What's new - Caseware Audit Fall 2020 (v2.899.0)

Onderstaand volgt een overzicht met de nieuwe functies die eind 2020 aan Caseware Audit zijn toegevoegd.

Watermark in print settings

You can now adjust the watermark in financial statements. See Print the financial statements document and Setup the print options in the financial statements for more information.

Submappen op de Documentenpagina

You can now add subfolders on the Documents page, using the plus button on any folder.

De saldibalans en VJP's aftekenen

Het is mogelijk om de saldibalans en VJP's af te tekenen.

Note references in text selections

Ook in tekstsecties kunt u verwijzingen naar specificaties invoegen.

See Add a note reference in a text section for more information.

Improved engagement search

We've improved the engagement search functionality for this release. The search functionality has been moved from the Documents page to a dedicated search button in the top navigation bar.

See Locate and access documents in the engagement file for more information.

Flipped sign indicator

Now, you can display row balances in the financial statements with the opposite sign.

See Edit table rows in the financial statements for more information.

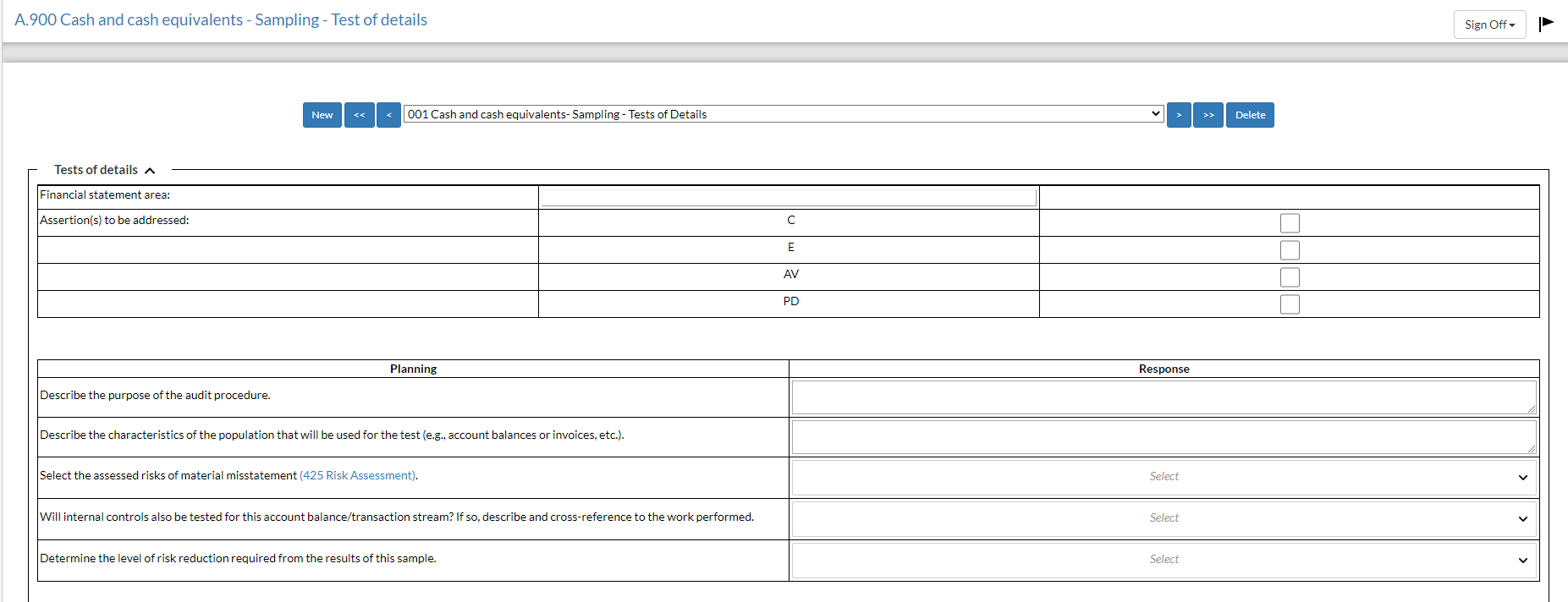

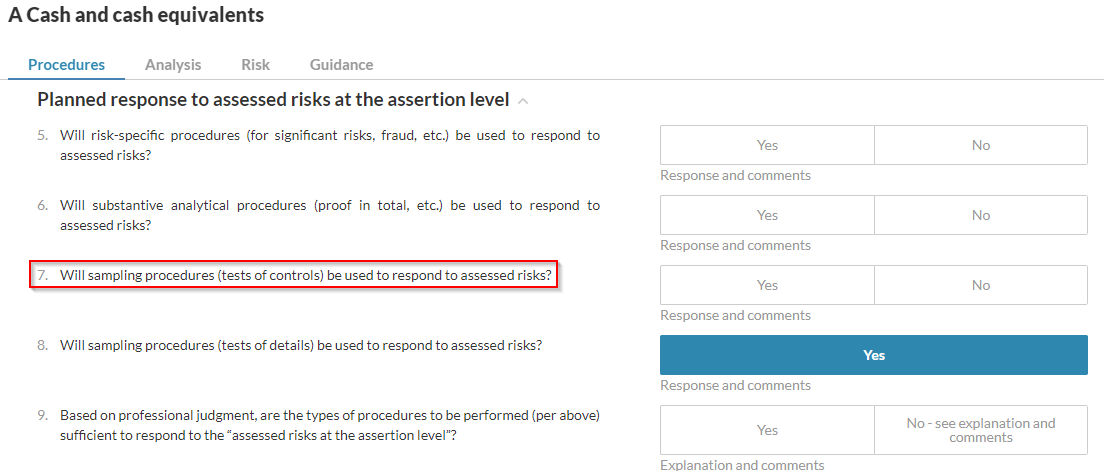

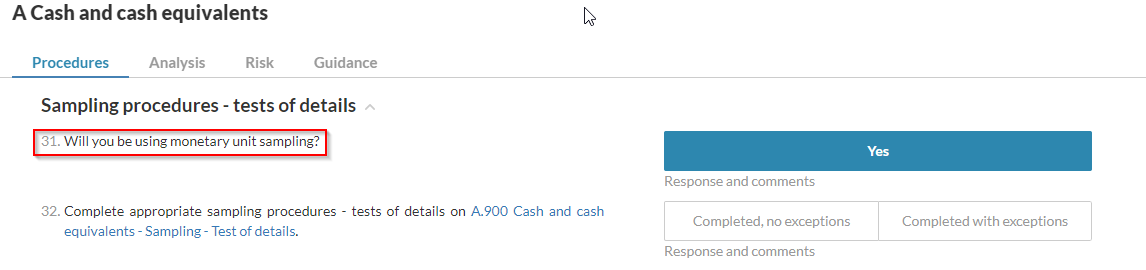

New sampling worksheets

We have added sampling worksheets to each financial statement area folder to assist the user in performing monetary unit sampling.

You can activate these new sampling worksheets through selections in each financial statement area's audit procedures document, for example:

PEG 2020 content updates

Caseware Audit has been updated to include the latest PEG content.

This includes the following:

New forms

375 Worksheet – Documenting consultation

706 Revenue recognition

Updated forms

020 Optimiser – Initial client queries

030 Client Queries – Initial client queries

310 Checklist – Audit completion

436 Team planning discussions

513 Understanding accounting estimates and related disclosures

513-1 Understanding accounting estimates and related disclosures – Part C and Part D

514 Worksheet – outcome of prior period accounting estimates

635 Accounting estimates – worksheet

650 Subsequent events

680 ASPE supplementary audit procedures – worksheet

705 Revenue

720 Cost of sales

735 Payroll

740 Non-operating income and expenses

A Cash and cash equivalents

B Short-term investments

C Accounts receivable, trade and other

D Inventory

E Loans and advances receivable

L Prepaid expenses and other assets

N Long-term investments

U Property, plant and equipment

W Intangible assets and goodwill

AA Bank indebtedness

BB Notes payable and bank debt

CC Accounts payable and accrued liabilities

FF Income taxes

GG Loans and advances payable

KK Long-term debt

UU Equity

FRF906 ASPE – general financial statement presentation

415.1 Engagement letter – standard ASPE

AL1.4 Letter to predecessor accounting firm

647.2 Hiring an external audit specialist

AL3.3 Audit findings letter

AL4.1 Management representations letter

Applicable reporting framework

Areas of documents that previously said "Applicable reporting framework" will now automatically refer to ASPE when ASPE is selected in the optimiser.

Analytical procedures moved

Analytical procedures have been moved from 500 Understanding the entity, to 501 Preliminary analytical procedures.

Document 501 moved

The 501 Preliminary analytical procedures document has been moved to the Understanding the entity folder on the Documents page.

Risk Identification and Assessment phase updated

The Risk Identification and Assessment phase has been reorganized to improve user workflow.

Graphs in notes

A visual presentation of your client's account information is now available in certain note disclosures in the financial statements to help you perform high-level analyses and identify areas of the trial balance that you need to investigate.