Perform a tax export

Note: Caseware Taxflow supports 2022 and 2023 tax exports for C-Corporations, S-Corporations and Partnerships for the following tax vendors:

-

CCH ProSystem fx® Tax

-

CCH Axcess™ Tax

-

Lacerte® Tax

-

GoSystem® Tax

-

UltraTax CS

Caseware Taxflow allows you to create an export file based on a default account mapping or grouping to import into your tax software. The following tax software is currently supported:

-

CCH ProSystem fx® Tax

-

CCH Axcess™ Tax

-

Lacerte® Tax

On the Documents page, the Tax export folder is available in the Tax preparation and export phase.

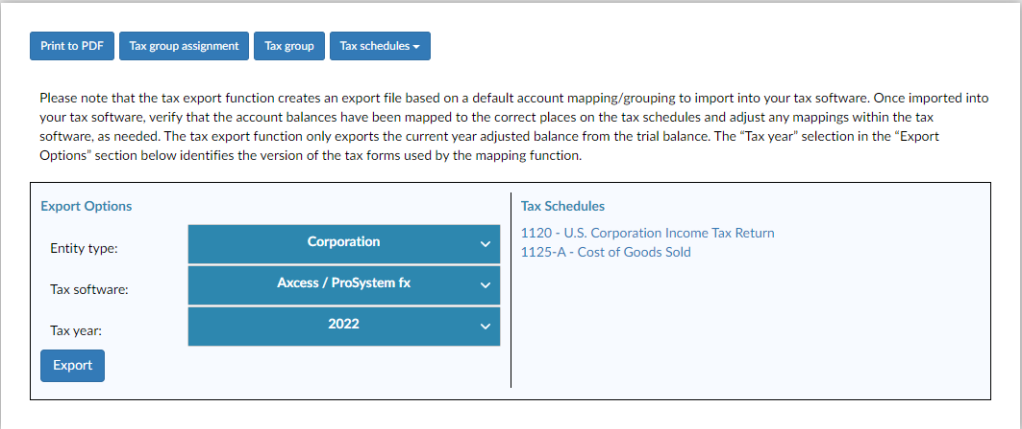

To perform a tax export:

-

Open the 2-500 Tax export form.

-

Select your Entity type.

-

Review the Tax schedules that become visible.

Note: The tax forms shown depend on your Entity type selection.

-

Select the Tax software.

-

Select the Tax year.

Note: The tax export function only exports the current year final tax balances calculated in the Tax Schedules.

-

Select the Export button.

The tax export file is downloaded to your device. You can verify that the account balances have been mapped to the correct places on the tax forms and adjust any mappings within the tax software, as needed.