Firm settings - CasewareCloud Time

Inhoud in dit onderwerp vereist CasewareCloud Time.

Algemeen

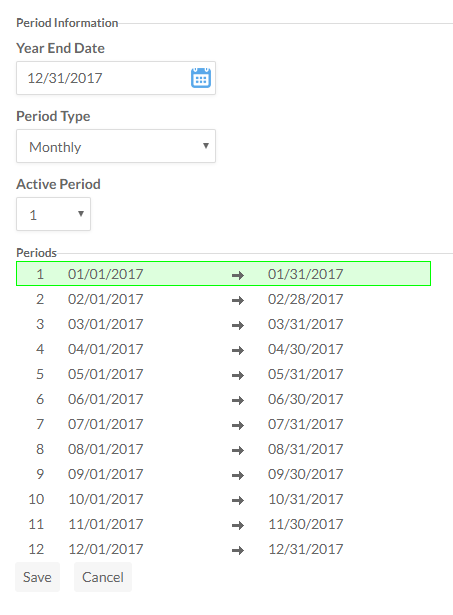

Data

Vanaf deze pagina kunt u de rapportagedata van uw organisatie instellen en de huidige actieve periodeinstellen. Deze instellingen hebben invloed op uw Tijdrapporten.

Voor meer informatie, zie Vaste werkdagen, standaardtijden en vakantiedagen.

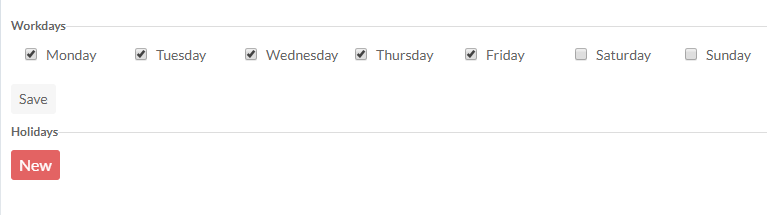

@Workday

Vanaf deze pagina kunt u de standaard werkdagen van uw organisatie instellen en vakantiedagen toevoegen aan de kalender van uw organisatie. De standaardinstelling is maandag tot en met vrijdag. Als vakantiedagen eenmaal zijn toegevoegd aan de agenda, kunnen ze niet meer worden gebruikt om werk in te plannen en worden ze grijs weergegeven in de organisatieagenda.

Voor meer informatie, zie Vaste werkdagen, standaardtijden en vakantiedagen.

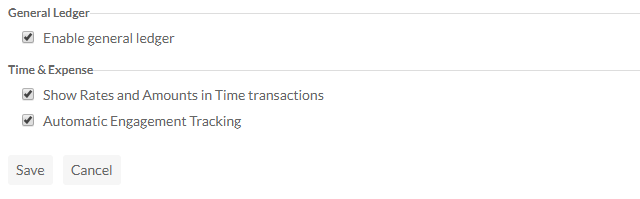

Tijd- en onkosteninstellingen

| Optie | Omschrijving |

| Grootboek inschakelen | Als deze optie is ingeschakeld, genereert Cloud grootboekinformatie. Deze optie wordt standaard geselecteerd. |

| Tarieven en bedragen weergeven in Tijdtransacties | Als deze optie is ingeschakeld, wordt tarief- en bedraginformatie voor Tijdtransacties weergegeven voor alle gebruikers. Als deze optie is uitgeschakeld, wordt de informatie over tarieven en bedragen verborgen, behalve op de factureringspagina , facturen en in sommige analyserapporten . Deze optie wordt standaard geselecteerd. |

| Automatisch engagement bijhouden | Houd de bestede tijd bij in een geïntegreerde app of in het dossier van een werkdocument en genereer automatisch wachtboekingen. Voor meer informatie, zie Volg het werk van het personeel tijdens de opdracht. |

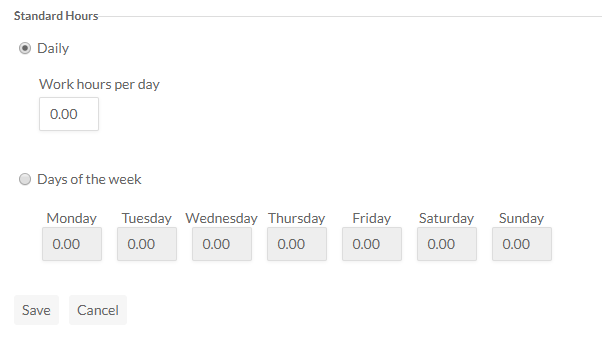

Standaard uren

Op deze pagina kunt u het standaard aantal werkuren per dag opgeven, door een standaard aantal in te stellen voor alle werkdagen of specifieke aantallen voor specifieke dagen van de week. Productiviteitsrapporten helpen om te ontdekken wanneer medewerkers minder of meer uren registreren dan verwacht.

Voor meer informatie, zie Vaste werkdagen, standaardtijden en vakantiedagen.

Importeren van tijd- en onkostendeclaraties

Met deze optie kunt u zowel tijd- als onkostenboekingen in bulk importeren met behulp van een CSV-bestand. Voor meer informatie, zie Tijd- en onkosten importeren met behulp van een CSV-bestand

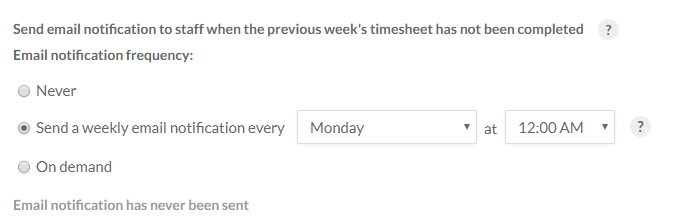

E-mailmeldingen

Korte uren

Vanaf deze pagina kunt u instellen hoe vaak (als dat al gebeurt) Cloud e-mailmeldingen naar uw medewerkers stuurt als hun timesheet van de vorige week niet is ingediend of onvoldoende gegevens bevat.

Voor meer informatie, zie Volg het werk van het personeel tijdens de opdracht.

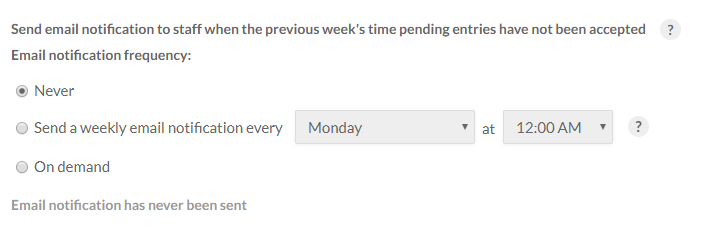

Tijd in afwachting van invoer

Vanaf deze pagina kunt u instellen hoe vaak (als dat al gebeurt) Cloud een e-mailbericht naar uw medewerkers stuurt als hun ureninvoer van de vorige week niet is gecontroleerd of geaccepteerd.

Voor meer informatie, zie Volg het werk van het personeel tijdens de opdracht.

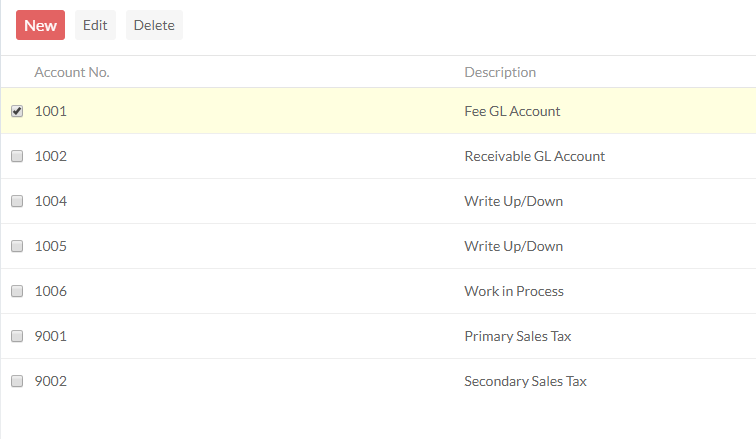

Rekeningen

Rekeningschema

Let op: Deze opties zijn alleen beschikbaar als een beheerder Grootboek inschakelen selecteert bij Instellingen | Tijd | Algemeen | Tijd- en onkosteninstellingen. Het grootboek is standaard uitgeschakeld.

Op deze pagina staan alle accounts die momenteel door uw organisatie worden gebruikt en kunt u naar wens accounts toevoegen, bewerken of verwijderen.

Voor meer informatie, zie Set up general ledger accounts.

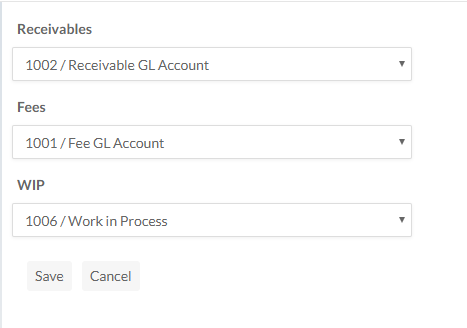

Standaardrekeningen

Vanaf deze pagina kunt u specifieke accounts aanwijzen als standaard voor werkboekingen van het type Receivables, Fees en WIP . Deze accounts worden automatisch gevuld wanneer gebruikers hun inzendingen versturen.

Voor meer informatie, zie Set up general ledger accounts.

Werkcodes

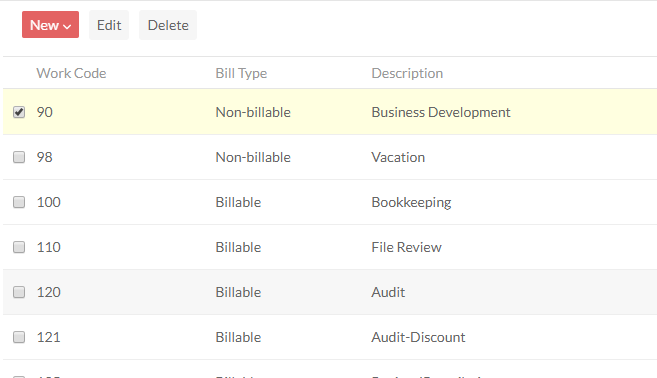

Tijd

Op deze pagina kunt u de werkcodes bekijken die momenteel door uw organisatie worden gebruikt, samen met hun type (factureerbaar of niet-factureerbaar), beschrijvingen andere details. U kunt ook werkcodes maken, bewerken of wijzigen.

Voor meer informatie over werkcodes, zie Personeelstarieven en werkcodes instellen.

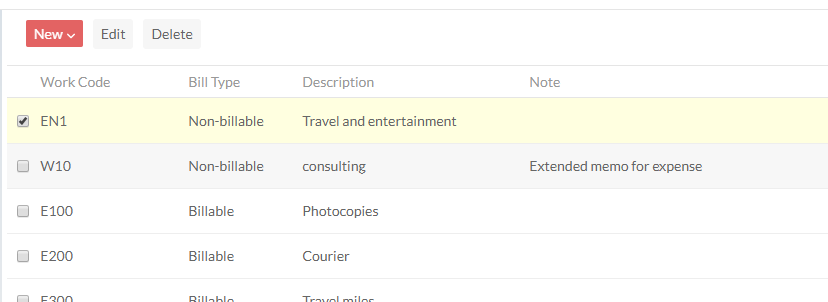

Onkosten

Op deze pagina kunt u de onkostencodes bekijken die momenteel door uw organisatie worden gebruikt, samen met hun type (factureerbaar of niet-factureerbaar), beschrijvingen andere details. U kunt ook onkostencodes aanmaken, bewerken of wijzigen.

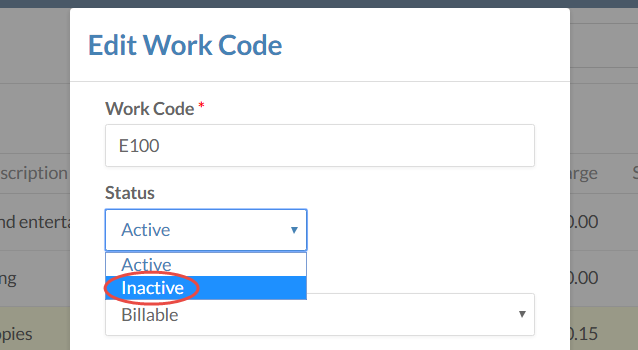

Inactieve werkcodes

Gebruikers met de juiste rechten kunnen werkcodes inactief maken om te voorkomen dat medewerkers ze in de toekomst gebruiken. Om een werkcode inactief te maken, gaat u naar Instellingen | Tijd, selecteert u de tijd- of onkostencode die u wilt bewerken, selecteert u Bewerkenen verandert u de status in Inactief.

Inactieve werkcodes hebben de volgende eigenschappen:

| Functie | Omschrijving |

|---|---|

| Tijd- en onkostenregistratie |

|

| Lijst met werkcodes voor personeel |

|

| Werkcodelijst entiteit |

|

Eigenschappen werkcode

Werkcodes worden gebruikt om werk in uitvoering (WIP) te registreren. Personeelsleden kunnen tijd en uitgaven boeken voor alle vastgestelde werkcodes in een bedrijf.

Werkcodes hebben de volgende eigenschappen om in te stellen:

| EIGENDOM | Omschrijving |

|---|---|

| Werkcode | Een unieke identifier voor de werkcode. Dit veld ondersteunt maximaal tien (10) tekens. Let op: Het wijzigen van dit veld heeft effect op bestaande vermeldingen die deze werkcode gebruiken. |

| Status | Geeft aan of de werkcode momenteel in gebruik is(Actief) of niet(Inactief). |

| Type rekening | Met factuurtypen kunt u transacties specificeren die factureerbaar of niet-factureerbaar zijn. Als de standaard Factureerbaar is, is de entiteit een verplicht veld op Tijd of Uitgaven. |

| Korte beschrijving | Een beschrijving voor de werkcode. Dit veld ondersteunt maximaal zeventig (70) tekens. |

| Memo Beschrijving | Een uitgebreide beschrijving voor deze werkcode. |

| Credit GL rekening | Een vooraf bepaald rekeningnummer in het grootboek dat is opgegeven voor crediteringen. |

| Debet GL rekening | Een vooraf bepaald rekeningnummer in het grootboek dat is opgegeven voor debettransacties. |

Factuur

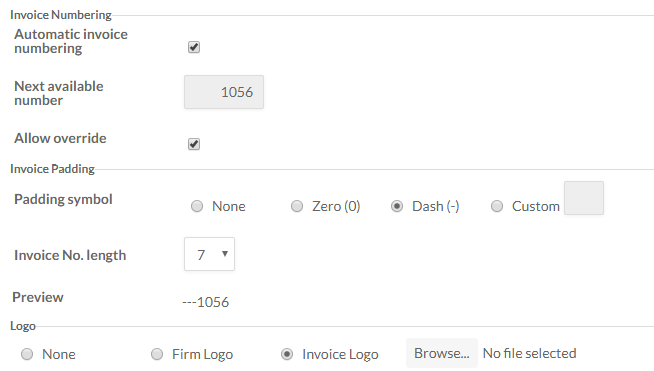

&Standaard

Vanaf deze pagina kunt u de standaardwaarden instellen om te bepalen hoe facturen worden weergegeven. U kunt bijvoorbeeld het aantal cijfers in het factuurnummerinstellen en instellen of u wilt dat factuurnummers automatisch interval hebben op basis van de vorige factuur.

Zie voor meer informatie over facturen Facturering voor klanten instellen.

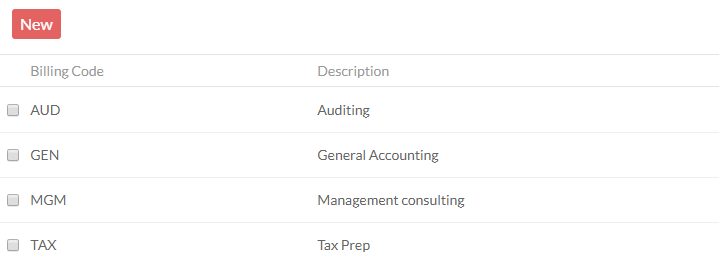

Factuurcodes

Vanaf deze pagina kunt u de facturatiecodes bekijken die toegankelijk zijn voor uw medewerkers en codes toevoegen, bewerken of verwijderen als dat nodig is.

Zie voor meer informatie over factureringscodes Facturering voor klanten instellen.

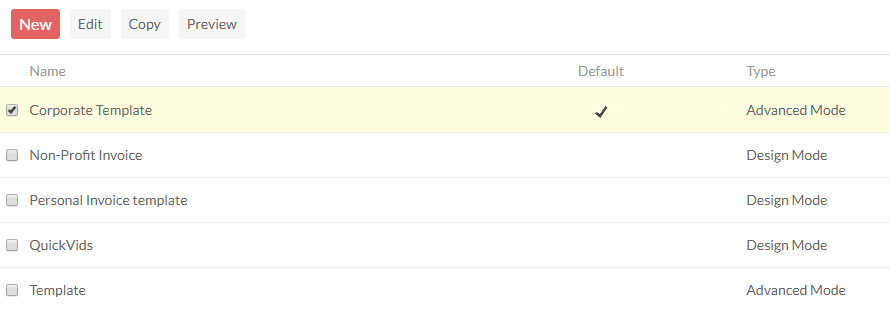

sjabloon

Vanaf deze pagina kunt u de factuursjablonen bekijken, bewerken en verwijderen die beschikbaar zijn voor uw medewerkers.

Zie voor meer informatie over sjablonen Facturering voor klanten instellen.

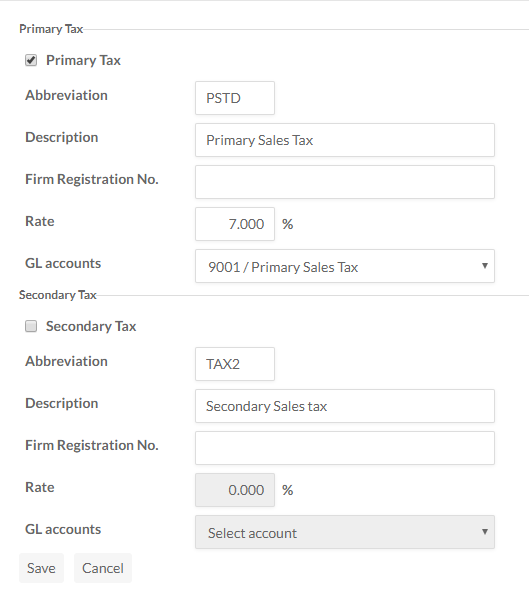

Belastingen

Vanaf deze pagina kunt u een Primaire en, indien van toepassing, een Secundaire belastingaccount instellen en de juiste Omschrijving en Tarieven voor uw regio instellen.

Voor meer informatie, zie Set up general ledger accounts.