Summary of misstatements

As part of the final documentation for an engagement, you may need to provide an evaluation of the misstatements identified during the audit. Your engagement file may include a report document named Summary of Misstatements.

This document automatically includes information relevant to your evaluation:

-

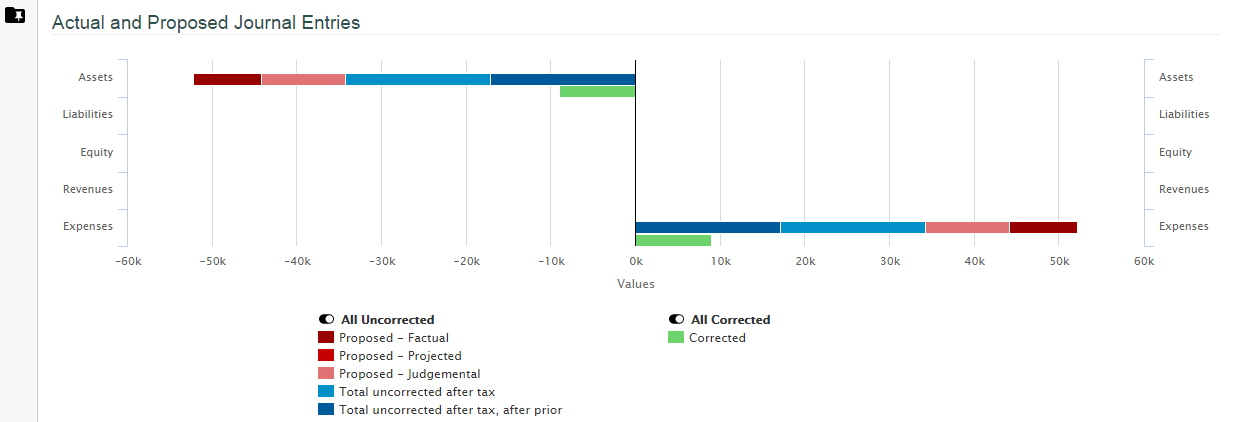

The Actual and Proposed Journal Entries section displays all of the adjusting and proposed journal entries as charts.

-

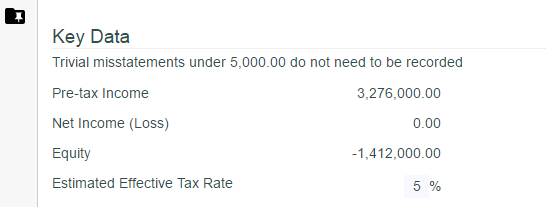

The key data section displays certain data about the overall engagement and materiality.

You can enter the estimated effective tax rate.

-

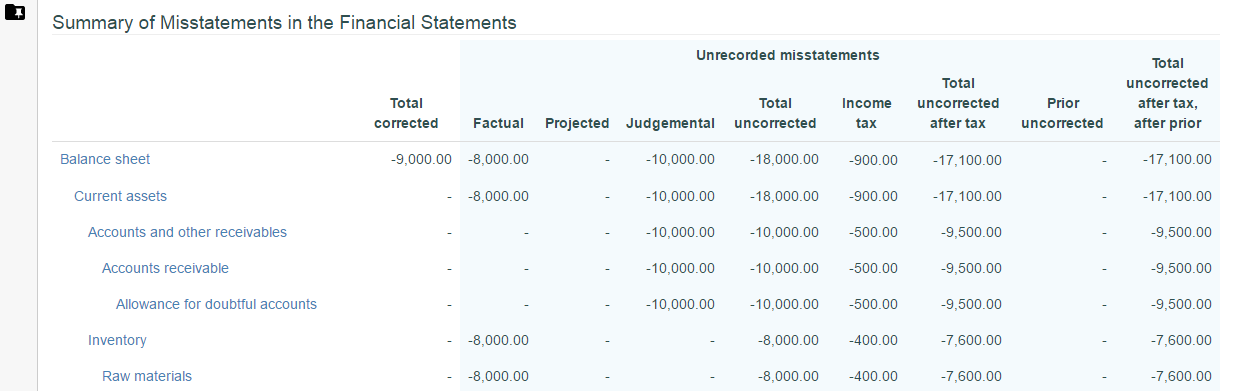

The Summary of Misstatements in the Financial Statements section contains a table with all of the financial groups that have misstatements and a breakdown of the misstatement amounts.

Beneath these sections, you can write up your evaluation of the misstatements. You can also add any omitted disclosures, including whether or not they were corrected and the reasons for not disclosing them.

Once you have completed the evaluation of misstatements, you can present your conclusion - whether or not the uncorrected differences are material in the aggregate - and sign off on the document.