Tax adjustments

Note: Caseware Taxflow supports 2022 and 2023 tax exports for C-Corporations, S-Corporations and Partnerships for the following tax vendors:

-

CCH ProSystem fx® Tax

-

CCH Axcess™ Tax

-

Lacerte® Tax

-

GoSystem® Tax

-

UltraTax CS

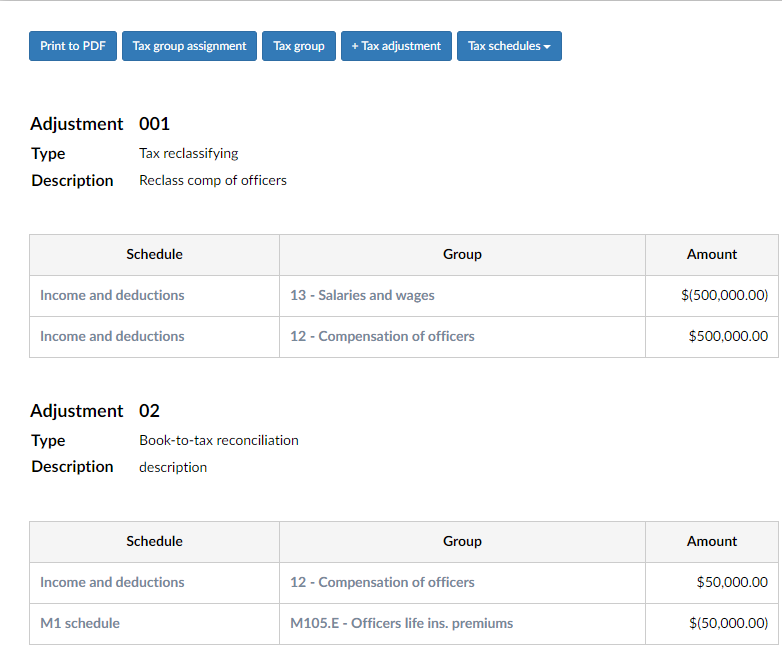

When posting tax adjustments to your Caseware Taxflow engagement file, you can add tax reclassifying adjustments and book-to-tax reconciliation adjustments. After posting your adjustments, you can view them from the Tax adjustments summary page.

Eine Steueranpassung vornehmen

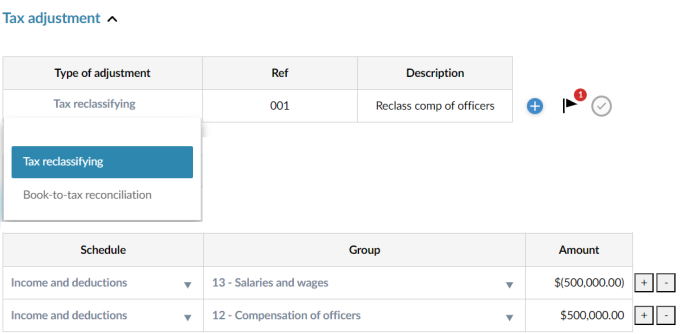

When posting a tax adjustment, you can add a tax reclassifying adjustment or a book-to-tax reconciliation adjustment.

To post a tax adjustment:

-

Select the New engagement item icon (

) and then Tax adjustments.

) and then Tax adjustments.The Tax adjustments form opens in a new tab or browser.

-

From the Type of adjustment drop-down, select either Tax reclassifying adjustment or Book-to-tax reconciliation adjustment.

-

Enter a reference number in the Ref column and a description in the Description column.

-

Select the applicable Tax Schedule and Tax Group, then enter the Amount.

-

To add or delete a tax form row, select the Add (

) or Delete icon (

) or Delete icon ( ).

).

Note: A warning displays if your tax adjustments are out of balance.

To view your tax adjustments, go to the Tax adjustments summary.

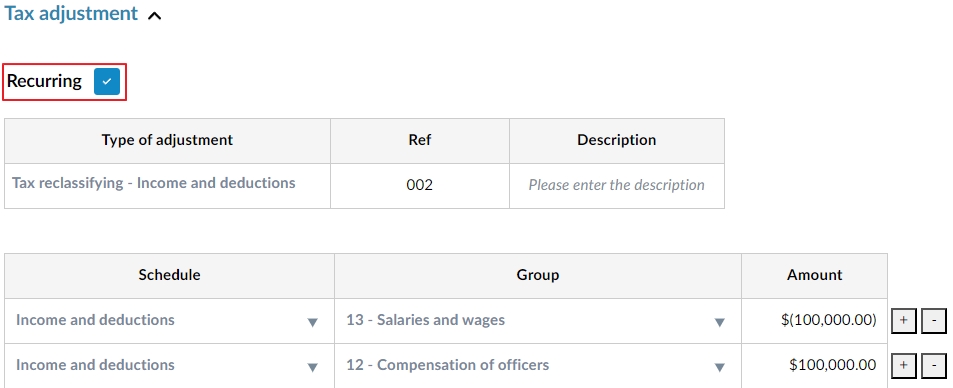

Recurring adjustments

To designate a tax adjustment a recurring entry, select the applicable checkbox in the Tax Adjustment dialog.

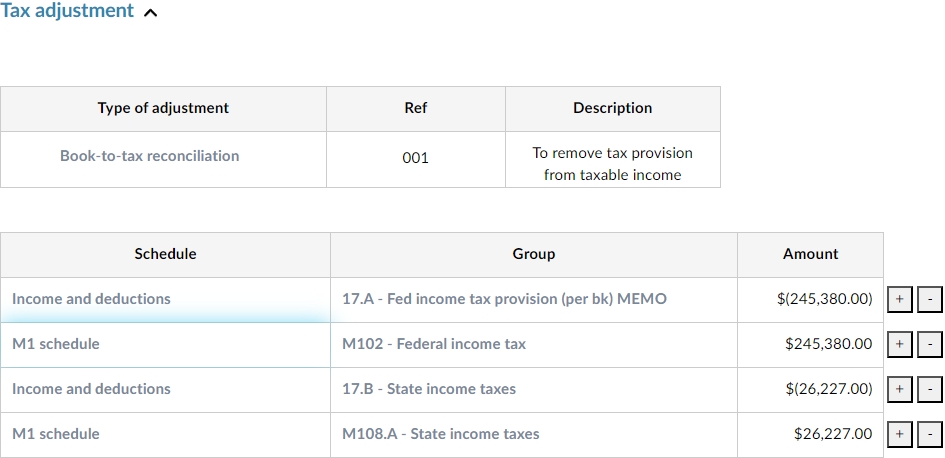

Tax provision automatic adjustments

A tax adjustment is now automatically generated to record the tax provision expense after the following steps are completed in a Caseware Taxflow engagement:

-

Import Financial information

-

Open and review the Tax groups assignment

Note: If changes to the default tax provision automatic adjustment are required, we recommend deleting the adjustment and recreating a new one based on the engagement specific. The new adjustment can be selected as “Recurring” to be carried forward in the next year’s file.