What's new - OnPoint Audit Annual Tax Export Updates 2023 Release (v2.1550.0)

Here is what’s new in OnPoint Audit Annual Tax Export Updates 2023 release.

Annual tax export updates

The tax export feature in OnPoint Audit now includes the latest 2023 tax exports and tax codes compatible with the following tax vendors:

-

Intuit's Lacerte© Tax

-

Thomson Reuters UltraTax CS®

-

CCH® ProSystem fx® Tax and CCH Axcess™ Tax

For a list of updates to the 2023 tax exports and tax codes see Tax export codes.

What's new - OnPoint Audit Annual Content Updates 2023 Release (v2.1550.0)

Here is what’s new in OnPoint Audit Annual Content Updates 2023 release.

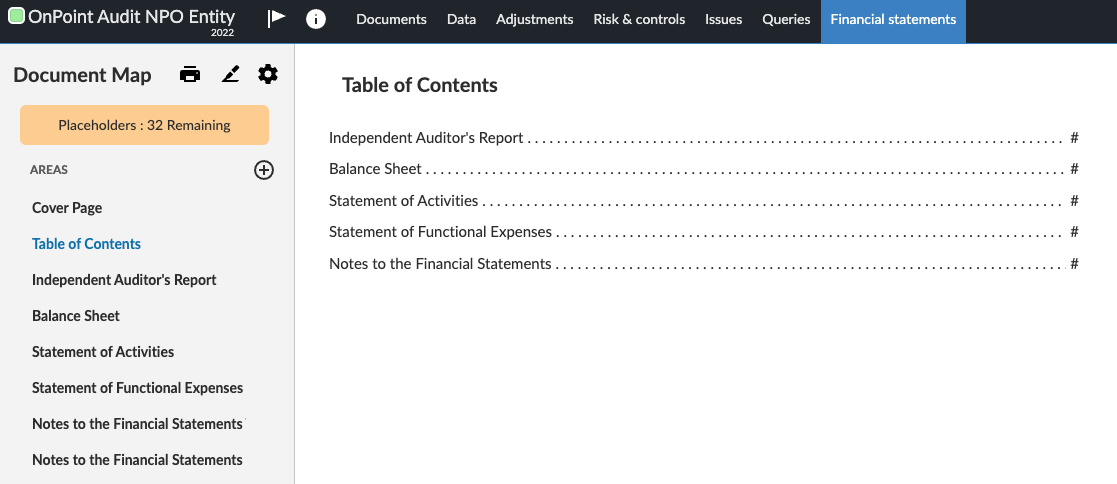

Not-for-profit financial statements

OnPoint Audit now includes Not-for-profit specific financial statements. Enhance audit efficiency by using the built-in draft financial statements and customized note disclosures designed for Not-for-profit entities. When combined with the Not-for-profit content from our preceding release, you can seamlessly complete your Not-for-profit audits and financial reporting.

Annual content updates

OnPoint Audit checklists and other documents have now been updated to meet all standards effective for audits of financial statements for periods ending on or after December 15, 2023, including SAS 143 - Auditing accounting estimates and related disclosures and SAS 145 - Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement.

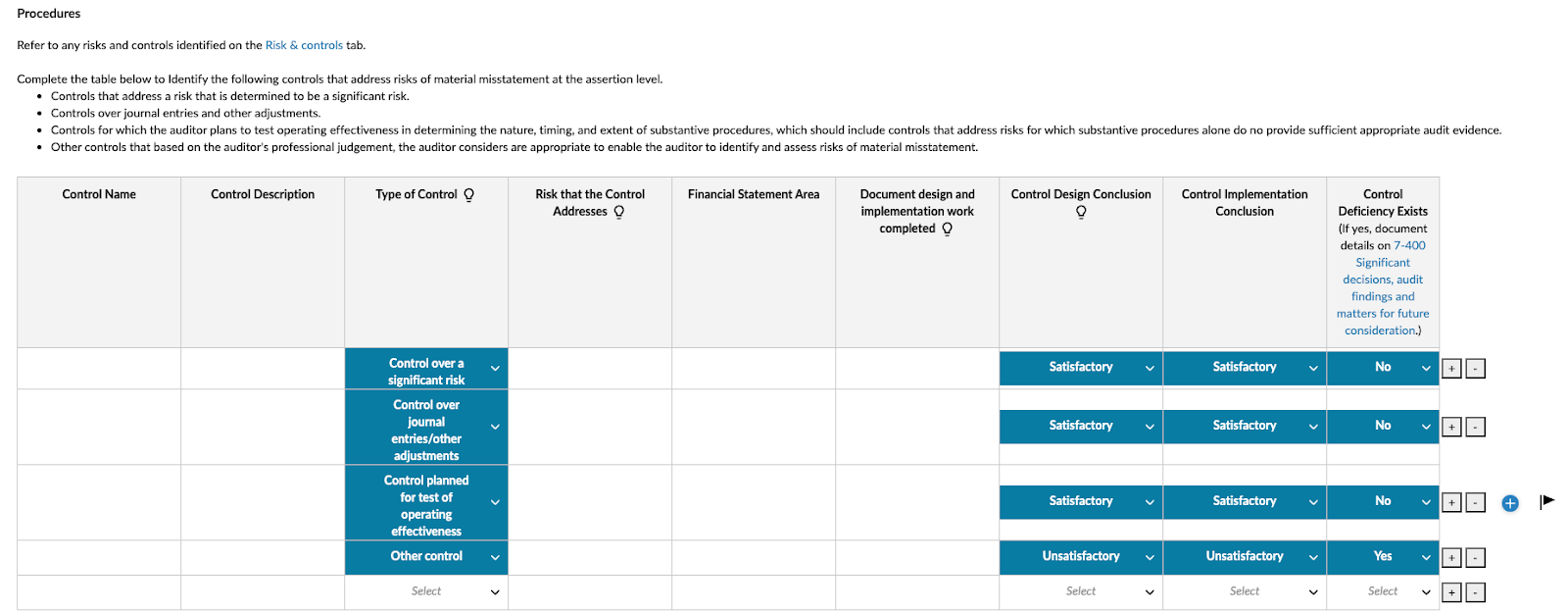

To address the requirements of SAS 145 - Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement, several enhancements were made to the controls evaluation workflow within OnPoint Audit. A new form, 3-300 Controls evaluation - Assertion level controls, is now available to be used in conjunction with the existing controls report in the Risk & controls tab. You can now use this form to document all identified controls, including the details of any significant risks that they address, assessment of the control design and implementation and identification of any control deficiencies.

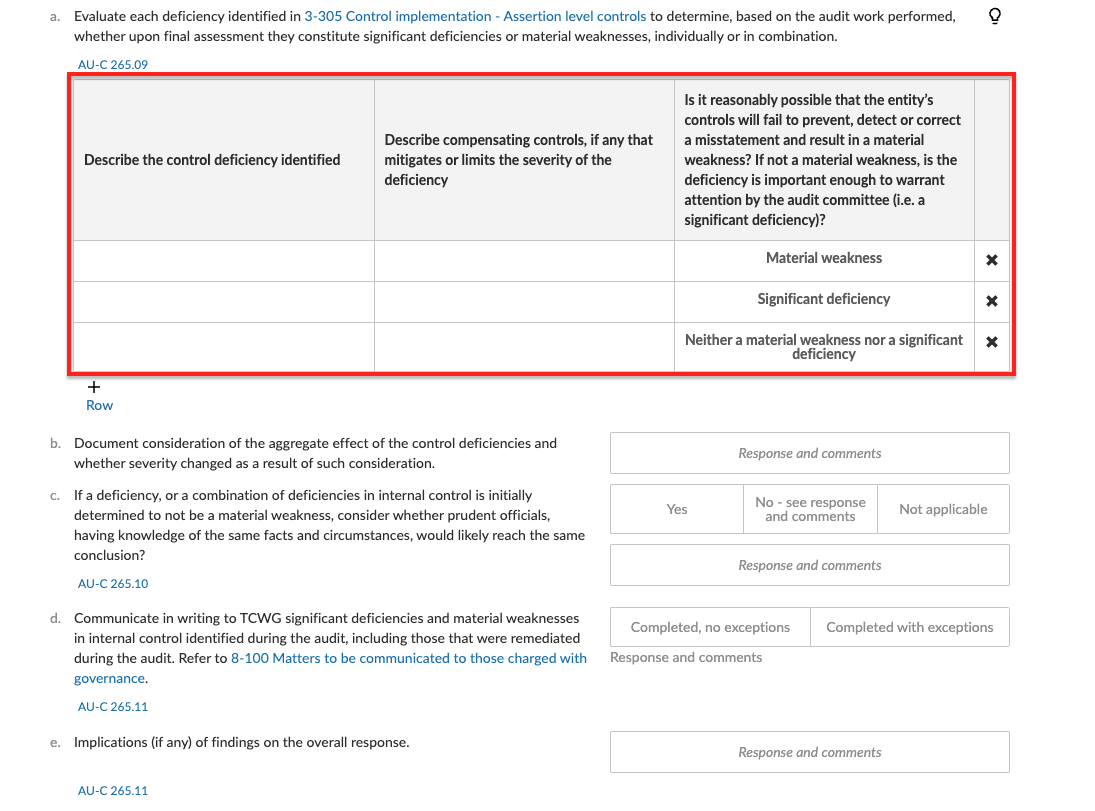

A new table was also added to the existing 7-400 Significant decisions, audit findings and matters for future consideration checklist to document details of any control deficiencies identified and to determine whether they, individually or in aggregate, result in a material weakness or a significant deficiency.

Additional lightbulb guidance for inherent risk has been included on the Risk Assessment tab within the 2-900 Risk report to inform users about the specific requirements for inherent risk assessment as defined in SAS 145 - Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement.

The following documents in OnPoint Audit have also been updated to meet the requirements of SAS 145 - Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement.

Letters:

-

1-450 Letter to a predecessor accounting firm - Draft

-

4-750 Audit planning letter - Those charged with governance - Draft

-

8-200 Management letter - Draft

-

8-300 Report for those charged with governance letter - Draft

-

8-500 Communicating deficiencies in internal control letter - Draft

Checklists:

-

1-100 Engagement - Acceptance/Continuance

-

1-600 Initial team planning

-

2-100 Overall analytical review

-

2-200 Identifying risks through understanding the entity

-

2-310 Understanding the IT environment - Listing

-

2-400 Planned risk assessment procedures

-

2-500 Identifying fraud risks

-

2-610 Minutes of governance meetings

-

2-800 Group audit

-

2-800 Group audit component summary

-

3-100 Entity level risk and controls

-

3-300 Control implementation - Business process controls (now 3-305 Control evaluation - Assertion level controls)

-

4-050 Possible misstatements in qualitative disclosures

-

4-300 Overall audit strategy

-

4-400 Selecting an auditor’s specialist

-

4-460 Understanding and evaluation a service organization

-

4-900 Planning overview

-

All the Tests of controls forms

-

5-115 Test of controls - Revenues receivables receipts

-

5-125 Test of controls - Purchases payables payments

-

5-135 Test of controls - Payroll

-

5-145 Test of controls - Financial reporting

-

5-155 Test of controls - Investments

-

5-165 Test of controls - Inventories

-

5-170 Test of controls - Pervasive (entity-level) controls

-

-

6-140 Litigations, claims, assessments and noncompliance

-

6-200 Testing of journal entries

-

All of the accounting estimates forms (xx.100E documents for each financial statement area under the Fieldwork phase)

-

All of the financial statement area audit work programs (A.100, B.100, C.100…)

-

1110 Revenues - Audit procedures

-

3110 Cost of Revenues - Audit procedures

-

3510 Operating expenses - Audit procedures

-

4000.100 Other income (expenses) - Audit procedures

-

7-200 Documentation checklist

-

8-800 Audit completion checklist

Accounting estimates workflow enhancements

Several enhancements were made to the accounting estimates workflow in OnPoint Audit to better address the requirements of SAS 143 - Auditing accounting estimates and related disclosures.

-

The 2-700 Understanding accounting estimates and disclosures has been condensed to ensure a more efficient workflow through the audit work programs and into the respective accounting estimates forms in the Fieldwork phase.

-

The 2-750 Outcome of prior period accounting estimates form was removed to reduce redundancies as the prior period accounting estimates are now addressed in the accounting estimates forms.

-

The 6-130 Accounting estimates checklist was removed.

-

New procedures have been added within the accounting estimates forms, replacing previous lightbulb guidance, to ensure completion of required steps as defined in the new standards.

New features and enhancements in OnPoint Audit

In addition to the content updates and workflow improvements, we have included the following new features and enhancements in OnPoint Audit.

Modify financial group names

Users can now modify the names of financial groups from the Data page. Note that when a group name is modified, the updated name will be used for the group regardless of sign changes and will override the consistent, contrary and inconsistent names of the group. Users also have the option to revert their changes from the Group properties dialog.

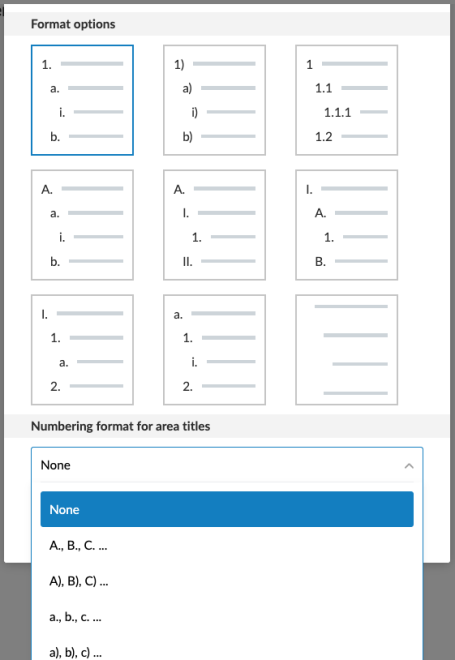

Numbered headings for notes and text areas in the financial statements

To further enhance the presentation of the default financial statements, new options have been added to customize numbering styles for headings.

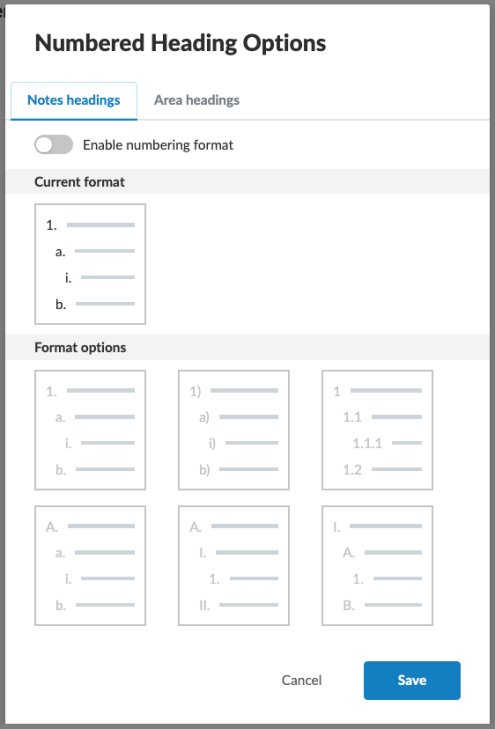

In the financial statements there are now new options to customize numbered headings. The number of heading levels has been increased to five and you can now customize the numbering style of the headings. You can also now add headings with or without numbering to any text areas in the financial statements.

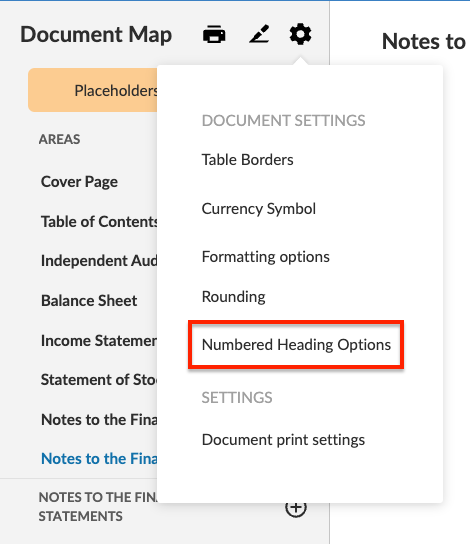

Users can access and customize the numbered heading settings by selecting the Numbered Heading Options from the Document settings (![]() ).

).

In the dialog, you can select whether to enable numbering for your headings, view what the current selected numbering format is and select a new format from the available options.

Note that for area headings, in addition to the options available for note headings, you also have the option to select a numbering format for area titles displayed in the Document Map.

To learn more, see Customize numbered headings in the financial statements.