Nieuw - Caseware ReviewComp Winter 2021 (v1.2106.0)

Bekijk de onderstaande video voor een demonstratie van wat er nieuw is.

Tijdstempels voor ReviewComp-functies:

-

00.39s / 01.22s

-

02.05s / 03.35s

Hier is een overzicht van wat er nieuw is voor de Caseware ReviewComp Winter 2021 release.

Update van de AAII-belastingberekening

In overeenstemming met de CRA-wetgeving bevat ReviewComp nu de bijgewerkte berekening van de Adjusted Aggregate Investment Income (AAII). Voor Canadese gecontroleerde particuliere bedrijven met belastingjaren na 2018 wordt de aftrek voor kleine bedrijven nu bepaald door AAII.

Netfiling Canadese buitenlandse aangifte

Caseware ReviewComp-certificeringsupdates voor vennootschapsbelasting omvatten nu het netfilen van Canadese buitenlandse aangiften (T1134, T1135, T106) voor bedrijven met einddatums tot 31 mei 2022.

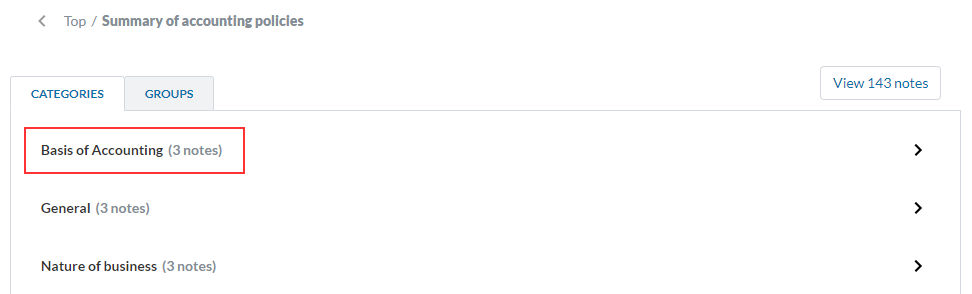

Bijwerking van Basis voor boekhouding volgens CSRS 4200

In de Notes Library is de Basis of Accounting-notitie, die nu vereist is onder de nieuwe CSRS 4200-standaarden, verwijderd uit de categorie General en nu opgenomen in de eigen categorie Basis of Accounting .

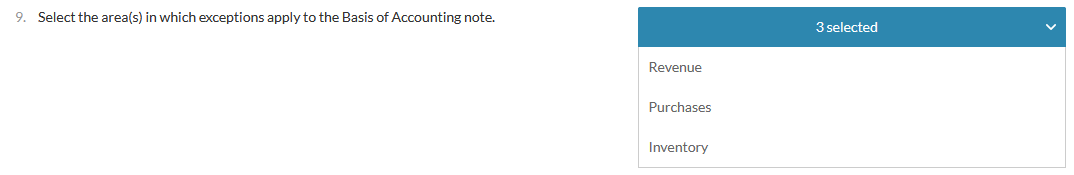

Het document 6-15 Financial statements optimiser bevat ook een Basis of Accounting vraag voor veelvoorkomende uitzonderingen.

Zie Een toelichting van de bibliotheek aan de jaarrekening toevoegenvoor meer informatie.

Workflowverbeteringen voor engagements

Caseware ReviewComp stelt beoefenaars nu in staat om bepaalde soorten opdrachten uit te voeren zonder een compilatie te hoeven voltooien. Gebruikers kunnen nu bijvoorbeeld een Vennootschapsbelastingopdracht of een eenvoudige boekhoudopdracht voltooien zonder rapportagecomponenten, zoals de Kennis van en inzicht in de entiteit en het samenstellingsopdrachtrapport, in te vullen.

Updates voor certificering vennootschapsbelasting

Caseware ReviewComp certificering voor vennootschapsbelasting voor het opstellen van de federale (T2) en de Alberta (AT1) belastingaangiften is bijgewerkt voor bedrijven met einddatums tot 31 mei 2022.

Wijzigingen in federale en Alberta belastingformulieren

In overeenstemming met de CRA Income Tax Guide: Hoofdstuk 1 & 2 Federal en hoofdstuk 3 Alberta updates, de volgende tabellen geven een overzicht van de wijzigingen in de federale en Alberta belastingformulieren.

Federale belastingformulieren

| Formulier | Omschrijving |

|---|---|

| Bijlage 200 T2 aangifte | 1 nieuwe regel toegevoegd (352). |

| T183 | 3 nieuwe regels toegevoegd (930, 931, 932). |

| Schema | 1 nieuwe regel toegevoegd (902). 1 diagnostische regel aangepast. |

| Schema 384 | Deel 9 verwijderd. |

| Schema 388 | 1 nieuwe regel toegevoegd (575). |

| Schema 570 | 5 nieuwe regels toegevoegd (110, 225, 325, 330, 335). 4 nieuwe diagnostische regels toegevoegd. |

Alberta belastingformulieren

| Formulier | Omschrijving |

|---|---|

| AT1 | 2 nieuwe regels toegevoegd (095, 096). |

| Schema 5 | Verwijderd, formulier is niet langer nodig. |

| Schema 8 | Verwijderd, formulier is niet langer nodig. |

| Schema 12 | 1 regel verwijderd (092). |

| Schema 14 | Verwijderd, formulier is niet langer nodig. |

| Schema 29 | 1 nieuwe regel toegevoegd (265). 12306, 5, 120, 122, 126, 134, 220 1 regel verwijderd (124). |

Ondersteuning voor de CSRS 4200-standaard

Caseware ReviewComp ondersteunt nu de nieuwe CSRS 4200 standaard. Voor meer informatie, zie De 4200 compilatienormen implementeren.

Update voor de notitiebibliotheek

In deze release is de Notes-bibliotheek uitgebreid herzien. Nieuwe toelichtingen zijn toegevoegd en bestaande toelichtingen zijn bijgewerkt, waar van toepassing. Er zijn kleine verbeteringen aangebracht in de ASPE-nota, zoals grammaticale fouten, inconsistenties in nota's en zoekfuncties.

Verbeteringen in de opmaak van financiële overzichten

De opmaak van het document 6-20 Jaarrekeningen is verbeterd. De inhoudsopgave, gebieden voor financiële overzichten, namen van financiële overzichten en groepen tonen nu consistent hoofdlettergebruik.

Let op: De What's New video bovenaan deze pagina bevat een demonstratie van enkele verbeteringen die zijn opgenomen in de Caseware ReviewComp Fall 2021 release. Raadpleeg de onderstaande functies voor meer informatie.

Eenvoudig logboek voor elektronische handtekening in een PDF-document

U kunt nu een handtekeningenlogboek als PDF bekijken en downloaden voor documenten die elektronisch zijn ondertekend door klanten in query-documenten.

Zie Reacties van contactpersonen beoordelen en Documenten aan een opdrachtdossier toevoegenvoor meer informatie.

PEG inhoud updates

Caseware ReviewComp ondersteunt nu de 2021 CPA Canada PEG formulier content updates. Als er een reden is om u terug te trekken, hebt u de mogelijkheid om uw conclusie op te nemen in 5-95 Werkblad - Terugtrekking.

| Formulier | Omvang | Beschrijving van herzieningen |

|---|---|---|

| 5-95 - Werkblad - Intrekking | Nieuw | Nieuw werkblad om situaties te documenteren waarin terugtrekking uit een beoordelingsopdracht de juiste conclusie kan zijn. |

Verbeterde procedures in gebieden met financiële overzichten in checklists

Om de algehele workflowervaring te verbeteren, zijn er extra instructies toegevoegd aan procedures in de checklists voor financiële overzichten. De instructies bevatten voorwaarden, referentie-informatie en koppelingen naar relevante documenten om u te helpen bij het invullen van de checklists.

Meerdere aftekeningen voor een rol

U hebt nu de optie om meer dan één gebruiker toe te staan om een rol af te melden. Als u meerdere aftekeningen voor een rol wilt inschakelen, gaat u naar het dialoogvenster Instellingen van de engagement en selecteert u vervolgens Rollen | Meerdere aftekeningen.

Zie Afmeldingsrollen wijzigenvoor meer informatie.

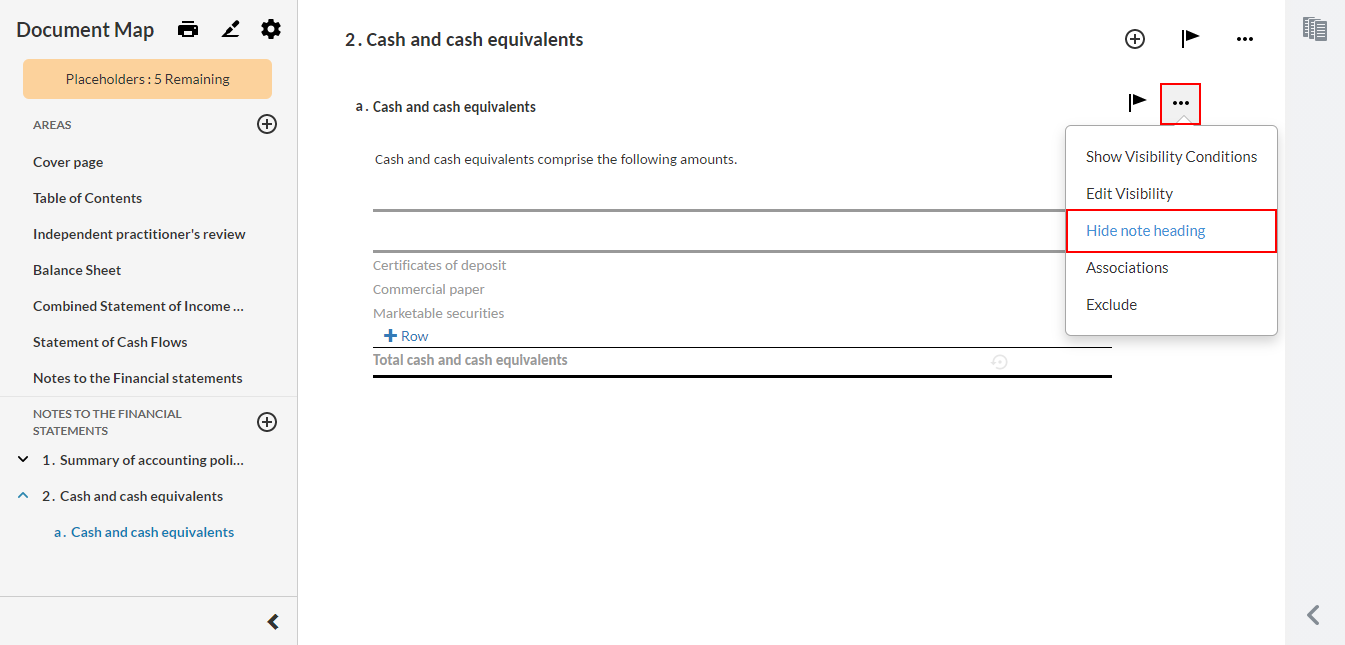

Koppen op subniveau voor toelichtingen in financiële overzichten verbergen

In het document 6-20 Financiële overzichten bevatten de afdrukinstellingen voor notities nu een optie om koppen op subniveau voor notities automatisch te verbergen in de PDF-uitvoer als er geen volgende notities in die groep zijn.

De optie om kopteksten op subniveau in de PDF-uitvoer te verbergen is ook beschikbaar voor individuele notities in het menu Meer acties als er geen volgende notities in die groep zijn.

Zie De afdrukopties in de jaarrekening instellen en Koppen op subniveau voor een toelichting verbergenvoor meer informatie.

Afdrukinstellingen voor belastingaangiften

Bij het afdrukken van belastingaangiften hebt u nu de mogelijkheid om de afdrukinstellingen aan te passen. U kunt de disclaimer aanpassen, de koptekst configureren en voorkeuren voor bulkafdrukken rechtstreeks binnen een belastingformulier maken.

Fix

De volgende lijst bevat een korte beschrijving van de problemen die in deze release zijn opgelost.

-

Wanneer u de inhoud van een procedure in een controlelijsttoevoegt of wijzigt, kan de tekstcursor inactief worden terwijl u tekst invoert of wanneer u hiermee stopt.

-

Op de gegevenspagina onder het tabblad Belasting (GIFI) Groepen worden de groepssaldi niet weergegeven.

-

Technische problemen zorgen ervoor dat het belastingformulier T1134 niet op het net kan worden ingediend.

-

In de Bijsluiter worden saldi die zijn berekend in de werkschema's voor termijnen van het INS-werkblad - Termijnenformulier niet bewaard.

-

In het belastingformulier S32 - (T661) Alberta wordt regel 429 onjuist berekend.

-

In het belastingformulier AS12 - (AT112) Alberta wordt regel 002 onjuist berekend.

-

In het belastingformulier AS16 - (AT238) Alberta wordt regel 035 onjuist berekend.

-

Op de pagina Diagnostieken worden voor opdrachten met een startjaar van 2021 in de diagnostiek voor T1134 niet de documentkoppelingen weergegeven om de regelfouten te herstellen.

-

Op de pagina Diagnostieken wordt ten onrechte een foutbericht weergegeven als het het laatste belastingjaar voor de samenvoeging is.

-

Het belastingformulier S570 - Ontario Regional Opportunities Investment Tax Credit gebruikt 366 dagen als het aantal dagen in het huidige belastingjaar, in plaats van 365.

-

Bij het afdrukken van het belastingformulier S421 - BC Mining exploration tax credit wordt overlappende tekst weergegeven.

-

In het belastingformulier S308 - NL Venture Capital Tax Credit worden onder de tabel Historische gegevens en berekeningen de kolommen Toegepast en Saldo voor overdracht verkeerd berekend.