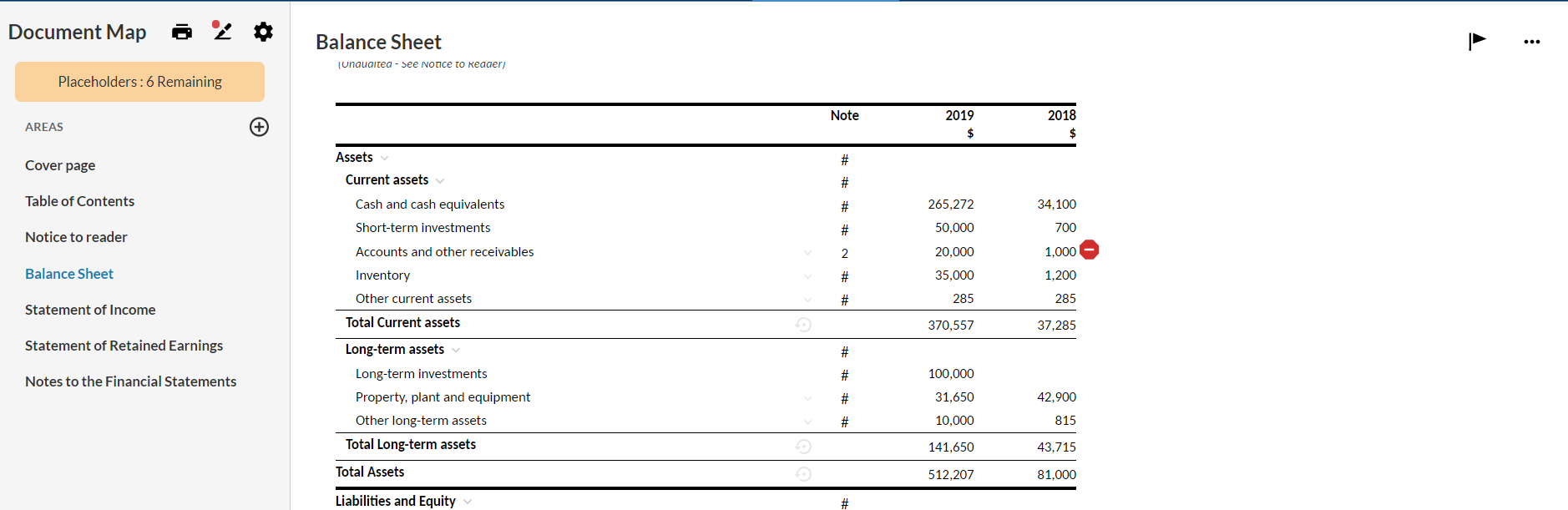

Gruppen- und Kontensalden im Jahresabschluss überprüfen

Wenn Sie die Cloud-Apps Claudia oder Finja einsetzen, verfügt die Bilanz teilweise über zusätzliche oder abweichende Funktionen. Weitere Informationen finden Sie in den jeweiligen Online-Hilfen der Apps. Sie können die Gruppen- und Kontensalden im Jahresabschlussbericht überprüfen, um zu verstehen, wie die Zahlen berechnet werden.Informationen zu Rundungs- und Saldoabweichungen sind in den Tabellen markiert, um Ihnen bei der Erstellung zuverlässiger, genauer und qualitativ hochwertiger Jahresabschlussberichte zu helfen.

Rundungsdetails im Jahresabschluss anzeigen

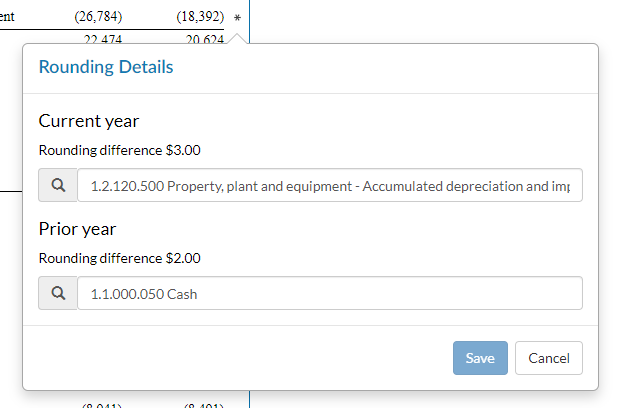

Um Rundungsdetails in einer Tabellenzeile anzuzeigen, wählen Sie das Sternchen (*) neben der Zeile aus. Es erscheint ein Pop-up mit folgendem Inhalt:

- Die gesamten Rundungsdifferenzen für das laufende Jahr und das Vorjahr.

- Das Konto, bei dem Rundungsdifferenzen für das aktuelle Jahr und das Vorjahr gelten.

In diesem Beispiel wird eine Rundungsdifferenz von insgesamt 3 $ zum Saldo von 1.2.120.500 Property, Plant and equipment - Accumulated depreciation and impairment für das laufende Jahr addiert. Für das Vorjahr wird eine Rundungsdifferenz von insgesamt 2$ zum Saldo von 1.1.000.050 Cash addiert.

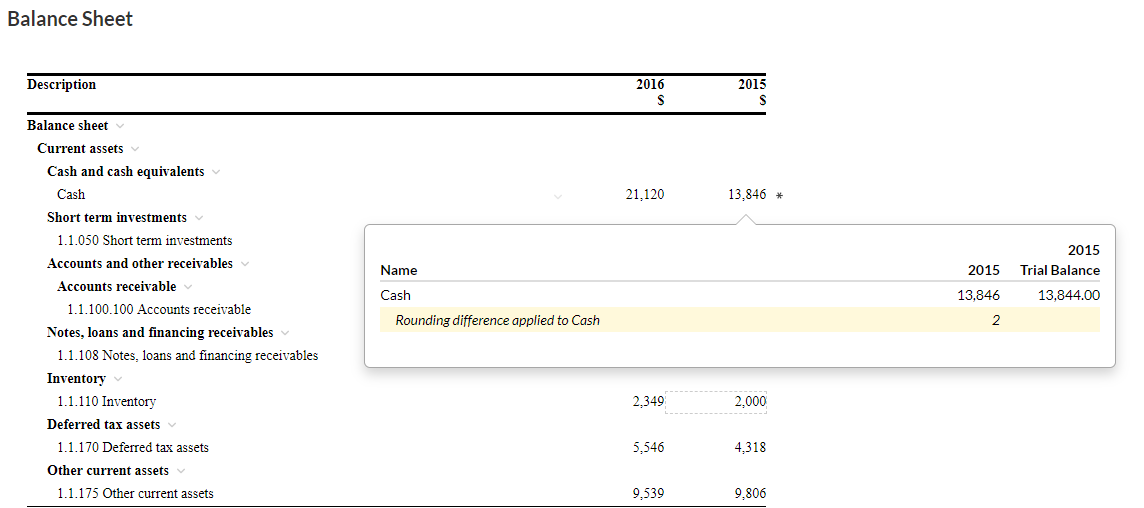

Wenn Sie den Saldo des Kontos auswählen, für das Rundungsdifferenzen gelten, wird im Pop-up Kontodetails eine hervorgehobene Zeile mit den Rundungsdetails angezeigt.

Bitte beachten Sie: Wenn ein HÜ-Saldo auf Null gerundet wird, wird die Tabellenzeile im Jahresabschluss grau angezeigt und ist weder in der Druckvorschau noch im PDF-Druckexemplar enthalten. Beachten Sie, dass dies nicht für Zeilen auf übergeordneter Ebene gilt, die immer im Jahresabschluss angezeigt werden und in der Druckvorschau und der PDF-Druckkopie enthalten sind.

Weitere Informationen zur Rundungslogik im Jahresabschluss finden Sie unter Runden im Jahresabschluss.

Ändern Sie das Konto, bei dem Rundungsdifferenzen gelten

Sie können das Konto ändern, für das Rundungsdifferenzen gelten, um diese beispielsweise zu einem in Ihrem Markt häufig verwendeten Jahresabschlussposten hinzuzufügen.

So ändern Sie das Konto, auf das Rundungsdifferenzen angewendet werden:

-

Wählen Sie die Zeile mit einem Sternchen (*) aus.

-

Wählen Sie unter Aktuelles Jahr den Namen des Kontos aus.

-

Wählen Sie das gewünschte Konto aus der Liste aus.

-

Wählen Sie den Kontonamen bei Vorjahr aus und wählen Sie dann das gewünschte Konto aus der Liste.

Das Pop-up Rundungsdetails wird geöffnet.

Tipp: Wenn es sich bei der Zeile um ein Konto handelt, bedeutet das Sternchen (*), dass in diesem Konto Rundungsdifferenzen angewendet werden. Wenn es sich bei der Zeile um eine Gruppe handelt, bedeutet dies, dass Rundungsdifferenzen auf ein Konto in dieser Gruppe angewendet werden.

Es wird eine Liste mit den HÜ-Gruppen und Konten angezeigt.

Rundungsdifferenzen für das laufende Jahr und die Vorjahre werden nun jeweils auf die Salden der ausgewählten Konten angewendet.

Saldoabweichungen im Jahresabschluss anzeigen

Bitte beachten Sie: Diese Funktion ist nur verfügbar, wenn sie in Ihrem Produkt eingerichtet ist.

Um Ihnen den Abgleich von Kontensalden zu erleichtern, können im Jahresabschluss Tabellenzeilen miteinander verglichen werden. Beispielsweise um Buchhalter dabei zu unterstützen, Einzelposten mit Gesamtbeträgen im Abschnitt Anmerkungen/Notizen abzugleichen.

Beim Vergleich ist in jeder Zeile, in der Saldoabweichungen festgestellt wurden, ein Stoppschild-Symbol (![]() ) verfügbar.

) verfügbar.

Bitte beachten Sie:

Sie können die Zeilen, die die Anwendung vergleicht, nicht auswählen. Sie sind in Ihrem Produkt vordefiniert.

Die Anwendung vergleicht die absoluten Werte der entsprechenden Zeilen. Vorzeichenunterschiede werden nicht als Saldoabweichungen gekennzeichnet.

Um Saldodiskrepanzen anzuzeigen, wählen Sie das Stoppschild-Symbol aus (![]() ). Es erscheint ein Pop-up mit folgendem Inhalt:

). Es erscheint ein Pop-up mit folgendem Inhalt:

- Die Zeilen in anderen Tabellen im Dokument, die mit der aktuellen Zeile verglichen wurden.

- Salden, die mit der aktuellen Zeile übereinstimmen.

- Salden, die nicht mit der aktuellen Zeile übereinstimmen.

Tipp: Sie können auch das Symbol Zeile anzeigen (![]() ) auswählen, um zu der spezifischen Zeile jedes aufgelisteten Kontos zu wechseln und dessen Daten anzuzeigen.

) auswählen, um zu der spezifischen Zeile jedes aufgelisteten Kontos zu wechseln und dessen Daten anzuzeigen.

Überschreiben Sie Salden im Jahresabschluss

Wenn Sie die Salden im Jahresabschluss überprüfen, müssen Sie möglicherweise die Saldenwerte in den Tabellen überschreiben. Beispielsweise können Sie einen bestimmten Saldo im Jahresabschluss ändern, um genau den Saldo widerzuspiegeln, den Ihre Kunden in ihren Berichten des Vorjahres hatten.

Hinweis: Wenn Sie einen Saldowert auf Null überschreiben, wird die Tabellenzeile im Jahresabschluss grau angezeigt und ist weder in der Druckvorschau noch in der PDF-Druckkopie enthalten. Beachten Sie, dass dies nicht für Zeilen auf übergeordneter Ebene gilt, die immer im Jahresabschluss angezeigt werden und in der Druckvorschau und der PDF-Druckkopie enthalten sind.

Kontensaldo überschreiben:

-

Wählen Sie den Saldo aus, den Sie ändern möchten.

-

Geben Sie den neuen Betrag ein.

Ein gestrichelter Rand wird angezeigt, um die Zelle als Saldo überschrieben zu markieren.

Gruppensumme überschreiben:

-

Wählen Sie die Gruppensumme aus, die Sie ändern möchten.

-

Geben Sie den neuen Betrag ein.

-

Wenn es in der Gruppe ein Konto gibt, gilt die Differenz automatisch für dieses Konto.

-

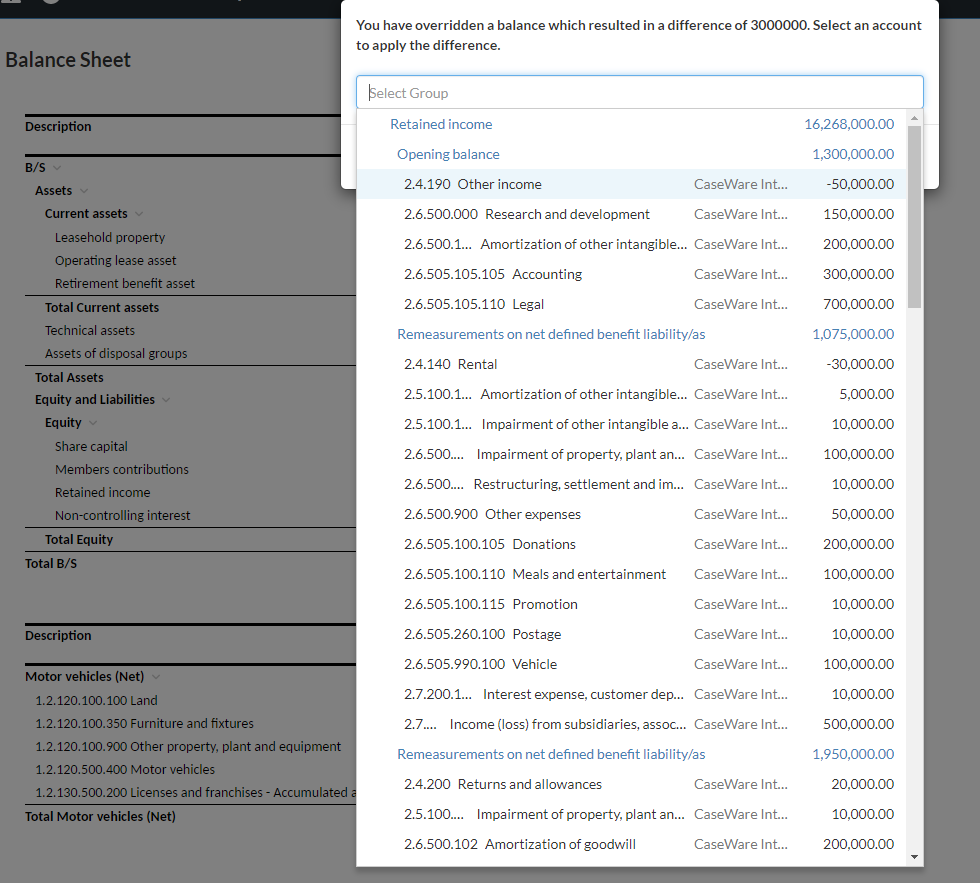

Wenn es mehr als ein Konto in der Gruppe gibt, wird ein Dialog angezeigt, der die Differenz (zwischen dem neuen Betrag und dem alten Betrag) anzeigt. Außerdem werden Sie aufgefordert, das Konto auszuwählen, für das die Differenz gelten soll.

-

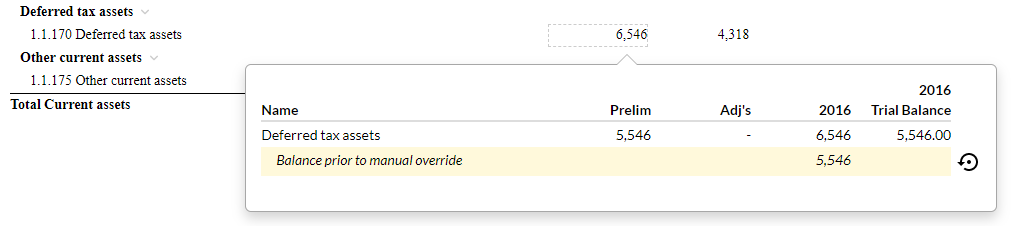

Beachten Sie, dass bei Auswahl einer Zelle mit überschriebenem Saldo im Popup-Fenster Kontodetails eine hervorgehobene Zeile mit dem ursprünglichen Saldo für diese Zelle (dem HÜ-Betrag) angezeigt wird

Tipp: Um zum ursprünglichen Betrag zurückzukehren, wählen Sie Zurücksetzen (![]() ).

).