What's new - Caseware ReviewComp Fall 2021 (v1.2009.0)

Here is a listing of what's new for the Caseware ReviewComp Fall 2021 release.

Improvements to ASPE note disclosures

Minor improvements have been made to the ASPE note disclosures such as grammatical errors, note inconsistencies and search functionality.

Updated names for Income Statement groups

For accuracy, the Income Statement groups that can have both a debit or credit balance have been renamed. The updated names display if the balance has a different sign between current year and prior year.

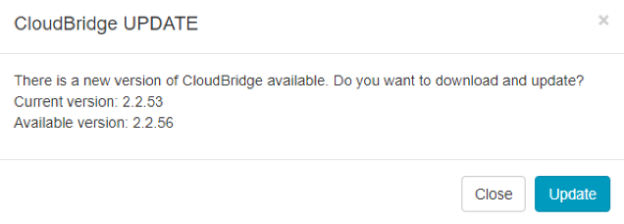

Automatic update notification in CloudBridge

When a new version of CloudBridge is available, you’ll now receive a notification to download and update.

Note: Automatic notifications are only available in versions downloaded after September 21, 2021, v2.2.56 and up. To download the latest version, see Get CloudBridge.

Downloading the reference copy after netfiling a tax return

After you file a tax return using EFILE, the client reference copy now automatically downloads to the Documents page.

Entering multiple certificate numbers in a schedule tax form

When entering a provincial certificate number into a provincial form, the Certificate Number and Claim Amount now automatically update in the S5 - Tax calculate supplementary - corporations tax form. If there are multiple Certificate Numbers and Claim Amounts, then each affected provincial form will be flagged to print and send to the CRA during netfiling. The total claim amount will then automatically update in the S5 tax form.

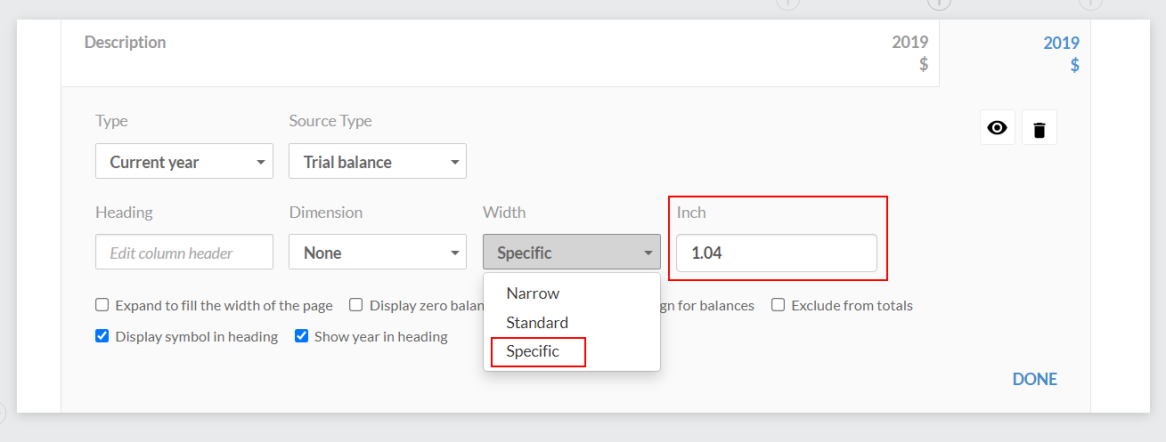

Custom widths for dynamic tables

You can now set custom widths for dynamic table columns from the column settings. Once you select Specific from the Width drop-down, you can specify the width of the column in inches or centimeters. The unit of measurement is determined by the unit selected in the product settings.

To learn more, see Column settings in dynamic tables.

Dynamic table font size

You can now modify the font size of text in dynamic tables from the More actions (![]() ) menu. This option can be used on large tables in order to fit more content on a single page. The default font size is 11.25pt.

) menu. This option can be used on large tables in order to fit more content on a single page. The default font size is 11.25pt.

To learn more, see Change the dynamic table font size.

Default underline and overline options for dynamic tables

To enhance the presentation of the financial statements, you can now set default underline and overline options for dynamic tables in the Table Borders settings.

You can set underline and overline options for header rows, total rows, grand total rows and final rows.

You can also select the OVERRIDE TABLE CUSTOMIZATION checkbox to override existing underline and overline options in all tables and apply the default settings instead.

To learn more, see Set default underline and overline options for dynamic tables.

Default behavior for rows overridden or rounded to zero

When you manually override trial balance values to zero or when trial balance values are rounded to zero, the dynamic table row now displays in gray in the financial statements and is not included in the print copy.

To learn more, see Review group and account balances in the financial statements.

Add financial groups to the firm template

Firm authors can now add financial groups to existing grouping structures in the firm template.

Note that firm authors cannot modify or delete any groups added by primary authors.

To learn more, see Customize financial groups and Group properties.

Dynamic text in financial statement area print settings

Firm authors can now add dynamic text to headers and footers for financial statement areas in the print settings.

Simple Electronic Signature log in PDF format

You can now view and download a signature log in PDF format for documents that were electronically signed by clients in query documents.

To learn more, see Review contact responses and Attach documents to an engagement file.

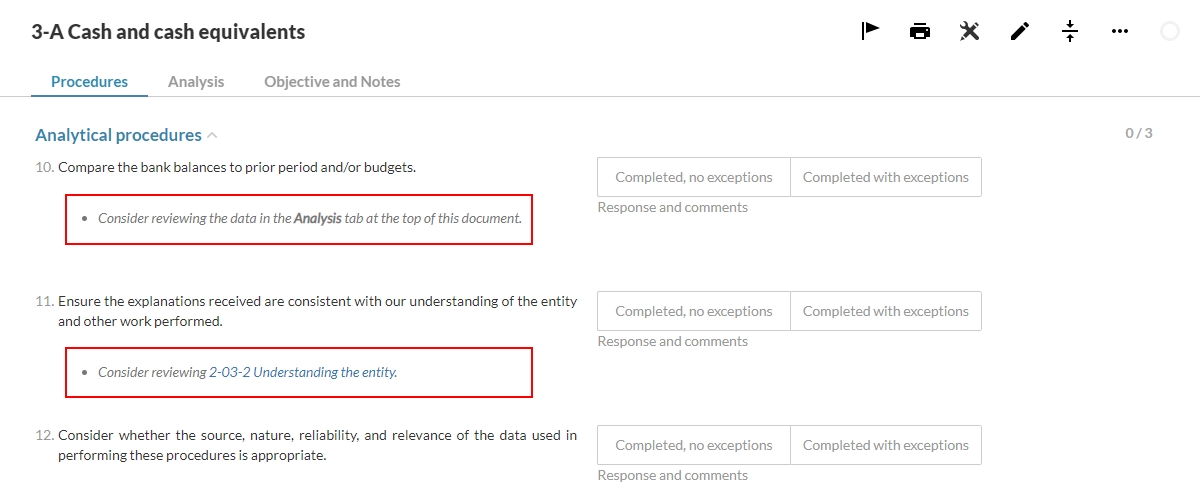

Enhanced procedures in financial statement areas in checklists

To enhance the overall workflow experience, additional instructions have been added to procedures in the financial statement area checklists. The instructions include prerequisites, reference information and links to relevant documents to help you complete the checklists.

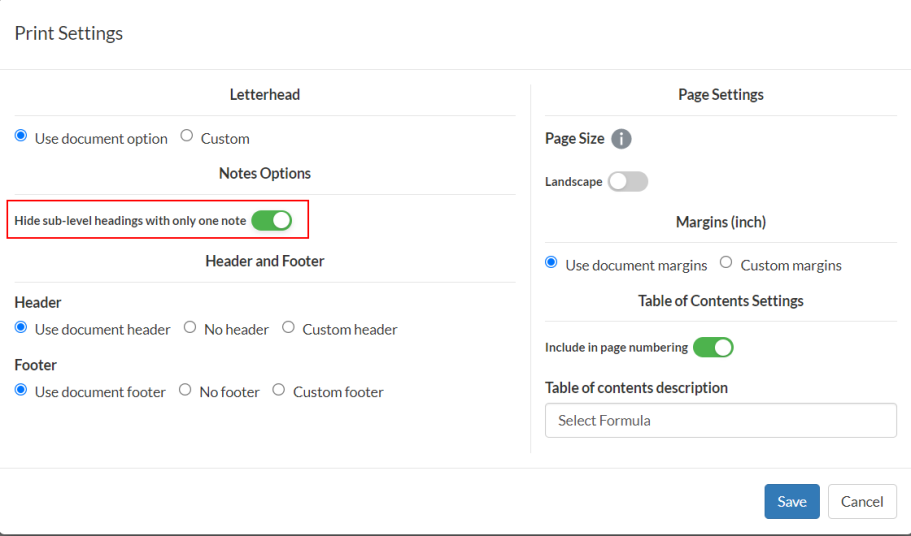

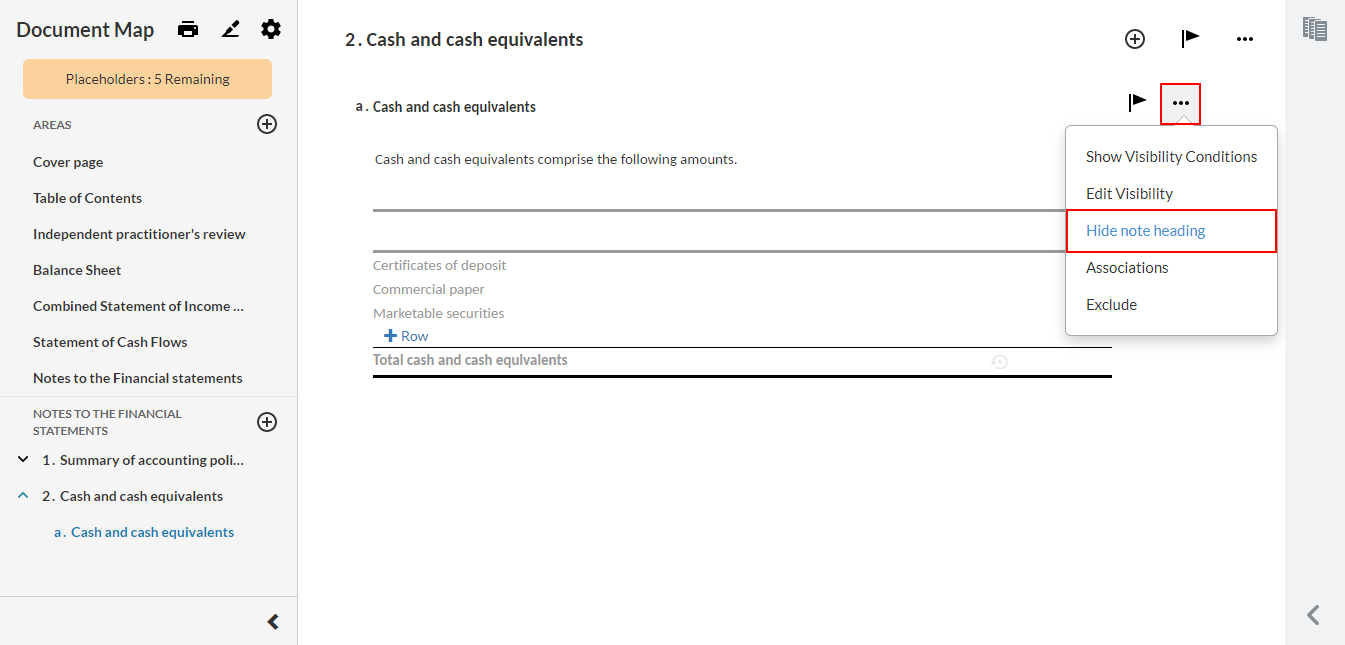

Hide sub-level headings for notes in financial statements

In the 6-20 Financial statements document, the Notes Print Settings now include an option to automatically hide sub-level headings for notes in the PDF output if there are no subsequent notes in that group.

The option to hide sub-level headings in the PDF output is also available for individual notes in the More actions menu if there are no subsequent notes in that group.

To learn more, see Set up the print options in the financial statements and Hide sub-level headings for a note.

Multiple signoffs for a role

You now have the option to allow more than one user to sign off on a role. To enable multiple signoffs for a role, go to the Engagement Settings dialog then select Roles | Multiple Signoff.

To learn more, see Modify signoff roles.

Print settings for tax returns

When printing tax returns, you now have the option to customize the print settings. You can customize the disclaimer, configure the header and create bulk print preferences directly within a tax form.

PEG content updates

Caseware ReviewComp now supports the 2021 CPA Canada PEG form content updates. In the event there is reason for withdrawal, you have the option to record your conclusion in 5-95 Worksheet - Withdrawal.

| Form | Extent | Description of Revisions |

|---|---|---|

| 5-95 – Worksheet — Withdrawal | New | New worksheet to document situations where withdrawal from a review engagement may be the appropriate conclusion. |

Fixes

The following list features a brief description of the issues that have been resolved in this release.

-

Printing various tax forms resulted in missing fields, duplicated text and text field overflow.

-

An error code 449 that prevented an unmodified T1134 - Information Return Relating to Controlled and Not-Controlled Foreign Affiliates form from being netfiled.