What’s new - OnPoint PCR Winter 2021 Release (v.1.3020)

Here is what’s new in OnPoint PCR Winter 2021 Release.

SSARS 25 and annual content updates

OnPoint PCR now includes updates made to the Statements on Standards for Accounting and Review Services (SSARS) No.25 - Materiality in a Review of Financial Statements and Adverse Conclusions was issued. These updates are applicable for engagements performed on financial statements for periods ending on or after December 15th, 2021.

SSARS 25 amendments to the following sections have also been included in OnPoint PCR Winter 2021 Release:

-

AR-C section 60, General Principles for Engagements Performed in Accordance With Statements on Standards for Accounting and Review Services

-

AR-C section 70, Preparation of Financial Statements

-

AR-C section 80, Compilation Engagements

-

AR-C section 90, Review of Financial Statements made to Review Standard

In addition to the SSARS 25 update, OnPoint PCR includes all standard updates that are effective for periods ending on or after December 15th, 2021.

As part of the content updates to this release, the following changes were made to all documents and checklists in OnPoint PCR:

-

Additional procedures.

-

Modifications to existing procedures.

-

Removal of procedures that are no longer relevant.

-

Updates to authoritative references.

Review work programs visibilities updates

Visibility settings for the review work programs have been updated according to the requirements of the SSARS 25 standard updates to automate workflows and custom the OnPoint PCR engagement file content to the auditors needs. The 2-400 Overall analysis checklist has also been updated to reflect these new changes.

The following changes to the OnPoint PCR workflow have been made:

-

A review work program is included by default in the engagement file if the corresponding financial statement area is material. The auditor can decide whether the review work program associated with a material financial statement area should be excluded from the engagement in the 2-400 Overall analysis checklist. If the review work program is excluded, the auditor will need to document the reason for excluding the review work program.

-

A review work program associated with a non-material or with a zero balance financial statement area is excluded by default from the engagement file. The auditor can decide whether the review work program associated with a non-material financial statement area should be included in the engagement in the 2-400 Overall analysis checklist.

Revised Independent Accountant's Review Report

The Independent Accountant's Review Report that is included in 4-250 Financial Statements document has been revised to include the updated language according to SSARS 25.

4-200 Financial Statements set-up checklist now includes additional procedures that drive the logic on the Review Report paragraphs.

Documents page updates

The following updates have been made to the Documents page:

-

Document phase names have been renamed and expanded. The following phases are now available:

-

Engagement acceptance and set up

-

Planning

-

Fieldwork

-

Jaarrekening

-

Presentation and disclosure checklists

-

Client correspondence

-

Completion

-

Permanent file

-

Tax Export

-

-

Updated document numbers now reflect accountant engagement workflows.

Single source organization type

Users can now document the organization type when the client’s entity is created in Cloud.

OnPoint PCR now provides guidelines and programs in line with the requirements for the following organization types:

-

BV

-

Limited Liability Company (LLC)

-

Partnership

-

Limited Liability Partnership (LLP)

-

Sole Proprietorship

The following organization type supports tax return only:

-

Individual

For more information on how to set up the client’s organization type, please refer to the Create client entities online documentation page.

Transactions and Data Completeness worksheet

We’ve enabled the ability to import transactions in an OnPoint PCR engagement. The new functionality provides an enhanced user experience and includes new features such as:

-

Drill-down from accounts to transaction details.

-

Import transactions from a CSV file or from an online accounting package or transfer the transactions data directly from Working Papers.

To learn more, see Import the client's transactions from a CSV and View the client's transactions.

2-550 - Data Completeness worksheet, checks whether the account balances from the trial balance match the account balances calculated from the general ledger transactions in an engagement. The document will note any discrepancies to alert the user and aid in scoping the engagement. Discrepancies may also indicate that you have received or uploaded an incomplete dataset and you may need to re-import the data.

For more information, see Check data completeness.

Overhaul the overall analysis graphs from 2-400 Review - Overall analysis

Improvements and additional graphs and ratios calculations have been added to the Analysis tab from the Review - Overall analysis document.

The following areas have been updated in the Analysis tab:

-

Overall graphs:

-

Total assets

-

Total liabilities

-

Total equity

-

Total revenues

-

Total cost of revenues

-

Total operating expenses

-

Total income tax

-

-

Relationships:

-

Revenues

-

Gross margin

-

Operating expenses

-

Income tax expense (benefit)

-

EBIT

-

EBITDA

-

-

Liquidity ratios:

-

Working capital

-

Accounts receivable to working capital

-

Current ratio

-

Quick ratio

-

Cash ratio

-

-

Profitability ratios:

-

Gross profit margin

-

Net profit margin

-

Return on assets

-

Pre-tax return on equity

-

After-tax return on equity

-

-

Assets

-

Liabilities

-

Equity

-

Revenues

-

Cost of revenues

-

Operating expenses

Trial balance updates

Financial grouping structure updated for Property, Plant and Equipment depreciation

The trial balance financial grouping structure has been revised to support additional financial grouping details for Property, Plant and Equipment depreciation category.

The Property, Plant and Equipment leadsheet was also updated to reflect the new changes.

Doel opnieuw toewijzen voor tegengestelde rekeningen

Certain financial groupings can now automatically re-assign their balances if they are opposite to the group's normal sign.

Tax specific financial groupings

New tax specific financial groupings have been added for the following categories:

-

Operating expenses - selling, general and administrative

-

Meals and entertainment

-

Gifts

-

-

Other operating (income) expense:

-

Accretion expense

-

-

Other (income) expense, the Investment income, interest and dividend has been split into:

-

Investment income, dividend

-

Investment income, interest

-

The following tax forms have been updated to reflect the new tax specific financial groupings:

-

1065 - U.S Return for Partnership Income

-

1120 - C U.S. Corporation Income Tax Return

-

1120 - Schedule M-3 Net Income (Loss) Reconciliation

-

1220S - U.S. Income Tax Return for an S Corporation

Simple Electronic Signature log in PDF format

You can now view and download a signature log in PDF format for documents electronically signed by clients in query documents.

To learn more, see Review contact responses and Attach documents to an engagement file.

Financial Statements updates

Notes Disclosures

Additional notes disclosures are now available in the financial statement library:

-

Significant accounting policy

-

Nature of business/basis of preparation

-

Subsequent events

-

-

Property, Plant and Equipment

-

Leases

-

Derivatives and hedges

-

Revenues

-

Expenses

-

Cash flow

Financial reporting framework for small and medium sized entities (“FRF for SMEs”) content

Additional Significant accounting policies notes have been added to the financial statements notes library for the Financial Reporting Framework for Small and Medium Sized Entities. Required paragraphs for FRF for SMEs have been added to the Accountant’s Compilation Report and the Independent Accountant’s Review Report.

Non-departmental Income Statements

The 4-250 - Financial Statements document can now generate non-departmental income statements. Non-departmental income statements provide the flexibility to create income statements which present all operating expenditures in a single section instead of departmental breakdowns.

Firm authors can now add financial groups to existing grouping structures in the firm template. Note that firm authors can’t modify or delete any groups added by primary authors. Voor meer informatie, zie Groepen toevoegen, bewerken en verwijderen en Groepseigenschappen.

If custom financial groupings have been created, the user can manually add the custom groupings to the non-departmental income statement. Added custom groupings in the Income Statement are retained when you carry forward the engagement and follow the same financial statement set-up procedures.

To learn how to add custom groupings to the financial statements, see Edit table rows in the financial statements.

Financial statements reconciliations (Diagnostics)

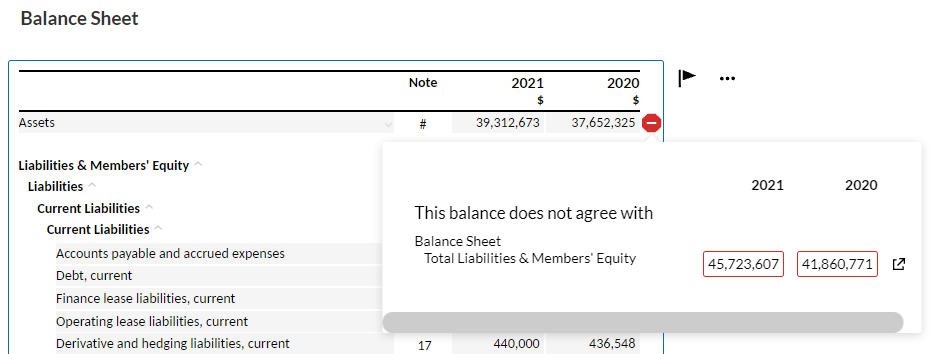

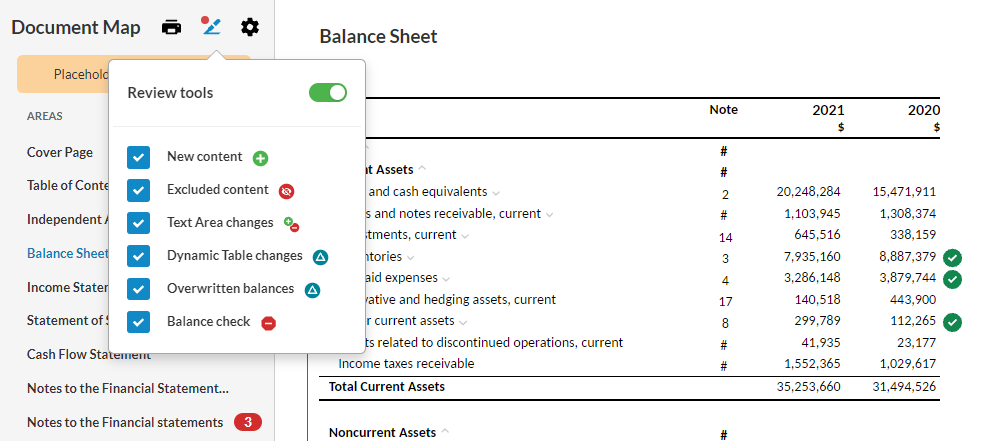

An automatic balance check process is now available in the financial statements to provide a more efficient reconciliation process. The process seamlessly runs in the background and detects and marks discrepancies in line items and note disclosures across all areas.

A diagnostic check icon (![]() ) displays next to areas with discrepancies detected so you can easily spot them. Select the icon to open a popup that displays the details, account names, and balances of the detected discrepancies. To learn more, see View balance discrepancies in financial statements.

) displays next to areas with discrepancies detected so you can easily spot them. Select the icon to open a popup that displays the details, account names, and balances of the detected discrepancies. To learn more, see View balance discrepancies in financial statements.

A new diagnostic check tool Balance Check is also available. This tool marks all areas that have been checked, as it highlights areas with discrepancies and locations where balances agree.

Voor meer informatie, zie Review hulpmiddelen in de jaarrekening.

Updated names for Financial Statement line items

For accuracy, the Income Statement financial lines that can have both a debit or credit balance have been updated to include the following names:

-

Consistent name: The preliminary wording for group names in the financial statements.

-

Contrary name: Displays for group amounts that are opposite to the group's normal sign.

-

Inconsistent name: Displays for the group when the current and prior year amounts have opposite signs.

Note references column for financial statements

Financial Statements (Balance sheet, Income statement and Cash Flow) now include a Note reference column linked to the corresponding Note disclosure. This will apply if note disclosures are included. To learn more, see Add, change or remove note references.

CashFlow Worksheets updates

Using Cloud Connector, CashFlow Worksheets for Commercial and Constructions have been updated to automatically pull amounts from Trial Balance and calculate amounts, where applicable.

To learn more about Cloud Connector, see Get started with Caseware Cloud Connector.

Other Financial Statements improvements

Financial Statements improvements

The financial statements have been revised and expanded to do the following:

-

Incorporate new groups added to the financial grouping structure. For example, new groupings added for Property, Plant and Equipment depreciation.

-

Provide additional flexibility in reporting. For example, a new column for Notes references added for all the financial statements.

-

Improved visibility settings for Notes disclosures. Notes disclosures associated with a grouping will only be included in the Financial Statements if the balance is different than a zero balance and if any other related conditions are met.

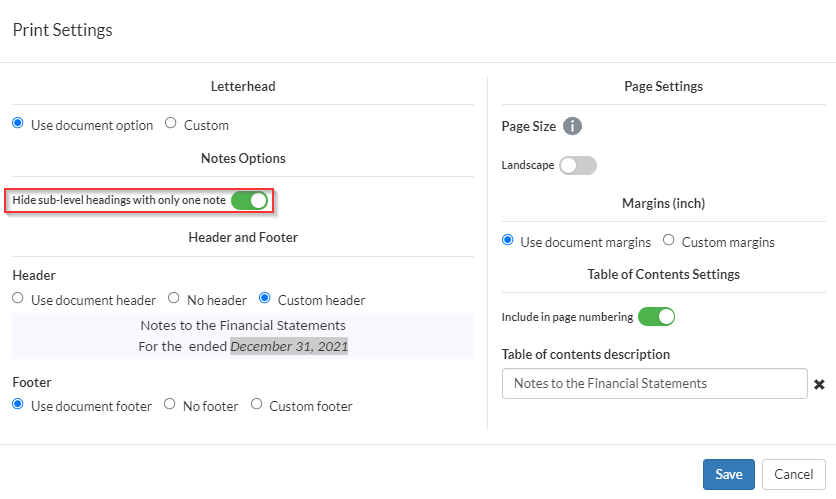

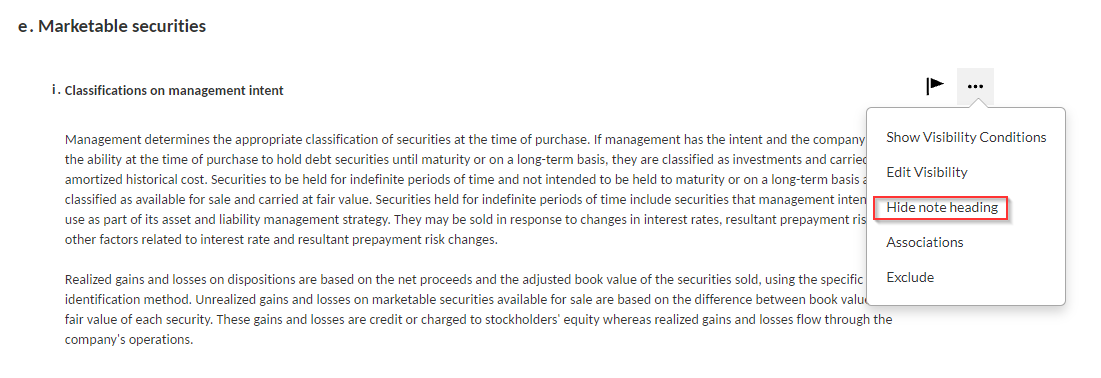

Hide sub-level headings for notes in financial statements

In the 4-250 Financial statements document, the Notes print settings now include an option to automatically hide sub-level headings for notes in the PDF output if there are no subsequent notes in that group.

The option to hide sub-level headings in the PDF output is also available for individual notes in the More actions menu if there are no subsequent notes in that group.

To learn more, see Set up the print options in the financial statements and Hide sub-level headings for notes.

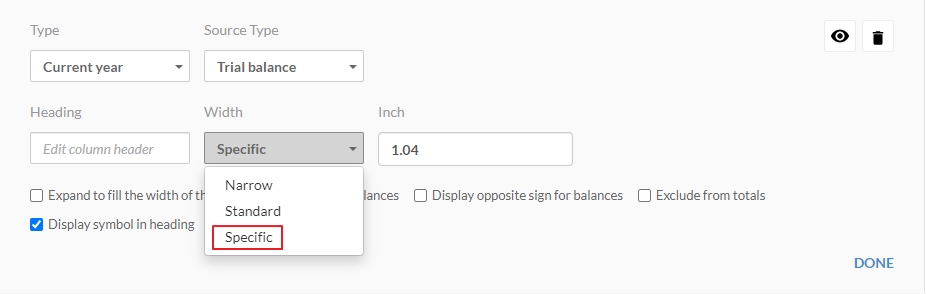

Custom widths for dynamic tables

You can now set custom widths for dynamic table columns from the column settings. Once you select Specific from the Width drop-down, you can specify the width of the column in inches or centimeters. The unit of measurement is determined by the unit selected in the product settings.

To learn more, see Edit table columns in the financial statements.

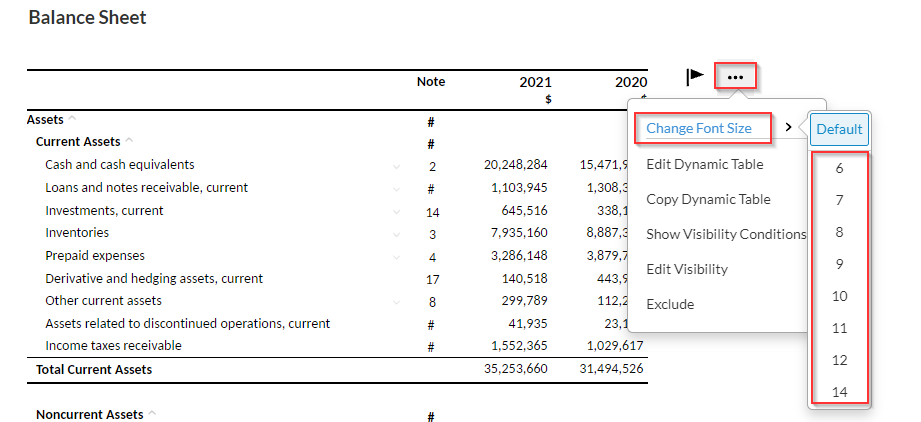

Dynamic table font size

You can now modify the font size of text in dynamic tables by selecting the More actions (![]() ) menu. You can use this option to decrease the font size when working with large tables to fit more content on a single page. De standaard tekengrootte is 11.25pt.

) menu. You can use this option to decrease the font size when working with large tables to fit more content on a single page. De standaard tekengrootte is 11.25pt.

To learn more, see Change the dynamic table font size.

Opmaak tabelranden instellen in dynamische tabel

In de jaarrekening vindt u de optie Opmaak tabelranden. Hiermee kunt u de stijl van de tabel aanpassen.

You can set underline and overline options for header rows, total rows, grand total rows and final rows.

You can also select the Override table customization checkbox to override existing underline and overline options in all tables and apply the default settings.

Voor meer informatie, zie Opmaak tabelranden instellen in dynamische tabel.

Default behavior for rows overridden or rounded to zero

When you manually override trial balance values to zero or when trial balance values are rounded to zero, the dynamic table row now displays in gray in the financial statements. This will not be included in the print copy.

Saldi in groepen en rekeningen reviewen in de jaarrekening.

Dynamic text in financial statement area print settings

Firm authors can now add dynamic text to headers and footers for financial statement areas in the print settings.

2021 Annual Tax year export updates

The tax export feature in OnPoint PCR now incorporates the updated 2021 tax exports. Updated tax codes are included for the following tax vendors:

-

Thomson Reuters UltraTax CS®

-

Intuit's Lacerte© Tax

-

CCH® ProSystem fx® Tax and CCH Axcess™ Tax

For a detailed list of changes included in this release, see Working Papers online documentation here: USA tax year export.

Queries overhaul updates

The following Queries documents have been updated to align with the latest content updates:

-

2-100Q Financial data and general entity information queries and responses

-

3-100Q Review inquiries - Required and general

Verbeteringen

The following list includes a brief description of the issue that have been resolved in this release.

-

In 3-100Q Review inquiries - Required and general, visibility settings for fieldwork related queries have been updated to correspond to the visibility settings for the review work programs to automate workflows and customize the query document.

-

Fixed an issue where assigning an account to Other Comprehensive Income/Loss financial groupings in a consolidation engagement would result in the Data Page not balancing.

-

Fixed an issue affecting the workflow in checklist 1-120 - Compilation - Engagement acceptance and conclusion. If the auditor is not independent and the Financial Statements do not include any notes disclosure, the auditor is now allowed to continue to perform the work.

-

Changes added to the visibility settings for Financial Statements and Presentation and disclosure checklists folders to improve the workflow logic.