What's new in PEG Audit Fall 2025 (v2.1976.0)

Here's a list of what's new in the PEG Audit Fall 2025 release.

Content updates

2025 PEG updates

The PEG Audit update includes all updated content based on CPA Canada PEG Audit Practice Aids up to and including the September 2025 updates.

Here is a list of documents that have been updated.

| PEG form – Content updates | PEG Audit document(s) - Content updates |

|---|---|

| 510 Identifying risk through understanding the entity | 510 Identifying risk through understanding the entity |

| 510 NFP Identifying risk through understanding the entity | 510 Identifying risk through understanding the entity |

| AL1.1 Engagement letter – Audit | 415.1 Engagement letter - Standard |

| GL1.1 Engagement letter – Group audit | 415.1 Engagement letter - Standard |

| 516 Service organizations | 516 Service organizations |

| 410.600 Group audit program – Terms of engagement (Supplemental) | 410 New or existing engagement - Acceptance/continuance |

| 305 Auditor's report | 305 Auditor's report |

| 306 Modified opinion checklist | 306 Modified opinion checklist |

| 310 Audit completion | 310 Audit completion |

| 312 Engagement partner checklist – Audit completion | 312 Engagement partner checklist |

| 313 Supplementary and other information | 313 Supplementary and other information |

| 314 Management representations | 314 Management representations |

| FRF906 ASPE – General |

|

| FRF907 First-time adoption of ASPE | 680 ASPE - Supplementary audit procedures |

| FRF908 ASPE – Income taxes | FF Income taxes |

| FRF909 ASPE – Investments | N Long-term investments |

| FRF910 ASPE – Leases | FRF906 ASPE - General financial statement presentation |

| FRF911 ASPE – Goodwill and intangible assets |

|

| FRF912 – Employee future benefits | 680 ASPE - Supplementary audit procedures |

| FRF913 – ASPE – Supplementary | FRF906 ASPE - General financial statement presentation |

| FRF914 – ASPE – Agriculture |

|

| FRF915 – ASPE – Business combinations | 680 ASPE - Supplementary audit procedures |

| FRF971 – First-time adoption of ASNPO | 681 NFP - Supplementary audit procedures |

| FRF972 – ASNPO – General | FRF972 ASNPO - General financial statement presentation |

| FRF973 – ASNPO – Combinations by not-for-profit organizations | 681 NFP - Supplementary audit procedures |

New features and enhancements

Group audit

What you can do

-

Identify common work areas across group components.

-

Share common work areas with component auditors in the same engagement (for example, Risks).

-

Document performance materiality for each group component.

Benefits

-

Reduce manual data entry.

-

Improve consistency and quality across group audit engagements.

To learn more, refer to Group audit.

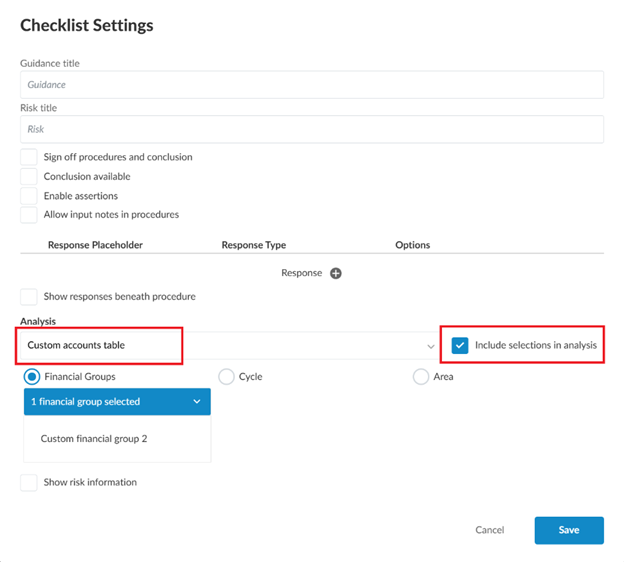

Add custom financial groups, areas and cycles to Account tables within the Analysis tab

You can now include custom financial groups, areas and cycles in Accounts tables within the Analysis tab. You can modify the checklist settings to include custom financial groups, areas and cycles using the radio button for selection. Ensure you select the Custom accounts table from the Analysis dropdown, as well as Include selections in analysis.

To learn more, refer to Add custom groups, cycles or areas to the analysis tables.

Note: This option is not available for Overview or Ratios tables.

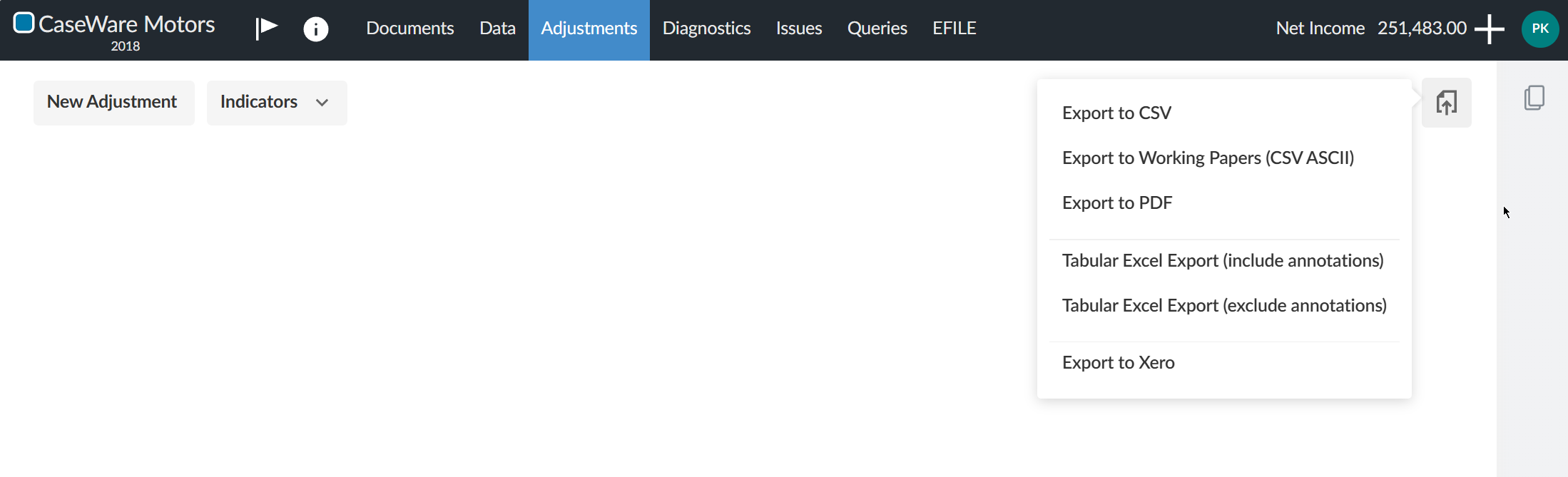

Adjusting entries: New export options

You can now export adjusting entries in PEG Audit using three new options:

-

Tabular Excel export (include annotations) – Export entries with annotations for a complete record.

-

Tabular Excel export (exclude annotations) – Export entries without annotations for a streamlined view.

-

Export to Xero – Send adjusting entries directly to Xero to simplify your workflow.

These options help you work more efficiently and tailor exports to your needs. To view the new export options, go to Adjustments and select Export Options [![]() ] in the upper right corner.

] in the upper right corner.