What's new - Caseware ReviewComp Winter 2019 (Version 1.329)

Here is a listing of what's new for the Winter 2019 release of Caseware ReviewComp.

Corporate Tax certification

Caseware ReviewComp is now certified for the preparation of federal T2 and the Alberta AT1 tax returns to include corporations with year-end dates up to May 31, 2020.

Standardpositionen

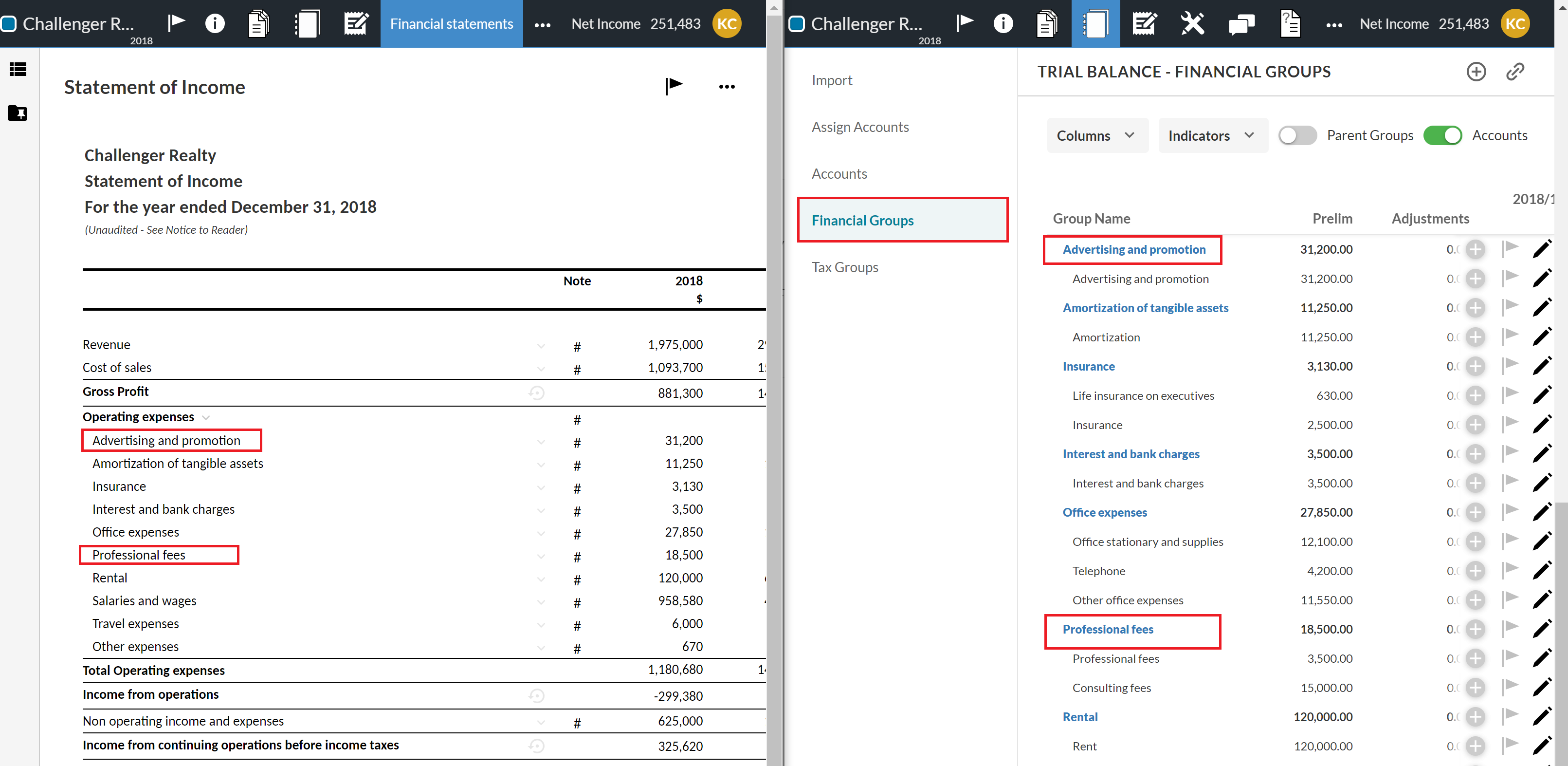

We have modified the Financial groupings structure for better presentation. In the Data page, Financial groupings have been broken down further, so you can easily relate the Financial groupings in the trial balance to the groups in the income statement.

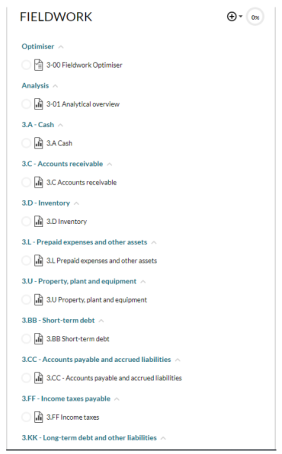

Analysis sheets

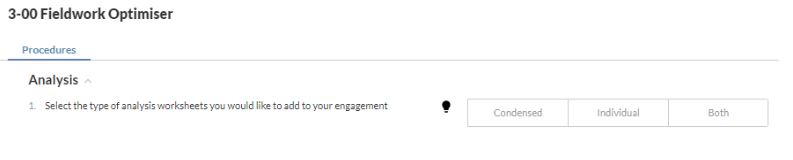

You can now choose how you want analysis worksheets to display in the Documents page. A new procedure is now available in the 3-00 Fieldwork Optimiser prompting you to select how you want to add analysis worksheets in the engagement.

You can choose whether to have all worksheets display in one folder (Condensed), in individual folders based on the corresponding financial area (Individual) or if you want to have both options (Both) - that is, to have them display in the generic folder and in individual folders as well.

To learn more, see Perform data analysis.

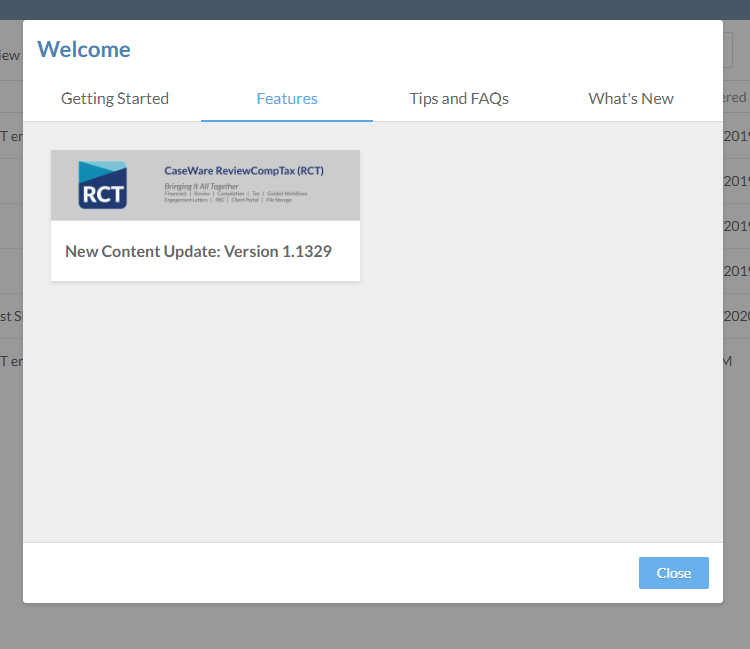

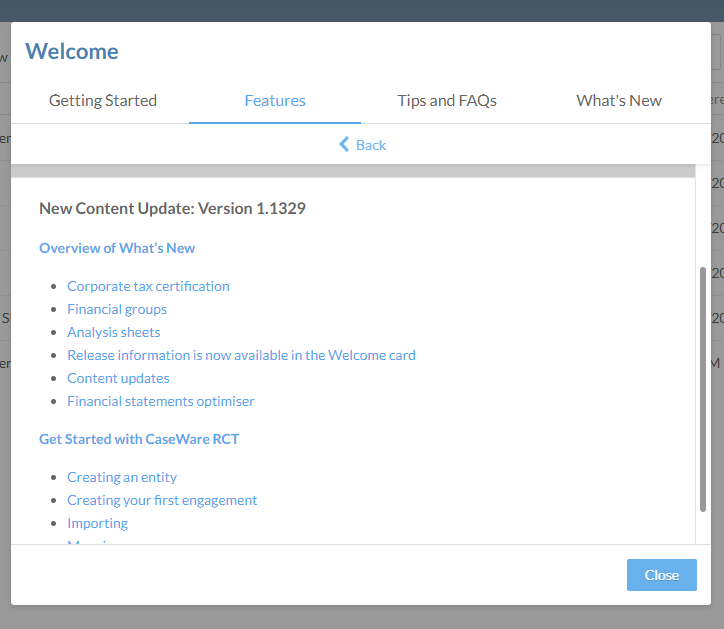

Release information is now available in the Welcome card

A Welcome card is now available once you sign in to Caseware ReviewComp. The card displays the current content version of the product.

The Welcome card also includes direct links to topics on what's new in the current release and how to get started with Caseware ReviewComp. Select the content version information to view the list of what's new and how to get started topics.

You can also access the Welcome card by navigating to your cloud entity page, the selecting Help icon (![]() ) | Welcome on the top right corner of the page.

) | Welcome on the top right corner of the page.

Content updates

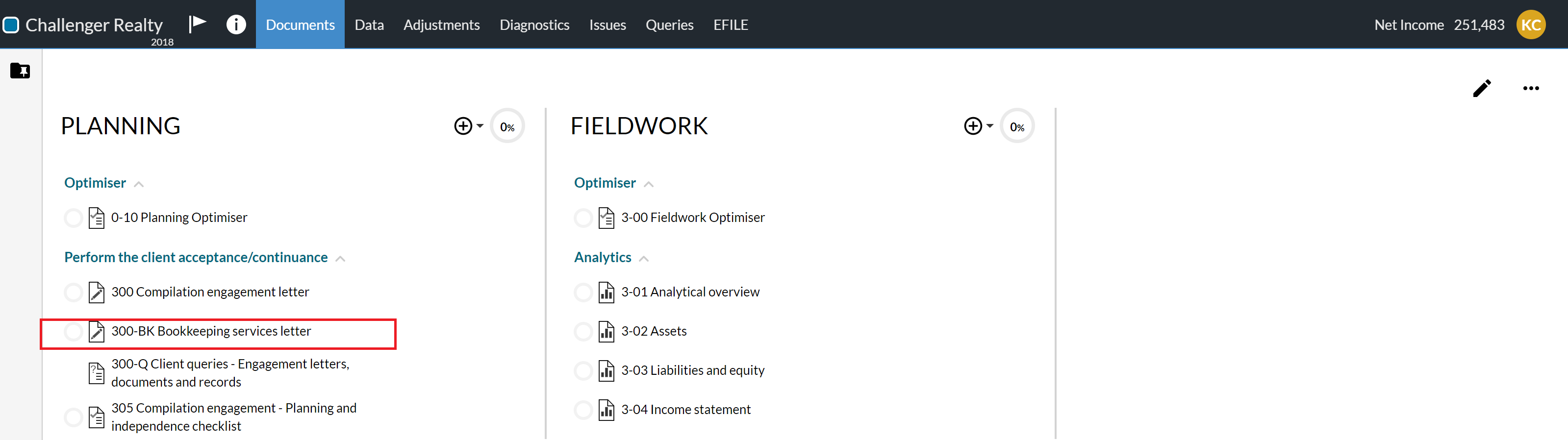

We have incorporated a couple of updates to remain compliant with CPA Canada content for Bookkeeping services engagement letters and to complement the Corporation Tax only engagement workflow.

-

If you're preparing a compilation engagement, a new procedure is now available in the Planning Optimiser asking if you want to prepare and share a Bookkeeping services engagement letter. If you answer Yes, the 300-BK Bookkeeping service letter document becomes available in the Documents page.

-

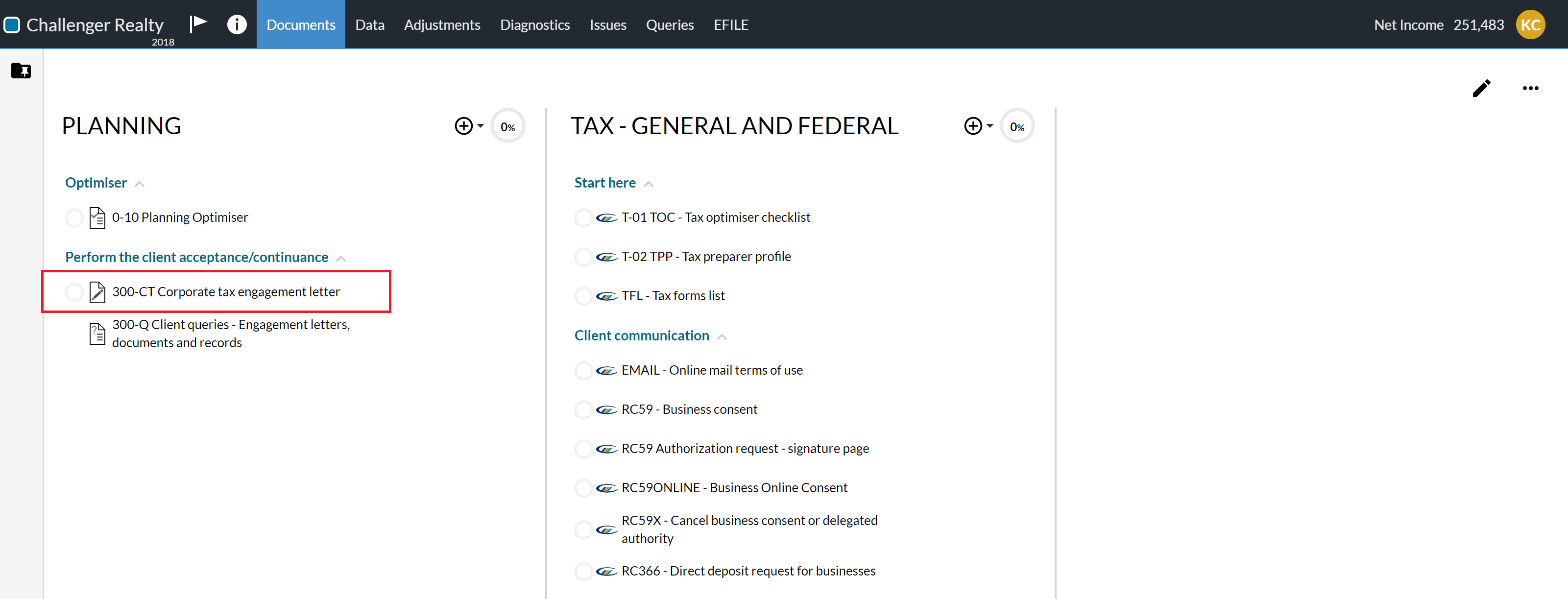

A sample engagement letter is now available for tax practitioners. If you're preparing a Corporation Tax only engagement, a new document 300-CT Corporate tax engagement letter becomes available in the Documents page.

Financial statements optimiser

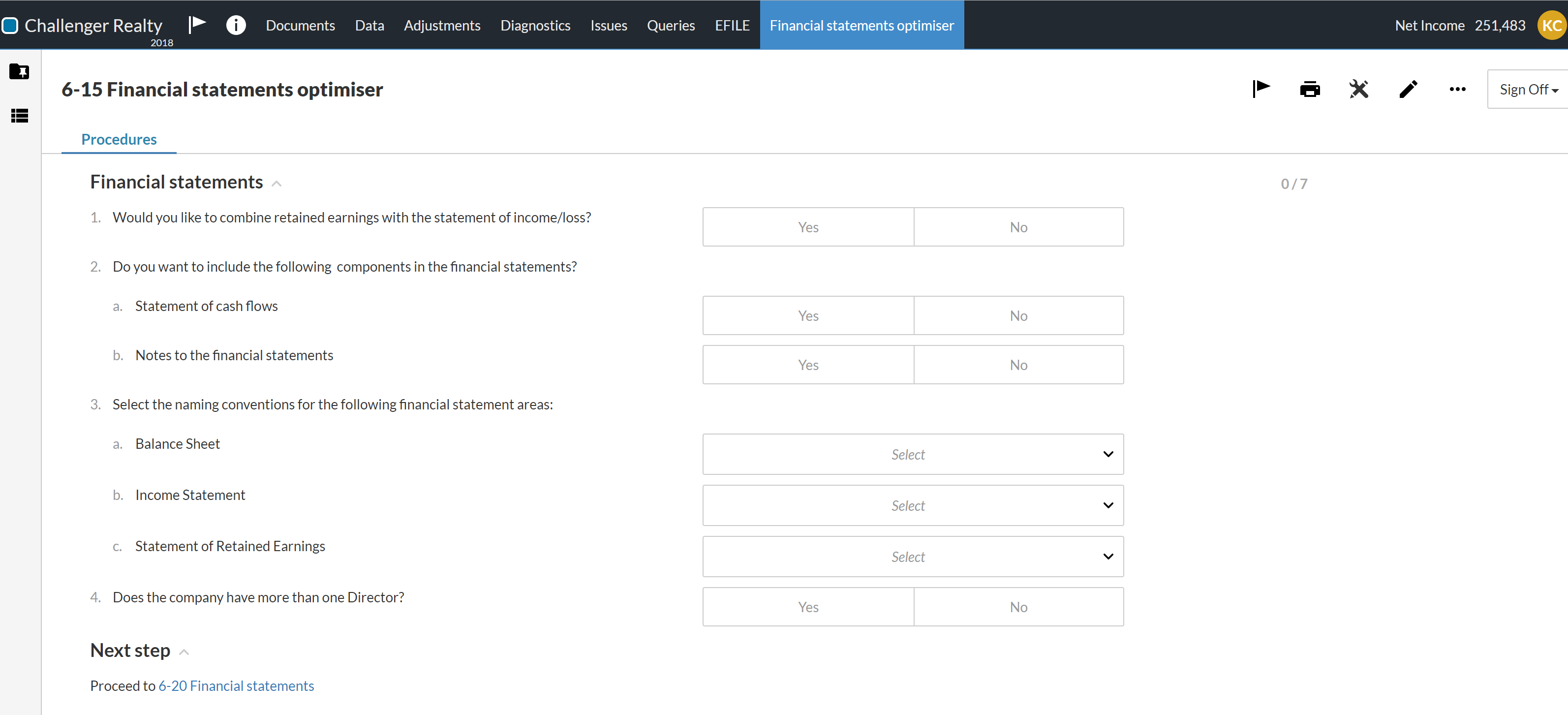

To enhance the financial statements preparation experience, the 6-15 Financial statements optimiser has been included in the workflow. The Financial Statements Optimiser encapsulates all procedures related to how you want to prepare and present the financial statements document in your engagement.

Note: With the Financial Statements Optimiser in place, the Planning Optimiser no longer includes procedures related to the preparation of financial statements.

To learn more, see Issue the report and send the relevant documents to your client.

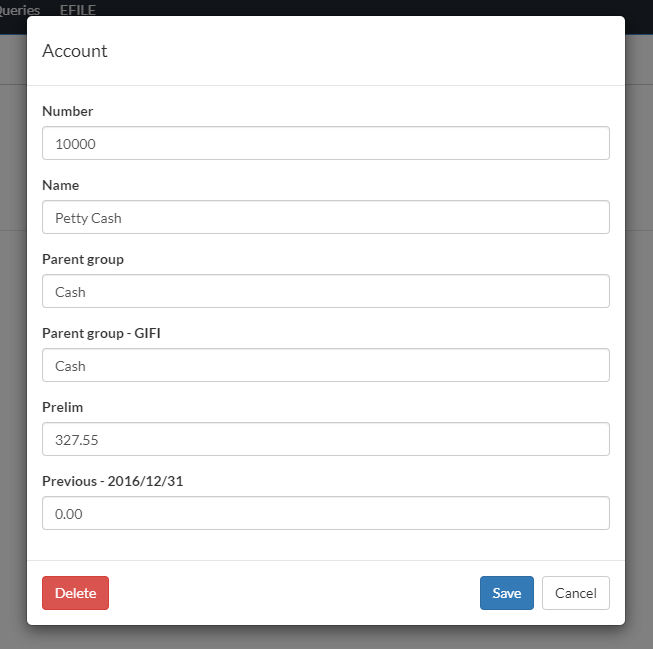

Accounts

You can now assign new accounts to groups without having to navigate to a different page. The Account dialog now features group drop-downs (Financial, GIFI or Tax Code). Note that if the account is assigned to a group that's linked to another group, it's automatically assigned to the linked group as well.

Buchungen

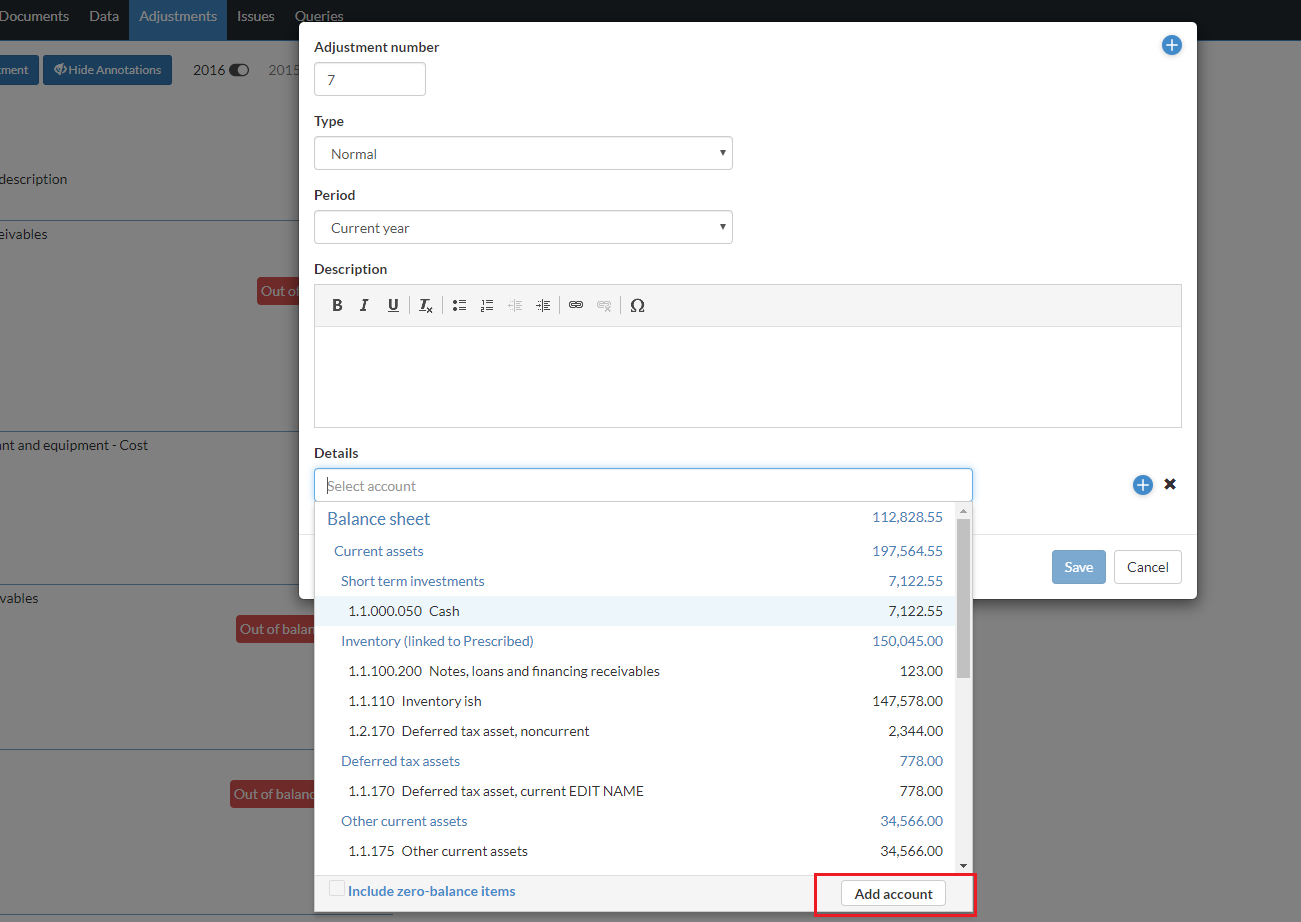

While posting adjustments, you can now create an account while you're adding the lines of the adjusting entry.

Abfragen

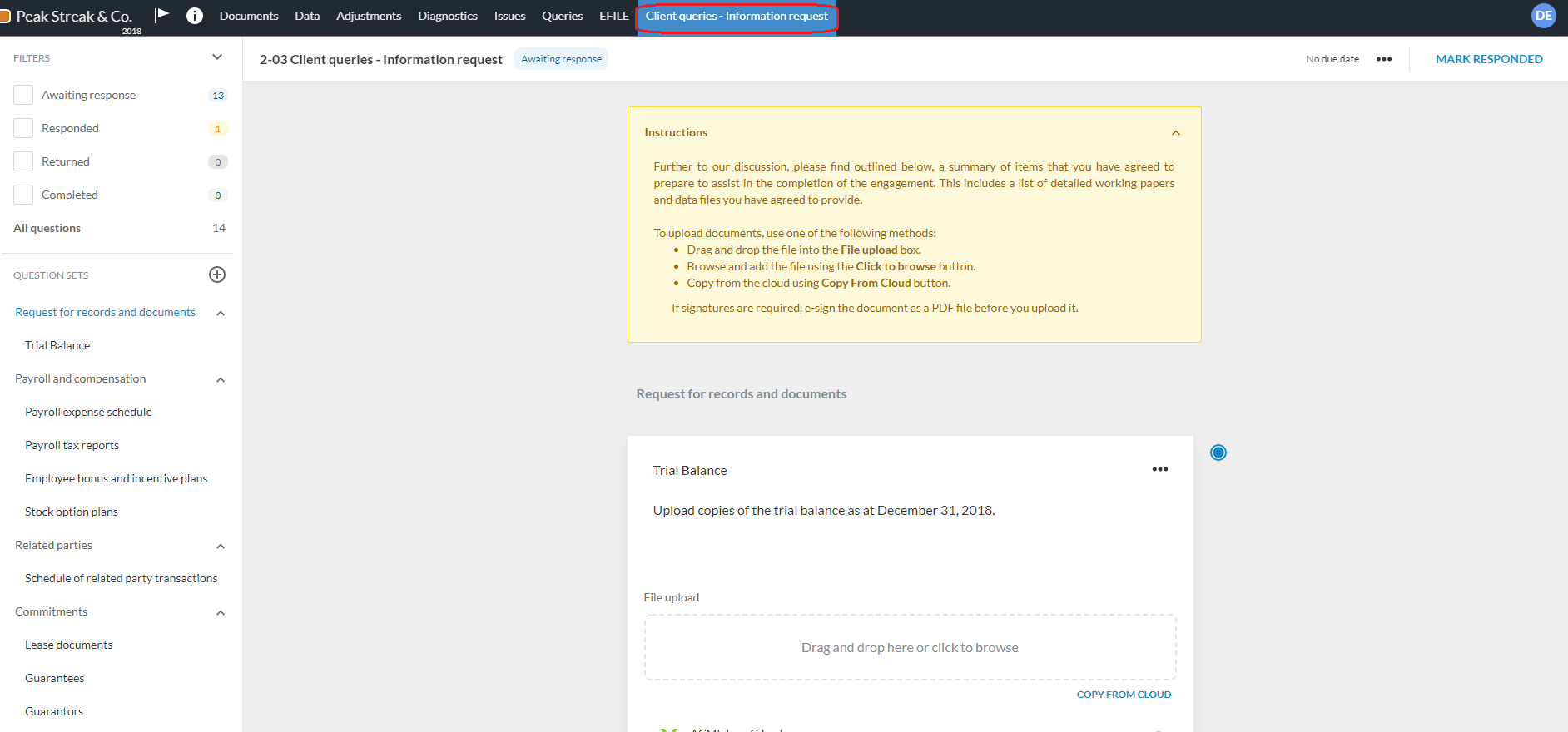

Query documents have witnessed a few improvements to retain legacy behavior and improve scannability.

-

To efficiently view and scan questions in queries, a filter now displays in the left side navigation in the document once it's sent to contacts.

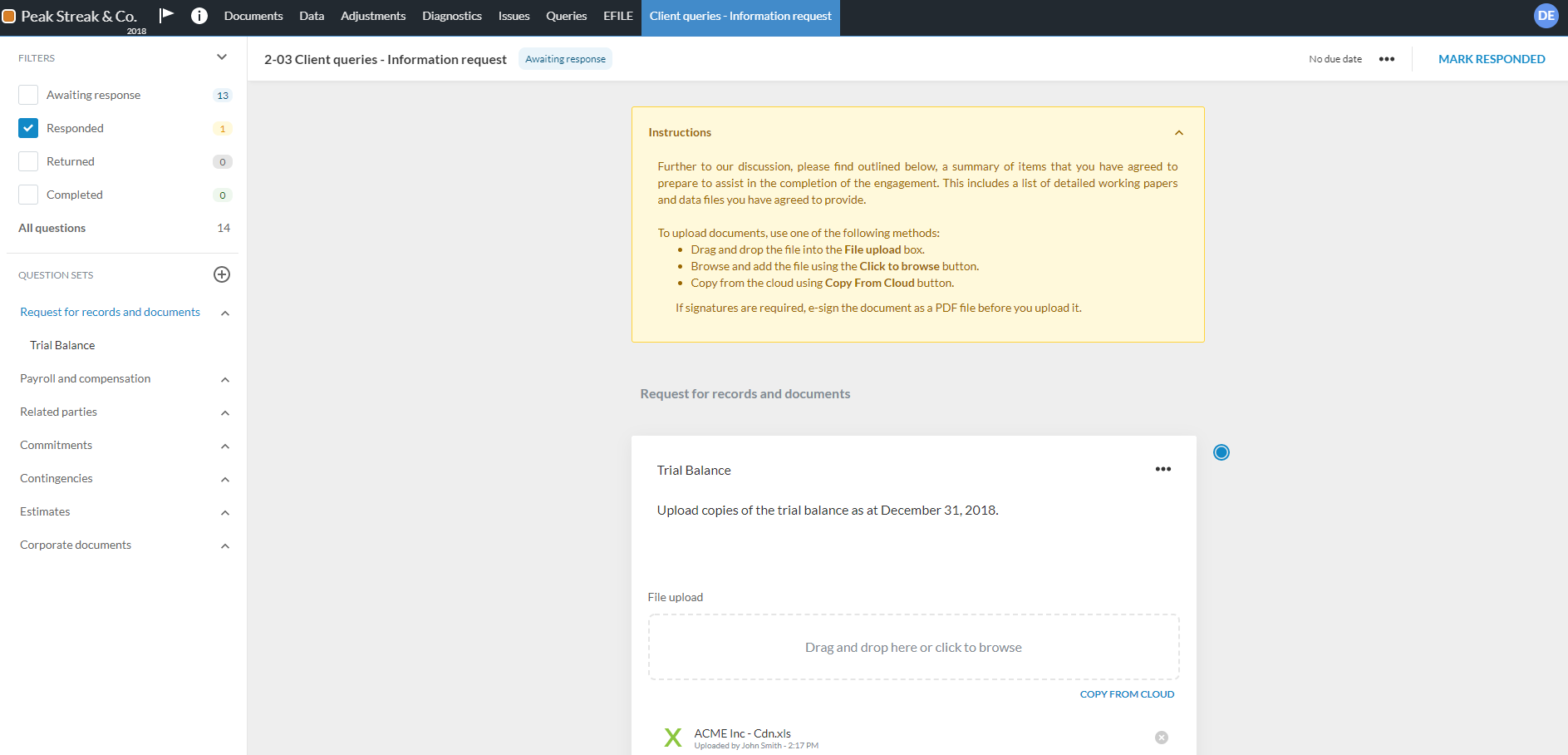

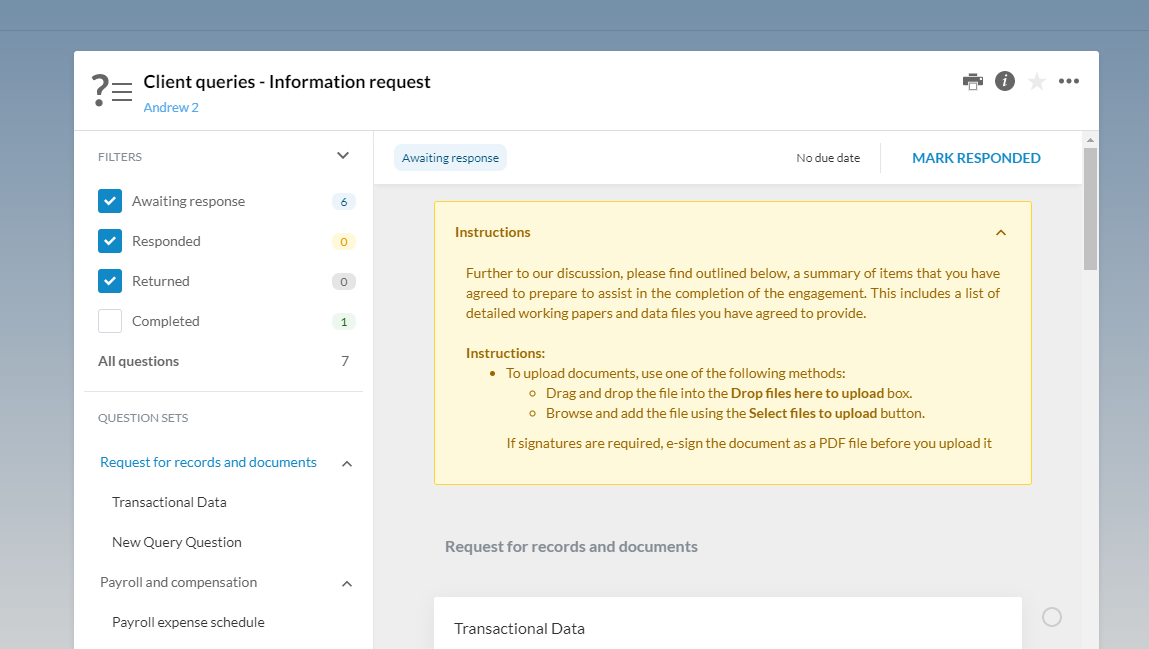

The figure below shows how staff can filter query questions by status.

The figure below shows how contacts can filter query questions by status.

-

Similar to the old query layout behavior, when you open a query document, its name now displays in the engagement's main navigation at the top.

To learn more, see Staff-Contact collaboration (Queries).