Completion

Dit artikel betreft Caseware Audit.

Complete this document in the Final analytical procedures folder:

- 655 Final analytical procedures

Use this to assist in forming an overall conclusion on whether the financial statements are consistent with your understanding of the entity, and to corroborate the conclusions formed about individual components/elements of the financial statements (CAS 520.6).

Complete the documents in the Summary of identified misstatements folder in the following sequence:

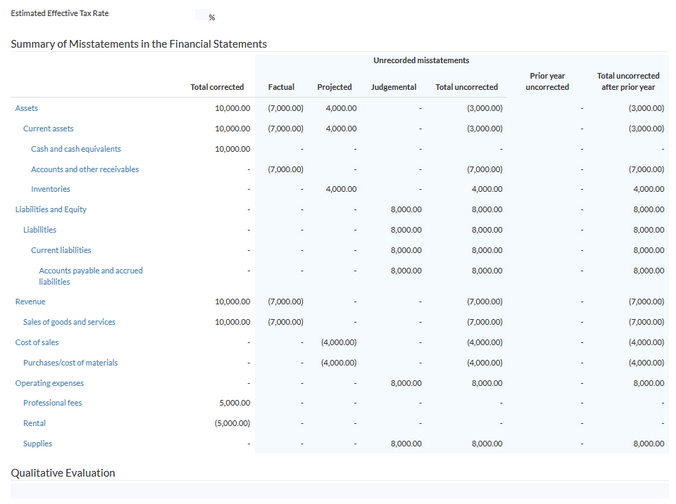

- 335.1 Summary of identified misstatements - worksheet

Use to document misstatements identified during the audit and to evaluate:

- The effect of identified misstatements (including those in qualitative financial statement disclosures) on the audit.

- The effect of any uncorrected misstatements on the financial statements.

- 335.2 Summary of identified misstatements - procedures

Use this in combination with 335.1 Summary of identified misstatements - worksheet, to document misstatements identified during the audit and to evaluate:

- The effect of identified misstatements (including those in qualitative financial statement disclosures) on the audit.

- The effect of uncorrected misstatements, if any, on the financial statements.

Complete this document in the Financial reporting framework folder in the following sequence:

- FRF906 ASPE - General financial statement presentation

This is a standard checklist to assist the user in completing their disclosure requirements. It ensures that the financial statement's presentation and disclosures comply with the Canadian Accounting Standards for Private Enterprises (ASPE).

Complete this document in the Documentation of audit issues folder in the following sequence:

- 320 Significant decisions, key audit matters, audit findings, and matters for future consideration

Use this to document significant matters arising during the audit, the conclusions reached and the professional judgments made in reaching those conclusions. If applicable, identify any matters communicated to those charged with governance that are to be included as key audit matters in the auditor's report (CAS 701).

This checklist consists of four tables where you can document each of:

- Significant decisions

- Key audit matters

- Audit findings

- Matters for future consideration

Complete 310 Audit completion in the Audit completion folder.

Complete the documents in the Final correspondence folder in the following sequence:

- 100 Report transmittal

- 109 Financial statement optimiser

This encapsulates all procedures related to how you want to prepare and present the financial statements document in your engagement. - Jaarrekening

Tijdens het werken aan de opdracht worden sommige gegevens al in het document ingevuld, zoals het kasstroomoverzicht en gegevens uit de saldibalans. U kunt de gegevens in het document reviewen en deze nog verder aanpassen of uitbreiden.

ga naar Opdrachten > Jaarrekening en afronding > De jaarrekening opstellen. - 340 Matters to be communicated to management and those charged with governance

Use this to address matters that are required to be communicated (refer to CAS 260 and 265). - 341 Management letter

Use this to communicate any significant control deficiencies to management. - 342 Letter to those charged with governance

Use this letter to communicate any significant control deficiencies to those charged with governance. - 350 Management representation letter

Use this to obtain the required representations from management for the audit engagement. - AL3.3 Audit findings letter

Use this to report audit findings to your audit client. - AR9 Client queries - End of engagement

Use to request your client's final deliverables (for example, audited financial statements, the auditor's report, appropriate letters).

Before this is sent, a reviewer from your accounting firm, typically a manager or partner, should review the work performed by the staff who completed the audit engagement.