Document the audit response to assessed risks

C100 Audit response to assessed risks includes the responses to assessed risks at the financial statements level, other audit tasks performed and discussions of significant matters with management.

Select your preferred method of documentation (Narrative or Procedures) for each section. When you have completed your work, select the Hide button in the Conclusion area to hide the desired documentation decisions.

Depending on your responses throughout the Planning and Risk Assessment phases, documents C110 to C155 are included in the Documents page so you can complete the necessary documentation for the engagement.

To design the nature, timing and extent of audit procedures that respond to assessed risks of material misstatement at the assertion level and obtain sufficient appropriate audit evidence, complete the Plans and Procedures documents (also known as Work Programs).

When you select High online collaboration in A100 Optimiser checklist - Initial Engagement Decisions, a query document is included for each section in the Plans and Procedures phase in the Documents page.

All Work Programs start with a Detailed Audit Response group, which includes two subgroups:

-

Audit response considerations: which includes procedures to assist in designing the audit response.

-

Audit response table (ART): a summary to assist in assessing the appropriate nature and extent of audit procedures to address each relevant assertion.

The Detailed Audit Response group will show if the Work Program’s corresponding Area is Material or if the RMM assessment for any assertion is Low or greater.

The procedures included in each Work Program are based on the following rules:

| Balance | RRM Assessment | Procedures |

|---|---|---|

| No | --- | None |

| Yes | ---/Insignificant | Minimal |

| Yes | Low/Medium | Substantive procedures |

| Yes | High/Significant | Substantive procedures |

| --- | --- | Substantive analytical procedures |

| --- | --- | Test of controls |

For example, if the RMM assessment for an assertion in a given Financial Area is Insignificant, a minimal set of analytical and schedule procedures are included in the corresponding Work Program.

If the RMM assessment for an assertion in a given Financial Area is Low or Medium, a set of substantive procedures are included in the corresponding Work Program.

When the RMM assessment for an assertion in a given Financial Area is High or Significant, additional substantive procedures are included along with substantive analytical procedures and tests of control procedures.

As you design the audit response, be sure to select N/A for any procedure that is not relevant to the engagement.

Plans and procedures work programs also include assertions. Assertions are implicit or explicit claims and representations regarding the appropriateness of various elements.

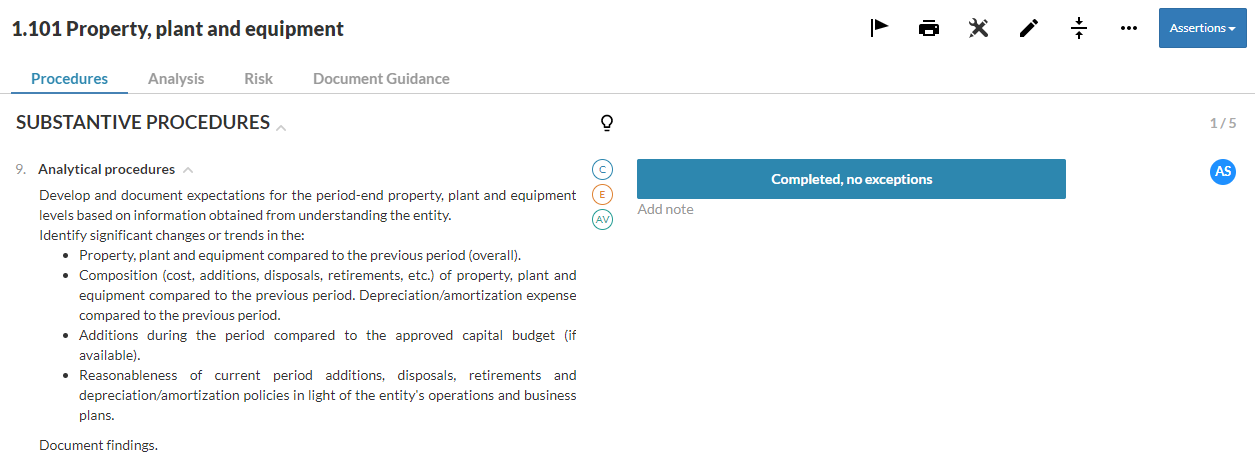

Take 1.101 Property, plant and equipment, for example:

Item 2, Analytical procedures includes the following assertions:

-

C—Completeness

-

E—Existence

-

AV—Accuracy and Valuation

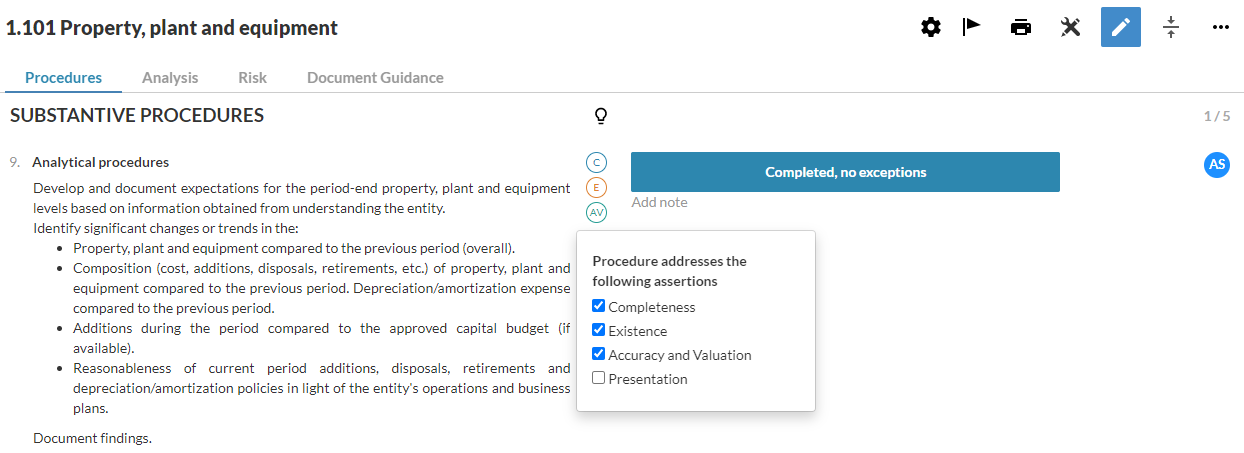

To change the assertions for a specific procedure:

-

Select Edit (

) and then the assertions beside the procedure.

) and then the assertions beside the procedure.The Procedure addresses the following assertions popup displays.

-

Use the check boxes to select the assertions to apply to the procedure.

To learn more, see Add assertions in procedures.

All Work Programs include an Accounting Estimates group, which are designed to assist you in documenting your work relating to accounting estimates and related disclosures, as stated by ISA 540 (Revised) Account Estimates. These procedures are included when you answer affirmatively to the procedure “Are the financial statements of the entity subject to extensive estimates ... ?” in B200 Understanding the entity and its environment for each Financial Area, and RMM assessment for an assertion for the Financial Area is Low or greater.