Client correspondence (Queries)

Note: Caseware Taxflow supports 2022, 2023 and 2024 tax exports for C-Corporations, S-Corporations and Partnerships for the following tax vendors:

-

CCH ProSystem fx® Tax

-

CCH Axcess™ Tax

-

Lacerte® Tax

-

GoSystem® Tax

-

UltraTax CS

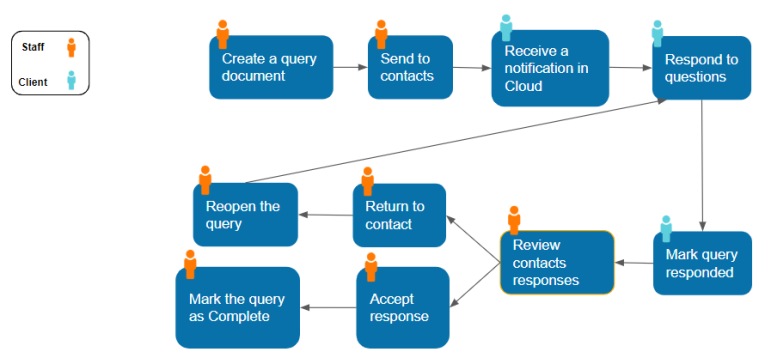

When performing your tax work, you may need to collaborate with a contact to retrieve additional information. The interaction between a staff member and a contact in queries can be summarized in the following figure.

To request information such as the trial balance, financial statements, taxation assessments, or general entity inquiries you can complete the 1-100Q Financial data and general entity information queries and responses query. You can also create and send a new query by selecting Create a document | Query.

After your contact provides the missing information, you’ll receive an email notification with their response. You can review their response and either accept or reopen the query.

To view a list of your queries, go to the Queries page.

To learn more, see: