Perform fieldwork

Content in this topic requires OnPoint PCR.

In the Fieldwork phase of the engagement, you need to present your analysis of the trial balance and any other applicable data sources.

In this phase, you need to complete the following checklist documents:

-

2-400 Review - Overall analysis - Based on selections in this checklist, additional checklists in the Assets, Liabilities and Equity and Revenue and Expenses folders will need to be completed.

-

3-100 Review Inquiries- To document any inquiries you have based on the work performed.

Note: Ensure all the checklists in this phase are signed off by the designated preparer and reviewer.

You can also use the 3-100Q Review inquiries - Required and general query document to request additional information and files from the client. To learn more about the query documents functionality, see Staff-contact collaboration (Queries).

Leadsheets

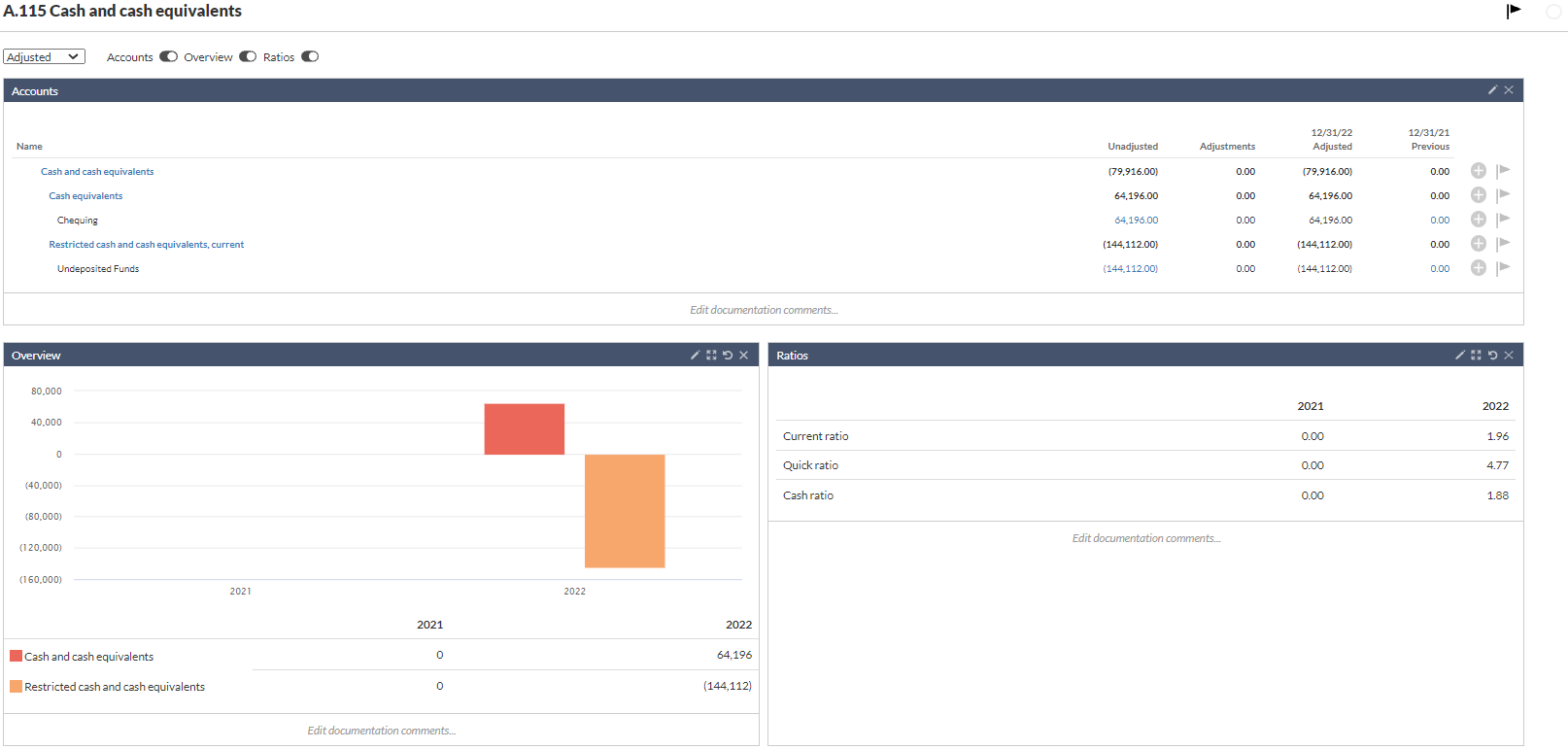

In case of a Preparation or Compilation engagement, Leadsheets can be enabled in the Engagement set up document. Leadsheets are located in the Fieldwork phase grouped by the corresponding financial area. For example, you can find the A.115 Cash and Cash Equivalents sheet in the Cash and Cash Equivalents section.

The default view in each leadsheet shows widgets with data for accounts, overview, and ratios. You can hide or display specific widgets by selecting the toggles (![]() ) at the top of the page.

) at the top of the page.

OnPoint PCR graph notes

Here is some guidance around the OnPoint PCR graphs that display in the Analysis tab.

Cash and Cash Equivalents

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Cash and Cash Equivalents.

| Bar Name | Financial Groupings |

|---|---|

| Cash and cash equivalents | Sum of:

|

| Restricted cash and cash equivalents | Sum of:

|

Receivables

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Receivables.

| Bar Name | Financial Groupings |

|---|---|

| Trade receivables, net | Net of:

|

| Non-trade receivables, net | Net of:

|

| Related party receivables, net | Net of:

|

| Total contract retainage receivables, net | Net of:

|

| Revenues from contracts with customers, goods | RevenueFromContractWithCustomerIncludingAssessedTax-ProductOrServiceAxis-ProductMember |

| Revenues from contracts with customers, services | RevenueFromContractWithCustomerIncludingAssessedTax-ProductOrServiceAxis-ServiceMember |

| Revenues from contracts with customers, related party | RevenueFromContractWithCustomerIncludingAssessedTax-DASRelatedPartyAxis-RelatedPartyMember |

| Revenues, other | RevenueNotFromContractWithCustomer |

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Receivables Turnover Ratio | Net Revenues divided by Average Gross Receivables |

| Days Sales Outstanding | 365 Days divided by Receivables Turnover Ratio |

| Receivables to Net Revenues | Gross Receivables divided by Total Net Revenues |

| Bad Debt to Receivables Ratio | Bad Debt Expense divided by Gross Receivables |

| Bad Debt to Net Revenues Ratio | Bad Debt Expense divided by Total Net Revenues |

Inventories

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Inventories.

| Bar Name | Financial Groupings |

|---|---|

| Raw materials inventory | InventoryRawMaterials |

| Work in process inventory | InventoryWorkInProcess |

| Finished goods inventory | InventoryFinishedGoods |

| Other inventory | OtherInventoryPurchasedGoods |

| Inventory valuation reserves | InventoryValuationReserves |

| Inventory in transit | OtherInventoryInTransit |

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Inventory Turnover Ratio | Cost of Revenues, Goods divided by Average Inventory |

| Days Sales in Inventory | 365 Days divided by Inventory Turnover Ratio |

| Gross Margin Return on Investment | Total Revenues less Total Cost of Goods Sold divided by Average Inventory |

| Raw Materials as % of Inventory | Raw Materials Inventory divided by Net Inventory |

| Work in Process as % of Inventory | Work in Process Inventory divided by Net Inventory |

| Finished Goods as % of Inventory | Finished Goods Inventory divided by Net Inventory |

| Other Inventory as % of Inventory | Other Inventory divided by Net Inventory |

Prepaid Expenses

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Prepaid Expenses.

| Bar Name | Financial Groupings |

|---|---|

| Prepaid rent | PrepaidRent |

| Prepaid insurance | PrepaidInsurance |

| Prepaid interest | PrepaidInterest |

| Prepaid tax | PrepaidTaxes |

| Other prepaid expenses | OtherPrepaidExpenseCurrent |

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Prepaid Interest as % of Interest Expense | Prepaid Interest divided by Interest Expense |

Property, Plant and Equipment and Leases

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Property, Plant and Equipment and Leases.

| Bar Name | Financial Groupings |

|---|---|

| Land | Sum of:

|

| Construction in progress | ConstructionInProgress |

| Depreciable property, plant, and equipment, net | Net of:

|

| Total depreciation expense | Sum of:

|

| Loss (gain) on disposal of assets | GainLossOnDispositionofAssets |

| Right-of-use assets, finance leases, net | FinanceLeaseRightOfUseAsset |

| Total finance lease liabilities | Sum of:

|

| Total finance lease amortization expense | Sum of:

|

| Right-of-use assets, operating leases | OperatingLeaseRightOfUseAsset |

| Total operating lease liabilities | Sum of:

|

| Net investment in leases, current (lessor) | NetInvestmentInLeaseCurrent |

| Net investment in leases, noncurrent (lessor) | NetInvestmentInLeaseNoncurrent |

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Depreciation Expense as a % of Depreciable Assets | Total Depreciation Expense divided by Depreciable Property, Plant, & Equipment |

| Lease Amortization as % of Finance Lease | Total Finance Lease Amortization divided by Right-of-use Assets, Finance, Leases, Gross |

| Property, Plant, & Equipment Turnover | Total Revenues divided by Average Property, Plant, & Equipment |

| Property, Plant, & Equipment Average Depreciation Life | Average Depreciable Property, Plant & Equipment, Gross divided by Total Depreciation Expense |

| Repairs & Maintenance to Gross Property, Plant, & Equipment | Repairs & Maintenance Expense divided by Property, Plant, & Equipment, Net |

Investments, Derivatives and Hedging

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Investments, Derivatives and Hedging.

| Bar Name | Financial Groupings |

|---|---|

| Debt securities | Sum of:

|

| Equity securities | Sum of:

|

| Other investments | Sum of:

|

| Derivatives and hedging assets | Sum of:

|

| Investment income, interest and dividend | InvestmentIncomeInterestAndDividend |

| Gain (loss) on investments | GainLossOnInvestments |

| Gain (loss) on derivatives and hedging | GainLossOnDerivativeInstrumentsNetPretax |

| Unrealized gain (loss) on available for sale debt securities | OtherComprehensiveIncomeLossAvailableForSaleSecuritiesAdjustmentNetOfTax |

| Unrealized gain (loss) on cash flow hedges | OtherComprehensiveIncomeLossCashFlowHedgeGainLossAfterReclassificationAndTax |

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Realized Investments Return as a % of Investments (Excluding Derivatives) | Realized Investment Income divided by Average Investments |

Loans and Note Receivable

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Loans and Note Receivable.

| Bar Name | Financial Groupings |

|---|---|

| Total loans and notes receivable, net (excluding related party loans and receivables) | Net of:

|

| Total related party loans and notes receivable, net | Net of:

|

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Interest Income to Notes Receivable (Excluding Related Party Loans and Notes) | Interest Income, Notes Receivable and Other divided by Loans and Notes Receivable |

| Related Party Interest Income to Notes Receivable | Interest Income, Related Party divided by Related Party Loans and Notes Receivable |

Goodwill, Intangible Assets, and Other Assets

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Goodwill, Intangible Assets, and Other Assets.

| Bar Name | Financial Groupings |

|---|---|

| Goodwill, net | Net of:

|

| Intangible assets (other than goodwill), net | Net of:

|

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Amortization Expense to Amortization Intangible Assets (Other than Goodwill) | Intangible Assets (Other than Goodwill) Amortization Expense divided by Intangible Assets (Other than Goodwill), Amortizable, Gross |

| Amortization Expense to Goodwill | Goodwill Amortization Expense divided by Goodwill, Gross |

| Average Amortization Life of Intangible Assets (Other than Goodwill) | Average Intangible Assets (Other than Goodwill), Gross divided by Intangible Assets Amortization Expense |

| Average Amortization Life of Goodwill | Average Goodwill, Gross divided by Goodwill Amortization Expense |

Accounts Payable and Accrued Expenses

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Accounts Payable and Accrued Expenses.

| Bar Name | Financial Groupings |

|---|---|

| Trade accounts payable | AccountsPayableTradeCurrent |

| Accrued expenses | AccruedLiabilitiesCurrent |

| Accrued payroll and related benefits | EmployeeRelatedLiabilitiesCurrent |

| Related party payable | AccountsPayableRelatedPartiesCurrent |

| Interest and dividends payable | Sum of:

|

| Total contract retainage payable | Sum of:

|

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Trade Accounts Payable Turnover | Total Purchases divided by Average Trade Accounts Payable |

| Trade Accounts Payable Turnover in Days | 365 Days divided by Trade Accounts Payable Turnover |

| Days Cost of Sales in Payables | Average Trade Accounts Payable divided by Cost of Goods and Services Sold times 365 Days |

| Accrued Payroll Costs as % of Payroll Costs | Accrued Payroll and Related Benefits divided by Total Salaries, Benefits, and Payroll Taxes |

Income and Other Taxes

Bar Graph

The following table outlines the financial groupings that generate the bar graphs for Income and Other Taxes.

| Bar Name | Financial Groupings |

|---|---|

| Deferred tax assets, noncurrent, net | DeferredTaxAssetsNet |

| Deferred tax liability, noncurrent | DeferredIncomeTaxLiabilities |

| Prepaid tax | PrepaidTaxes |

| Income taxes receivable | IncomeTaxReceivable |

| Total income taxes payable | Sum of:

|

| Total uncertain tax positions | Sum of:

|

| Sales and excise tax payable | SalesAndExciseTaxPayableCurrent |

Debt

Bar graph

The following table outlines the financial groupings that generate the bar graphs for Debt.

| Bar Name | Financial Groupings |

|---|---|

| Total line of credit | Sum of:

|

| Total notes payable | Sum of:

|

| Total related party debt | Sum of:

|

| Total debt issuance costs | Sum of:

|

| Total other debt | Sum of:

|

| Total interest expense | Sum of:

|

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Interest as % of Average Debt, Excluding Related Party Debt | Interest Expense, Excluding Related Party divided by Average Debt, Excluding Related Party |

| Interest as % of Average Related Party Debt | Interest Expense, Related Party divided by Average Debt, Related Party |

| Debt to Equity Ratio | Total Debt divided by Total Equity |

| Debt to Assets Ratio | Total Debt divided by Total Assets |

| Debt to Net Working Capital Ratio | Total Debt divided by Net Working Capital |

Other Liabilities and Commitments and Contingencies

Bar graph

The following table outlines the financial groupings that generate the bar graphs for Other Liabilities and Commitments and Contingencies.

| Bar Name | Financial Groupings |

|---|---|

| Total deferred compensation liability | Sum of:

|

| Total asset retirement obligation | Sum of:

|

| Total contract liabilities | Sum of:

|

| Total miscellaneous other liabilities | Sum of:

|

| Total liabilities related to discontinued operations | Sum of:

|

Equity

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Return on Equity | Net Income divided by Average Equity |

| Return on Assets | Net Income divided by Total Assets |

Revenues and Cost of Revenues

Bar graph

The following table outlines the financial groupings that generate the bar graphs for Revenues and Cost of Revenues.

| Bar Name | Financial Groupings |

|---|---|

| Gross profit, overall | Net of:

|

| Gross profit, goods | Net of:

|

| Gross profit, services | Net of:

|

| Gross profit, related party | Net of:

|

| Gross profit, other | Net of:

|

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Gross Profit - Overall | Revenues less Cost of Revenues |

| Gross Margin - Overall | Revenues less Cost of Revenues divided by Revenues |

| Gross Profit - Goods | Revenues from Contracts with Customers, Goods less Cost of Goods |

| Gross Margin - Goods | Revenues from Contracts with Customers, Goods less Cost of Goods divided by Revenues from Contracts with Customers, Goods |

| Gross Profit - Services | Revenues from Contracts with Customers, Services less Cost of Services |

| Gross Margin - Services | Revenues from Contracts with Customers, Services less Cost of Services divided by Revenues from Contracts with Customers, Services |

| Gross Profit - Related Party | Revenues from Contracts with Customers, Related Party less Cost of Related Party Revenues |

| Gross Margin - Related Party | Revenues from Contracts with Customers, Related Party less Cost of Related Party Revenues divided by Revenus from Contracts with Customers, Related Party |

| Gross Profit - Other | Revenues, Other less Cost of Other Revenues |

| Gross Margin - Other | Revenues, Other less Cost of Other Revenues, divided by Revenues, Other |

| Net Profit Margin | Net Income divided by Total Revenues |

| Total Asset Turnover | Revenues divided by Average Assets |

Operating Expenses, Other Income (Expense), and Other

Bar graph

The following table outlines the financial groupings that generate the bar graphs for Operating Expenses, Other Income (Expense), and Other.

| Bar Name | Financial Groupings |

|---|---|

| Operating expenses | OperatingExpenses |

| Other income (expense) | NonoperatingIncomeExpense |

Analytics

The following table describes the financial ratios and how they're calculated.

| Ratio Description | Calculation |

|---|---|

| Operating Ratio | Operating Expenses divided by Revenues |