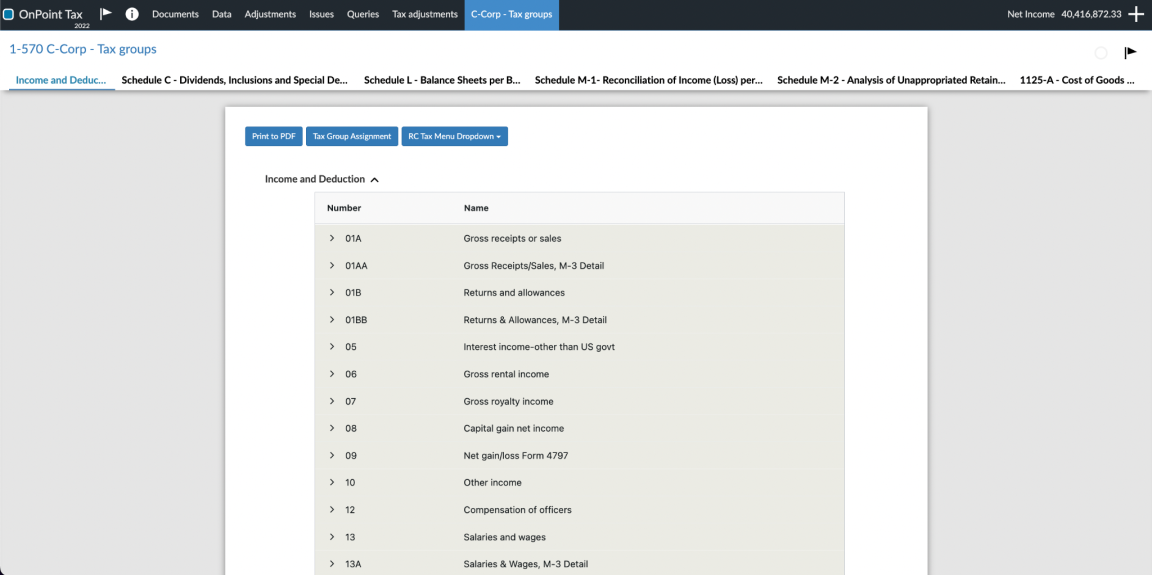

Tax groups

Note: Caseware Taxflow supports 2022 and 2023 tax exports for C-Corporations, S-Corporations and Partnerships for the following tax vendors:

-

CCH ProSystem fx® Tax

-

CCH Axcess™ Tax

-

Lacerte® Tax

-

GoSystem® Tax

-

UltraTax CS

Caseware Taxflow allows you to assign tax groups to your financial group accounts. Depending on your organization type, parent tax groups are available by default. You can add, modify or delete tax groups using the 1-570 C-Corp - Tax groups form.

Note: Parent tax groups cannot be modified or deleted.

Add a tax group

To add a tax group:

-

From the Schedule tab in the 1-570 C-Corp - Tax Groups form, select the Schedule you want to add a tax group to.

A list of all available tax groups displays.

-

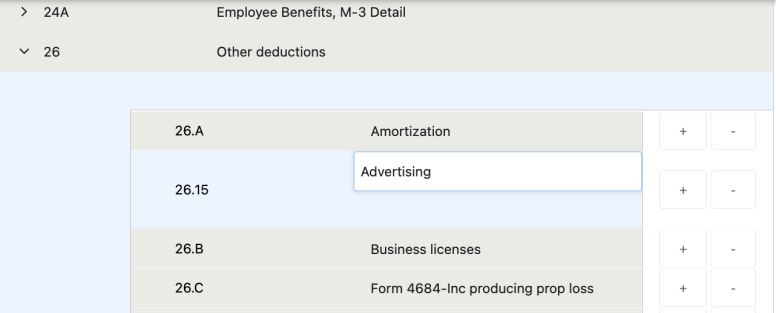

Select the Expand icon (

) of the parent tax group.

) of the parent tax group. -

Select the Add icon (

) to add a new entry row.

) to add a new entry row. -

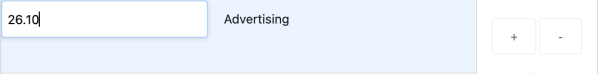

Complete the Number and Name fields.

Note: The tax subgroup number must be between 1 and 79.

Modify a tax group

After adding a tax group, you can modify the number and name of the subgroup.

To modify a tax group:

-

From the Schedule tab in the 1-570 C-Corp - Tax Groups form, select the Schedule of the tax group you want to modify.

-

Select the Expand icon (

) of the parent tax code.

) of the parent tax code. -

Locate the subgroup you want to modify and update the Number and Name fields.

Delete a tax group

If you create a tax group that is no longer needed, you have the option to delete the subgroup.

To delete a tax group:

-

From the Schedule tab in the 1-570 C-Corp - Tax Groups form, select the Schedule of the tax group you want to delete.

-

Select the Expand icon (

) of the parent tax code.

) of the parent tax code. -

Select the Delete icon (

) to delete the subgroup.

) to delete the subgroup.