What's new in Audit International v2022.1.0

This version of Audit International Cloud includes the changes and new requirements in ISA 315 (Revised 2019) which are intended to clarify and assist auditors in identifying and assessing risks of material misstatement more consistently and robustly. As a result of these changes and new requirements, updates were made to Audit International Cloud.

Here is what’s new in Audit International v2022.1.0.

Content update

Audit plans and procedures work programs

The following changes were implemented to all Financial Area work programs in the Plans and Procedures folder, with document reference X.101:

-

Document guidance:

-

Updated the document guidance to provide clearer guidance on determining audit procedures as well as instructions on how to complete the Work Program.

-

-

Detailed audit response:

-

New group added including two subgroups:

-

Audit Response Considerations: New procedures to assist designing the audit response.

-

Audit Response Table: New table added to assist documenting the appropriate nature and extent of audit procedures to address each relevant assertion.

-

-

-

Grouping changes:

-

Groups A. SUBSTANTIVE PROCEDURES - BASIC and B. SUBSTANTIVE PROCEDURES - EXTENDED were merged into SUBSTANTIVE PROCEDURES.

-

Group C. SUBSTANTIVE ANALYTICAL PROCEDURES was renamed to SUBSTANTIVE ANALYTICAL PROCEDURES.

-

New group TESTS OF CONTROLS and new procedures added.

-

-

Entity appointed experts procedure:

-

Updated the procedure’s response set to Firm has SUFFICIENT expertise / Firm has INSUFFICIENT expertise / N/A to better align with the procedure’s requirements.

-

-

Evaluation of entity appointed expert work procedure:

-

Updated the procedure Visibility Conditions to be dependent on the response to procedure “Entity appointed experts”. The procedure will now display if the response to procedure “Entity appointed experts” is set to Firm has INSUFFICIENT expertise.

-

-

Accounting estimates:

-

Visibility Settings in the ACCOUNTING ESTIMATES Group are now driven by the selections in B200 Understanding the entity and its environment, procedure Key elements of the auditor’s understanding of the entity and its environment.

-

Response set changes

The Manual response set was replaced with Procedure Input Notes for all Financial Area work programs in the Plans and Procedures folder, as well as for all other checklists which had a combined Picklist and Manual response set. This change provides greater efficiency when responding to procedures and leveraging the automated signoff functionality.

Additionally, all checklists with a Done / Not Done / N/A response set, were replaced with a response set tailored to the procedure text to improve documentation when responding to procedures and reviewing procedures responses.

Substantive analytical procedures worksheets

Substantive analytical procedures worksheets were added to all Financial Areas in the Plans and Procedures folder.

The objective of these practice aids is to plan and perform a substantive analytical procedure.

Tests of controls worksheets

Tests of controls sampling worksheets were added in the Tests of Control folder under the Risk Response folder, for the following Business Cycles:

-

C050 Worksheet - Sampling - Tests of controls - Revenues, receivables, receipts

-

C055 Worksheet - Sampling - Tests of controls - Purchases, payables, payments

-

C060 Worksheet - Sampling - Tests of controls - Payroll

-

C065 Worksheet - Sampling - Tests of controls - Financial reporting

-

C070 Worksheet - Sampling - Tests of controls - Investments

-

C075 Worksheet - Sampling - Tests of controls - Inventory

-

C080 Worksheet - Sampling - Tests of controls - Treasury

-

C090 Worksheet - Tests of controls - Financial statement level controls

The objective of these practice aids is to provide guidance on the use of tests of controls in evaluating the operating effectiveness of controls.

Group audit content

The following group audit related documents have been updated to remove older group audit content:

-

C205 Group audit - Acceptance and planning: (previously C170)

-

C210 Group audit - Communication: (previously C180)

-

C215 Group Audit - Evaluation and conclusion: (previously C190)

-

C205 Worksheet - Consolidation completion: (removed)

-

C220 Worksheet - EQR checklist - Group audits involving component auditors: (previously C210)

-

C215 Worksheet - Group audit - Overall strategy: (removed)

-

C220 Worksheet - Group audit - Group audit plan: (removed)

-

C240 Worksheet - Group audit - Preparation of group audit instructions (removed)

List of updated documents

| Document Number Cloud | Document Name | Changes |

| A100 | Optimiser checklist - Initial Engagement Decisions | Minor procedure changes |

| A200 | Preliminary engagement activities | Minor procedure changes |

| A300 | Overall audit strategy | Major procedure changes |

| A315 | Worksheet - Understanding and evaluation of a service organisation | Minor procedure changes |

| A320 | Worksheet - Understanding and evaluation of the internal audit function | Major procedure changes |

| A400 | Team planning discussions | Major procedure changes |

| A405 | Preparing the risk assessment procedures | Major procedure changes |

| A410 (new form) | Worksheet - Fraud scenarios | New document format |

| A505 | Materiality of qualitative disclosures | New document |

| B200 | Understanding the entity and its environment | Major procedure changes |

| B205 | Understanding the entity and its environment - Industry, regulatory, and other external factors | Major procedure changes |

| B210 | B210 Understanding the entity and its environment - Nature of the entity | Major procedure changes |

| B215 | Understanding the entity and its environment - Selection and application of accounting policies and financial reporting matters | Major procedure changes |

| B220 (removed) | Understanding the entity and its environment - Objectives, strategies, and related business risks | Removed (procedures combined into B210) |

| B220 (previously B225) | Understanding the entity and its environment - Measurement and review of the entity's financial performance | Minor procedure changes |

| B250 | Worksheet - Understanding accounting estimates | Minor procedure changes |

| B260 | Worksheet - Outcome of prior period accounting estimates | Minor procedure changes |

| B300 | Understanding of the entity's controls | Major procedure changes |

| B305 | Understanding the IT Environment | Minor procedure changes |

| B310 | Understanding the IT environment - Listing | Minor procedure changes |

| B315 | Entity level risks and controls (Core) | Major procedure changes |

| (New form) | Major procedure changes | |

| B320 | General IT Controls | Minor procedure changes |

| B325 | B325 Worksheet - Control implementation - Business process controls | Minor procedure changes |

| B330 (new form) | Worksheet - Information flow - Business process | New document |

| B400 | Assessment of RMM (including Fraud Risks) | Major procedure changes |

| B405 | Identifying fraud risks | Major procedure changes |

| B410 | Worksheet - Minutes of governance meetings | Minor procedure changes |

| B600 | Specific areas | Major procedure changes |

| C100 | Audit response to assessed risks | Major procedure changes |

| C110 | Responding to risk at the financial statement level | Major procedure changes |

| C115 | Worksheet - Going-concern evaluation | Major procedure changes |

| C135 | Subsequent events (Core) | Minor procedure changes |

| C140 | Worksheet - Related party transactions (Core) | Minor procedure changes |

| C150 | Statement of cash flows - Audit procedures | Major procedure changes |

| 1,101 | Property, plant and equipment - Audit procedures | Minor procedure changes |

| 5,101 | Investment property - Audit procedures | Minor procedure changes |

| 20,101 | Long-term investments - Audit procedures | Minor procedure changes |

| 35,101 | Loans and advances receivable - Audit procedures | Minor procedure changes |

| 40,101 | Agricultural assets - Audit procedures | Major procedure changes |

| 40.110 (new form) | Agricultural assets count checklist | New document |

| 110,101 | Inventory - Audit procedures | Major procedure changes |

| 110,110 | Inventory count checklist | Major procedure changes |

| 120,101 | Investments - Audit procedures | Minor procedure changes |

| 130,110 | Accounts receivable confirmation - Supplementary procedures | Major procedure changes |

| 300,101 | Long-term debt - Audit procedures | Major procedure changes |

| 335,101 | Government grants - Audit procedures | Major procedure changes |

| 340,101 | Leases for lessees - Audit procedures | Major procedure changes |

| 425,110 | Accounts payable confirmation - Supplementary procedures | Major procedure changes |

| 1600,105 | Payroll and other expenses - Audit procedures | Major procedure changes |

| 1700,101 | Other income | Major procedure changes |

| 1800,101 | Other expenses | Major procedure changes |

| D100 | Evaluation of misstatements identified | Minor procedure changes |

| D300 | Evaluation of Work Performed by others involved in the Audit | Major procedure changes |

| D305 | Worksheet - Engagement quality control review checklist | Minor procedure changes |

| D500 | Communications with Management/TCWG | Minor procedure changes |

| D505 | Worksheet - Matters to be communicated to management and those charged with governance | Major procedure changes |

| D510 | Communications to be made by the auditor with those charged with governance and management | Major procedure changes |

| D600 | Audit completion | Major procedure changes |

| D610 | Reporting checklist | Minor procedure changes |

| D615 | Documentation checklist | Major procedure changes |

| D625 | Checklist - Audit completion (Core) | Minor procedure changes |

Risikobeurteilung

The following Risk Assessment functionalities were added to address the changes and new requirements in ISA 315 (Revised 2019):

Inherent Risk (IR):

-

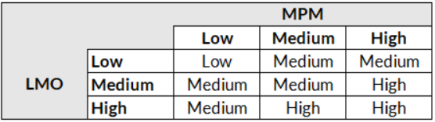

LMO: Likelihood of Misstatement Occurring:

-

Assessment scale: 3

-

Low (L)

-

Medium (M)

-

High (H)

-

-

-

MPM: Magnitude of Potential Misstatement:

-

Assessment scale: 3

-

Low (L)

-

Medium (M)

-

High (H)

-

-

-

Inherent Risk Automation:

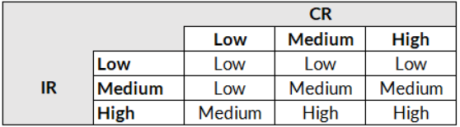

Risk of Material Misstatement (RMM):

-

Assessment scale:

-

Insignificant: I

-

Low: N

-

Medium: M

-

High: H

-

Significant: S

-

-

RMM Automation:

Business Cycles

The following Business Cycles were added:

-

Revenue, Receivables, Receipts

-

Purchases, Payables, Payments

-

Payroll

-

Financial Reporting

-

Investments

-

Vorräte

-

Treasury

New Roles and Schemes

A new Partner role was created and assigned the Review workflow.

A new Partner review scheme was created with the following details:

-

Preparer role:

-

Prepared by

-

-

Reviewer role:

-

Reviewed By

-

Partner

-

The Partner review scheme was assigned to the following documents:

-

C205 Group audit - Acceptance and planning

-

C215 Group Audit - Evaluation and conclusion

-

D625 Checklist - Audit completion

The Preliminary and final scheme was assigned to the following documents:

-

A500 Materiality

-

A505 Materiality of qualitative disclosures

-

B500 Risk Assessment Report

-

B700 Risk report