Risk response

Dit artikel betreft Caseware Audit.

Complete the documents in the Journals entries analysis folder in the following sequence:

- 670 Use of journal entries

Use to determine whether material misstatements (fraud or error) have occurred from the use of inappropriate, fictitious or unauthorized journal entries. If you selected Yes to the question Would you like to use Caseware's AnalyticsAI to assist with journal entries testing in your engagement? in the 010 Planning optimiser, you will be able to use AI-20, AI-30, and AI-40 to assist in completing this checklist. If you selected No you will only use the default procedures in 670 Use of journal entries. - AI-20 Data completeness

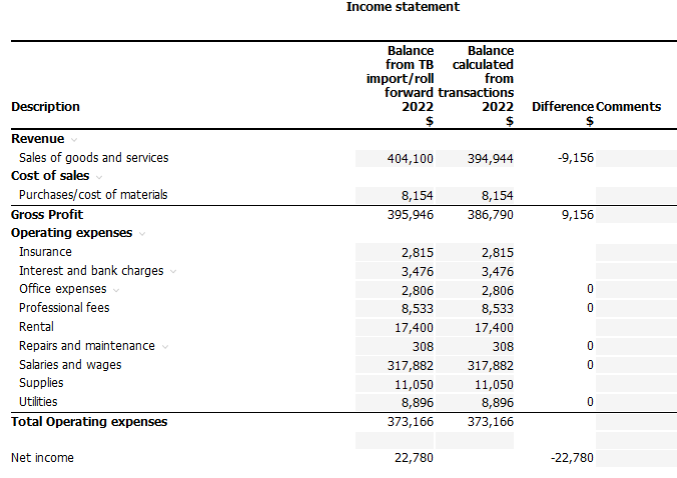

This is a simple table designed so that you can verify that the groupings totals from the trial balance agree with the groupings totals taken from imported transactions. For example, the total sales of goods and services from the trial balance is $404,100, so we want to verify the transactions that make up the sales of goods and services account add up to $404,100. There should ideally be "0" in all areas of the Difference column to indicate there are no issues. In this example there is a difference of (9,156) which indicates the trial balance and supporting transactions do not agree.

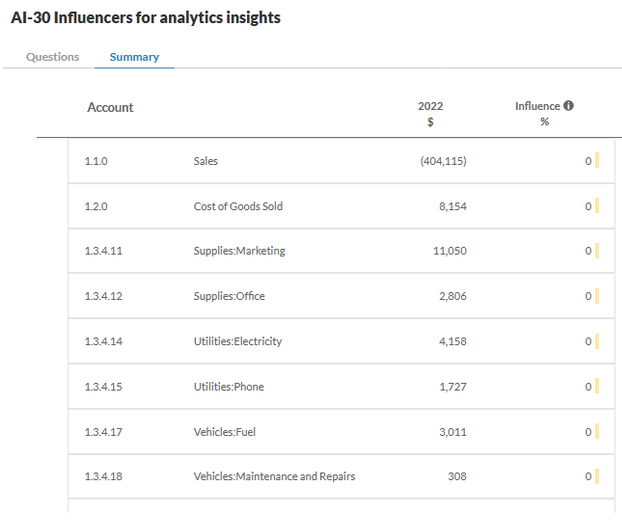

- AI-30 Influencers for analytics insights

See Beïnvloeders aanpassen for more information.

- AI-40 Analytics insights

This takes you to the AnalyticsAI functionality. For more information see Testresultaten.

Let op: You must import transactions in 501 Analytical procedures for documents AI-20, AI-30, and AI-40 to function as expected.

Complete the documents in the Risk response folder in the following sequence:

- 625 Going concern evaluation, accounting estimates, subsequent events, related party transactions

This is a standard checklist that is optimised based on what is needed for the engagement. By default, only the "Subsequent events" grouping is required. The other three groupings are driven by the following visibility settings:

- Going concern evaluation - Entire grouping is hidden unless on 500 Understanding the entity, you have selected "Yes - see response and comments" on the procedure "Going concern risk".

- Accounting estimates - Entire grouping is hidden unless on 513 Understanding accounting estimates, you have selected an estimate.

- Related party transactions - Entire grouping is hidden unless on 500 Understanding the entity, you have selected "Yes - see response and comments" on the procedure "Identification of related parties". This document also lets you choose between a "Full" and "Memo" format for each section. Full is the standard checklist with all procedures. Memo allows the user to hide all the procedures for that group and have a text entry box instead where they can type up how they will respond to that specific group issue. The "memo" option is intended for simple audits. - 630 Summary of external confirmations

Use this to summarize the use of external confirmation procedures (CAS 505). - 640 Client queries - Records and documents

This query document is similar to 030 Client queries - Initial client queries, except this document is used to drive the completion of the Risk Response phase. - 680 ASPE - Supplementary audit procedures

Use this to obtain the necessary audit evidence relating to the first-time adoption of Accounting Standards for Private Enterprises (ASPE), financial instruments and employee future benefits in accordance with ASPE.