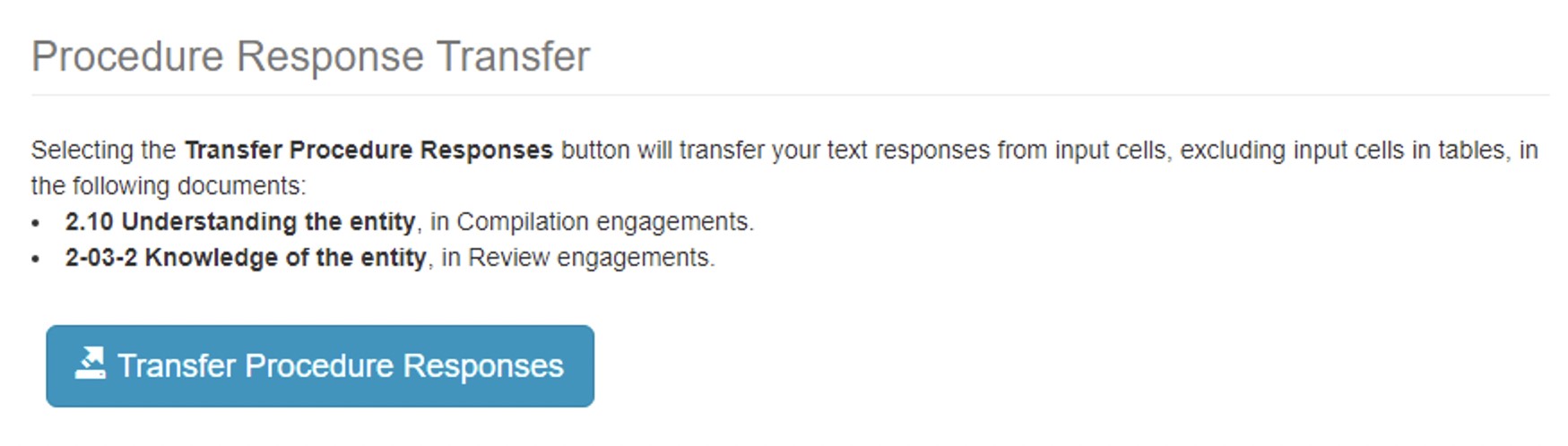

CloudBridge enhancements

CloudBridge now allows you to transfer some of your procedure responses from our PEG Review and Compilation Working Papers template into Caseware Cloud.

CloudBridge currently supports the transfer of text responses from input cells in the following documents:

-

2.10 Understanding the entity, in Compilation engagements.

-

2-03-2 Knowledge of the entity, in Review engagements.

To get the latest version, see Get CloudBridge.

Interactive welcome guide

We now support an interactive tool to help navigate you through PEG ReviewComp. From your engagements, you can participate in guided walkthroughs, see the latest announcements and learn more about product updates.

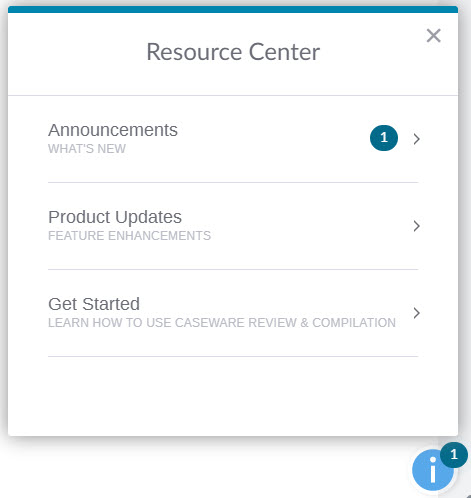

Interactive Resource Center

We’ve added an interactive Resource Center where you’ll receive the latest announcements and product updates. The Resource Center is also where you can access the guided walkthroughs available to you.

To open the Resource Center from your engagement, select the blue information icon on the bottom right corner. When there’s a new announcement or product update, you’ll see a badge notification.

Discontinuation of Tax

Effective December 31, 2022, the Tax component of PEG ReviewComp will be discontinued. Although you will no longer be able to use the Corporate Tax EFILE submission functionality, we will continue to maintain the GIFI tax forms and allow you to export your GIFI data and financial statement notes, as needed.

For more information, see Tax deprecation FAQs.

Fixes

The following list features a brief description of the issues that have been resolved in this release.

-

When printing checklists, the Next step guidance displays.

-

In the 6-20 Financial statements, placeholder text is inaccessible to define the Basis of accounting note reference in the Compilation Engagement Report.

-

When you select Download reference copy, issue flags incorrectly display in the Trial Balance.

-

In the Notes to the Financial Information section:

-

The Basis of accounting note contains a duplicate “the.”

-

The Revenue recognition - Sales note displays a smaller font size.

-

The Cash and cash equivalents note does not display.

-