Tax schedules

Note: Caseware Taxflow supports 2022 and 2023 tax exports for C-Corporations, S-Corporations and Partnerships for the following tax vendors:

-

CCH ProSystem fx® Tax

-

CCH Axcess™ Tax

-

Lacerte® Tax

-

GoSystem® Tax

-

UltraTax CS

Casware Taxflow includes tax schedules that are relevant to your organization type, where you can review tax adjustments and final tax balances. Depending on your organization type, applicable Tax schedules are available under the Tax preparation and export phase on the Documents page.

Tax schedules include the following tax information:

-

Tax reclassifying adjustments posted for each tax group.

-

Book-to-tax reconciliation adjustments posted for each tax group.

The Adjusted financial balances and Final tax balances are automatically calculated in tax schedules using the Final financial balances and posted tax adjustments. You can also view the calculated Final tax result.

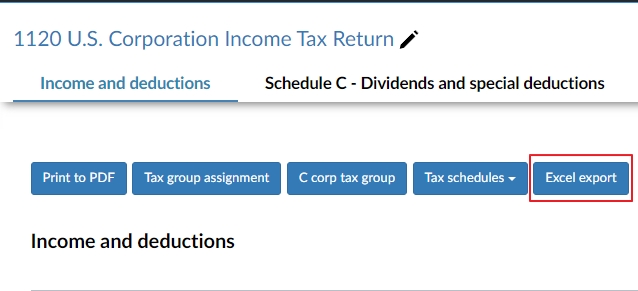

Tax schedules can be exported to Microsoft Excel. Each tab can be exported individually. Where sub-groups exist, parent tax groups will be excluded from the export, to avoid data duplication.

To learn how to change the column view or filter column headings of the table, see Adjust table settings.