Post adjustments to the trial balance

You can add adjustments to the trial balance accounts or groups.

Post an adjusting entry to the trial balance (Data page)

You can post adjusting entries to accounts or groups, and include a description of the entry and an annotation.

To post an adjusting entry:

-

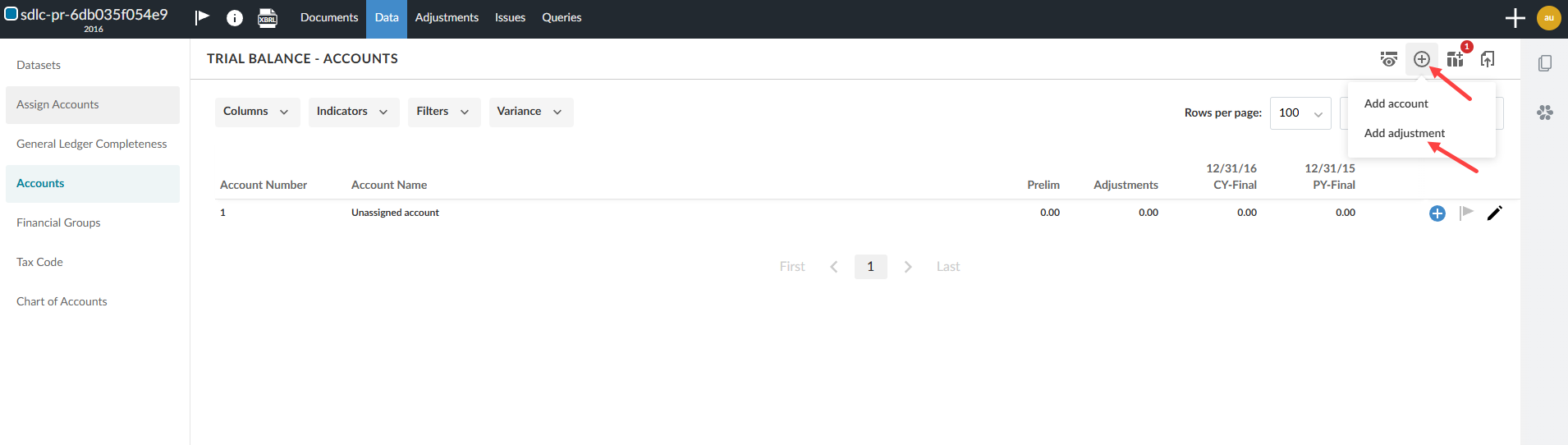

Go to the Data page.

-

Select Accounts from the left panel.

-

Click Add (

) | Add adjustment.

) | Add adjustment.

You can also add adjustments in the FINANCIAL GROUPS view option.

Note: You can also select TAX GROUPS and PRESCRIBED GROUPS, if they're enabled in your product.

-

Add the details of the adjusting entry in the dialog.

-

Enter the Adjustment Number.

-

Choose an adjustment Type.

-

Enter a description for the adjustment.

Note: If this is not the first adjustments entry, the application automatically increments the last entered adjustment number and displays it in the Adjustment Number field. If this is the first adjustment entry, 1 displays in the field as the default adjustment number. You can override the default.

Note: The available adjustment types in the drop-down are based on your product setup.

-

-

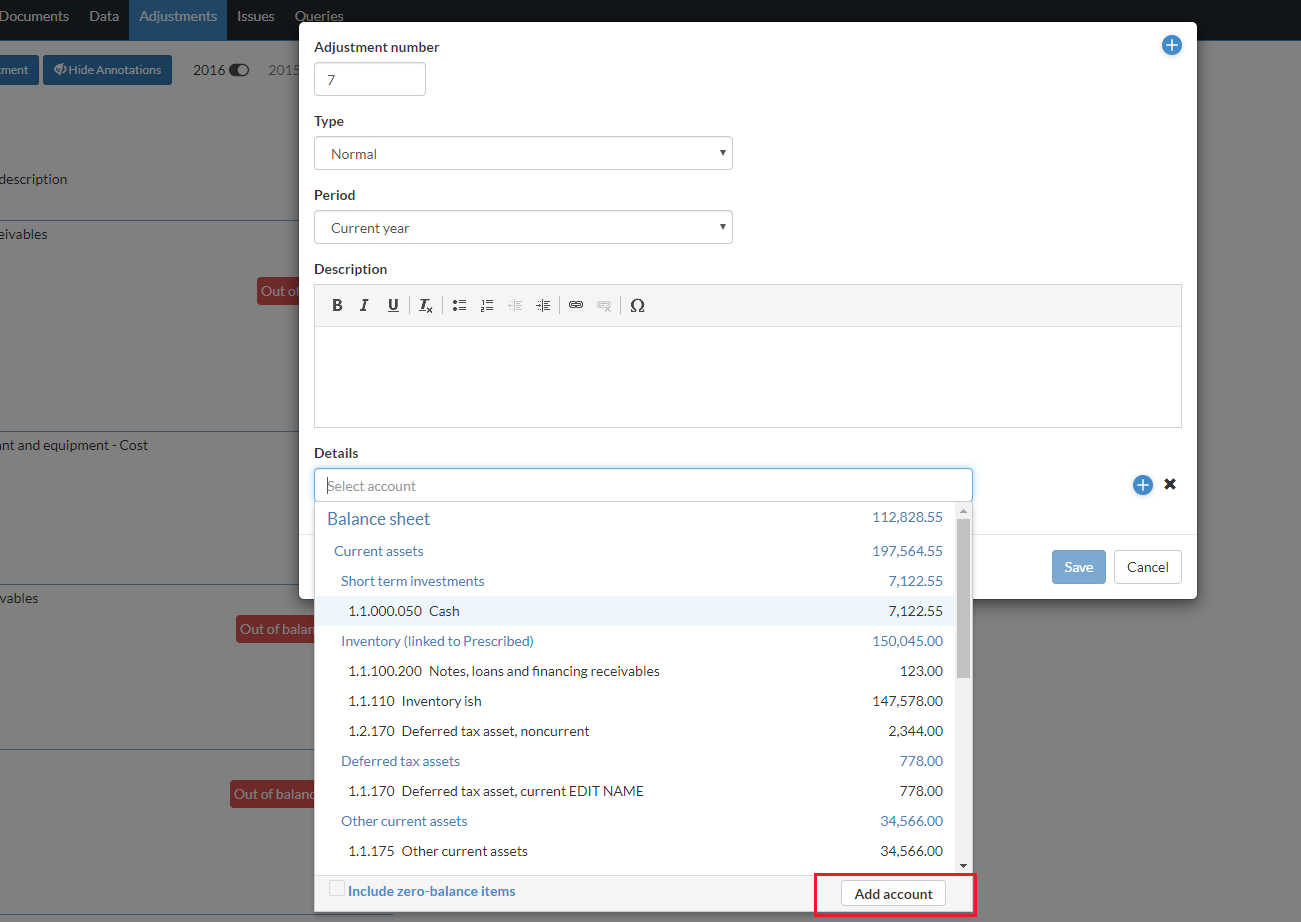

At Details, select + Account line to post the adjusting entry to an account, or select + Group line to post it to a group.

-

Tip: You can create an account as you add its lines using the Add account button.

If there are multiple grouping structures enabled in your product and you add a group line adjustment, you can select the appropriate grouping structure from the drop-down. The adjustment will apply only to that grouping structure and not to any linked groups in other grouping structures.

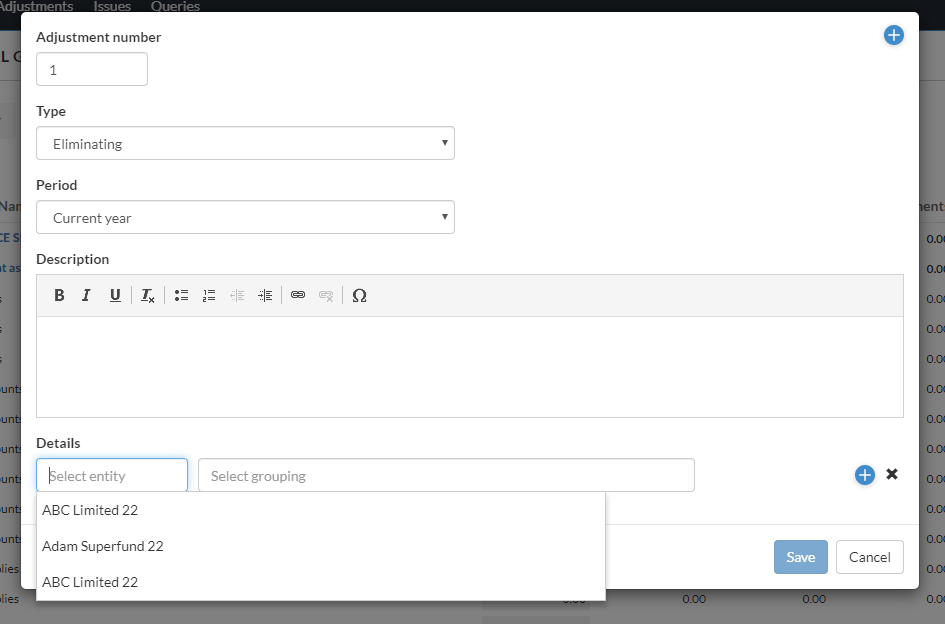

If the engagement is a consolidation engagement and you choose to,

- add an account line adjustment, a list of the parent and subsidiaries accounts displays in the dialog.

- add agroup line adjustment, a list of the parent entity groups displays in the dialog.

Note that if the adjustment type is Eliminating, you can also post the adjustment for a subsidiary group. Select the entity name to display a list of available entities (parent and all subsidiaries). For more information on adjustment types, see Common adjustment types.

-

Select an account or a group and enter the adjustment amount. If you want to enter a calculation for the adjustment amount select fx in the Amount field and enter the calculation. To learn more, see the Calculated adjustments section.

Note: If you select a group and dimensions are enabled in your product, you can also select dimensions to assign to the adjustment. You can select one dimension for each dimension category assigned to the group.

-

Finalize the entry by selecting + Account line or + Group line to add another account or group to balance the adjustment.

-

Select Save.

Your adjusting entry is posted to the account or group. The data is immediately updated with the new values. You can view your adjustment on the Adjustments page, and apply filters if required.

You can also post an adjusting entry by selecting Duplicate for an existing adjustment to create a copy of it.

When you duplicate an adjustment, the new adjustment has the same type, description, and account details as the original adjustment. Duplicate adjustments are set by default to the current year even if the original adjustment is for the prior year.

Any annotations, issues or signoffs associated with the adjustment are not copied.

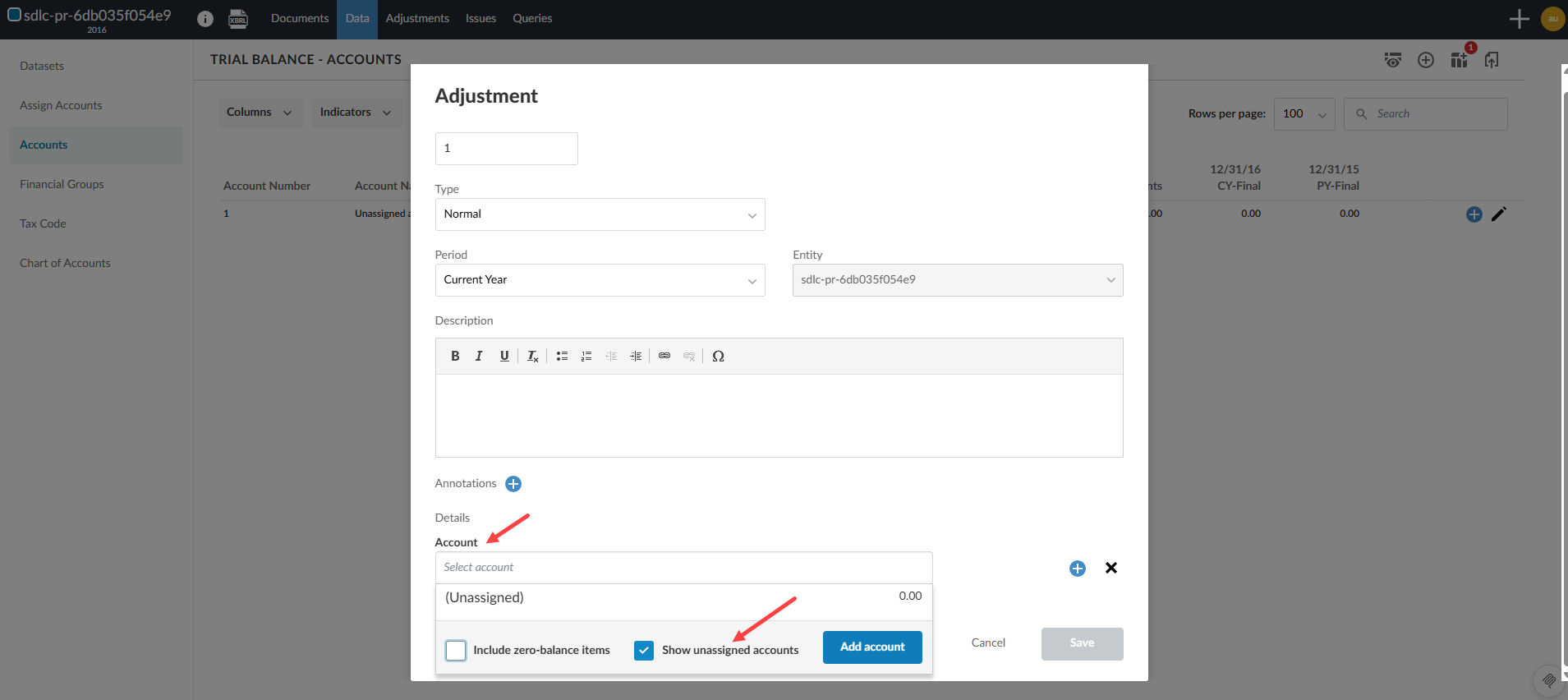

Post adjustments to unassigned accounts

In addition, you can post adjustments for accounts that have not yet been mapped to a financial group. A Show unassigned accounts checkbox is now available in the Account selector when adding an adjustment in Accounts.

-

The selector respects the zero-balance filter and saves the toggle state to session storage.

-

The “Unassigned” group appears at the bottom of the list, and the selector jumps to this group when enabled.

Show unassigned accounts in Add Adjustment dialog box:

Calculated adjustments

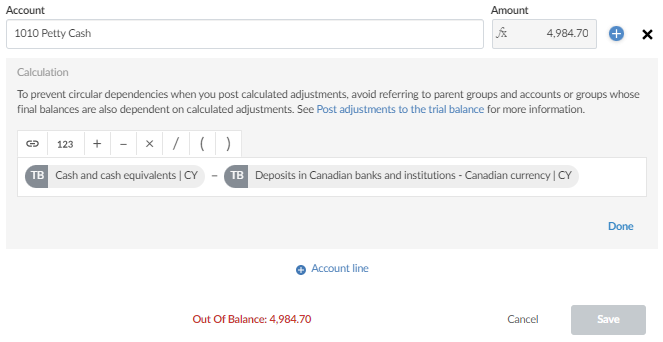

When you enter the adjustment amount, you can select fx to enter a calculation for the amount. You can reference other accounts and groups in the calculation, which allows you to create an adjustment that can be easily updated if the referenced account or group balance changes.

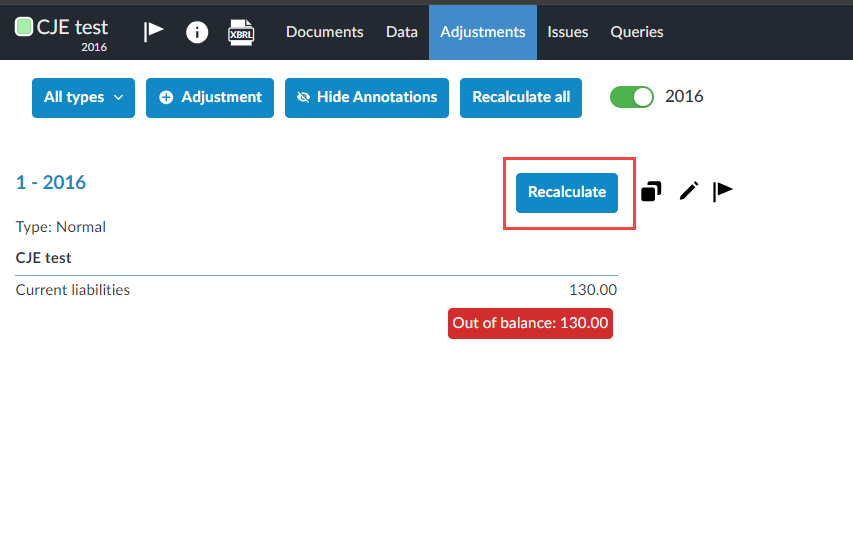

If a calculated adjustment contains a reference whose balance has changed, the Recalculate button displays next to the adjustment on the Adjustments page. You can also easily recalculate multiple adjustments at once, by selecting the Recalculate all button at the top of the page.

When you create calculated adjustments, you must avoid creating circular dependencies. To do this, ensure you do not reference parent groups and accounts or groups whose final balance is also dependent on calculated adjustments.

For example, if you make an adjustment to the Petty Cash account and reference its parent group, Cash and cash equivalents, in the calculation, you will create a circular dependency. When the adjustment is calculated and applied to the Petty Cash account, the balance of the parent group will also change. This will result in the Recalculate button displaying for the adjustment. If you select to recalculate the adjustment, the parent group’s balance will again be updated and the adjustment will continue to require recalculation. This will result in inaccurate balances for both the account and the parent group.

Another example that could lead to a circular dependency is when you add a calculated adjustment to one group that uses an account balance from a second group, and then add another adjustment to the second group that uses the final balance of the first group.

For example, say you add an adjustment to the Petty Cash account and reference the Short-term investments group balance. Now, if you add a second adjustment to the Short-term investments group that references the final balance of the parent group of the Petty Cash account, Cash and cash equivalents, you will create a circular dependency.

If the Short-term investments balance changes, the adjustment for the Petty Cash account will require recalculation. This will result in the final balance of the Cash and cash equivalents group changing, which means the adjustment for the Short-term investments group will also require recalculation. Once this adjustment is recalculated, the first adjustment will again require recalculation and so on.

Common adjustment types

Adjustment types include normal entries, reclassifying entries, uncorrected entries, and tax entries. Here are some examples of the most common adjustment types and a brief description.

-

Normal: Use to update all relevant automatic documents such as journals, ledgers, trial balance, financial statements, and leadsheets. When updating from one period to another, including a year-end close, these entries are transferred from the adjustment column to the opening or preliminary balance column on the trial balance and leadsheet documents.

-

Reclassifying: These are not recorded in the normal accounting records. However, they are recorded in all financial statements and working papers such as leadsheets. When made in any period other than the last period of the fiscal year, reclassifying entries are excluded from the accounting records. In this case, the entries to non-consolidated balances do not have to be reversed.

Reclassifying entries made in the last period of the fiscal year get included in the next year's opening balances when either of the following choices is made during a year end close: Update next year's opening balance with consolidated or report. Those reclassifying entries then have to be reversed.

-

Eliminating: Use to prepare combinations or consolidations of divisions or companies. These entries appear in consolidated trial balances, leadsheets, and financial statement documents.

-

Unrecorded - Factual: These represent factual misstatements that will not be recorded because of materiality or proposed entries that may be subsequently changed to a normal status. These entries appear on the Summary of Uncorrected Misstatements Document.

-

Unrecorded - Projected: These represent projected misstatements that are unrecorded based on the auditor's best estimates of misstatements in populations, usually derived from sampling. These entries appear on the Summary of Uncorrected Misstatements Document.

-

Unrecorded - Judgmental: These represent judgmental misstatements that are unrecorded based on differences arising from the judgments of management concerning accounting estimates, or the selection or application of accounting policies that the auditor considers inappropriate or unreasonable. These entries appear on the Summary of Uncorrected Misstatements Document.

-

Tax - Federal: These adjust the federal tax balance. They are not recorded in the normal accounting records. Use the trial balance, journal, and leadsheet documents to display the federal tax entries. If creating a Journal - Adjusting journal entries automatic document, any Permanent or Temporary adjusting entry displays in the Difference column of the report.

-

Tax - State: These adjust the state tax balance. They are not recorded in the normal accounting records. Use the trial balance, journal, and leadsheet documents to display the state tax entries.

-

Tax - City: These adjust the city tax balance. They are not recorded in the normal accounting records. Use the trial balance, journal, and leadsheet documents to display the city tax entries.