Perform a tax export

Content in this topic requires OnPoint Audit.

OnPoint Audit allows you to create an export file based on a default account mapping or grouping to import into your tax software. The following tax software are currently supported:

-

Lacerte

-

Axcess / ProSystem fx

-

UltraTax CS

For information on tax export codes, see Tax export codes.

The Tax Export phase is available on the Documents page after you complete the 1-100 Engagement - Acceptance/Continuance checklist.

To perform a tax export:

-

Select 9-100 - Tax Export from the Tax Export phase.

-

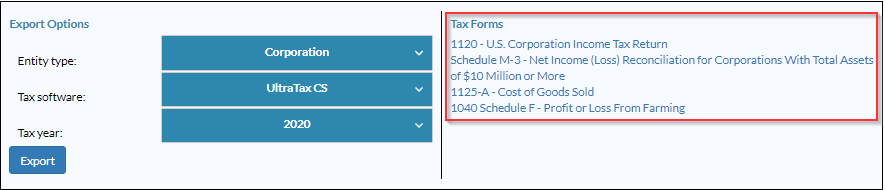

Select your Entity type.

-

Review your trial balance data and modify as needed using the Tax forms that become visible.

Note: The tax forms shown depend on your Entity type selection.

-

Select the Tax software.

-

Select the Tax year.

Note: The tax export function only exports the current year adjusted balance from the trial balance. The Tax year identifies the version of the tax forms used by the mapping function.

-

Select the Export button.

The tax export file is downloaded to your device. You can verify that the account balances have been mapped to the correct places on the tax forms and adjust any mappings within the tax software, as needed.